Blog Cost Management Costs Schedules Workflow

How Cost-Loaded Schedules and Project Management Information System (PMIS) Provide A Real-Time Single-Version-of-the-Truth Earned Value Management Report

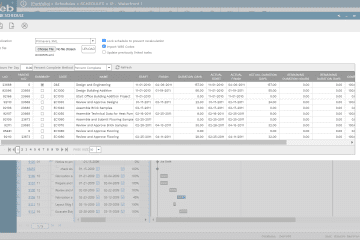

The use of what is known as the cost-loaded schedule to establish the value of interim payment certificates is a growing trend among contractors as well as project owners who are involved in delivering capital construction projects. The approved cost-loaded schedule will become the basis for quantifying the work in Read more…