One of the growing requirements for capital construction project owners and investors is how to maintain an efficient and safe operation of their existing assets portfolio as well as newly acquired assets. This is usually achieved by investing in recapitalization programs with the objective of extending the duration of those facilities’ life cycles while ensuring continuous and improved revenue generation from those assets. The recapitalization programs for those assets could be undertaken for different reasons including the need for refurbishment to comply with health and safety regulations, building systems compliances, CO2 emissions, asbestos removal, expanding facility sizes, and complying with access for disabled legislation among many others. In addition, the recapitalization programs could be to convert the usage of low-revenue historic buildings, like post office buildings, ports, and palaces among others into high-revenue one-of-a-kind hotels and resorts. One of those examples is the post office building in Budapest, Hungary which became the super luxury Four Seasons hotel.

The successful delivery of recapitalization programs requires implementing three phases. The first is creating a repository of all assets that the organization has or could have access to. The repository needs to identify those assets including their location, components, current condition, and occupants. This phase helps in identifying what assets could be considered the capitalization program. The second phase is assessing those considered assets by formally scoring them to determine their attractiveness and priority in an objective manner. The second phase also includes determining the cost estimate for the refurbishment and expected revenue of the refurbished asset as well as a master schedule for delivering the refurbishment project. The third phase is generating the recapitalization project for all shortlisted opportunities. Of course, this does not mean that those recapitalization projects have been given the approval to proceed. The formal approval would have its cycle and it is not part of this analysis.

Using a Project Management Information System (PMIS) that has asset management and opportunities assessment functionalities like PMWeb, capital project owners as well as entities who invest in capital projects can have a single web-enabled platform to manage, monitor, evaluate and report on all of their recapitalization programs. To achieve this, four PMWeb modules are used. Those are the asset location, initiatives, programs, and project modules.

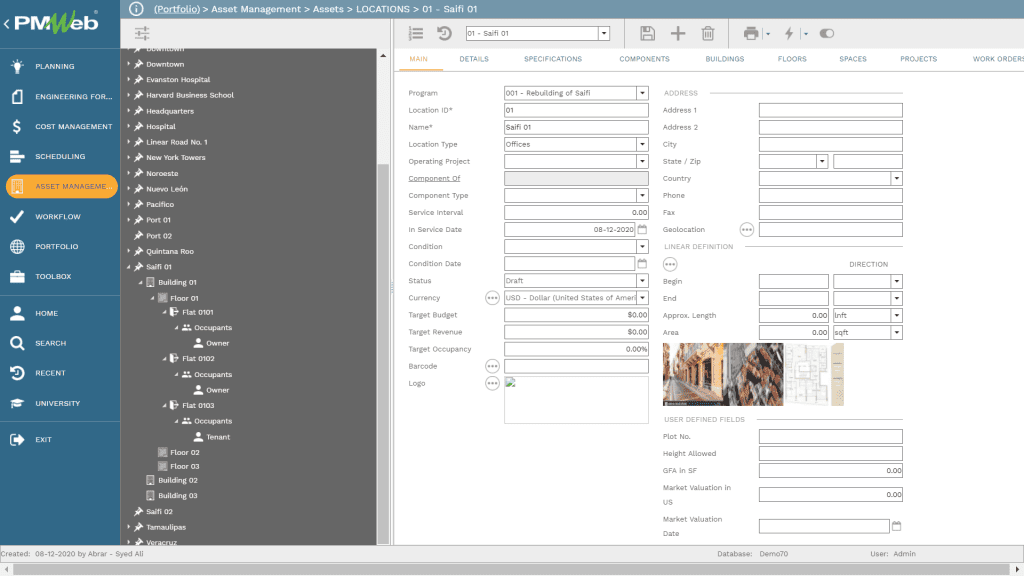

PMWeb asset location module is used to identify the details of all existing assets as well as possible assets that could be acquired by the entity. Each asset is assigned a unique location identity for which all required details are captured such as condition, type, spatial latitude, longitude, and elevation values among many others. For each location, PMWeb allows to capture the details of all buildings, floors within each building, and spaces (flats, rooms, lobby, shop, kitchen, etc.) at each floor level. In addition, the details of all equipment, furniture, and other types of assets that are not permanent components of the building structure can be also captured. Those assets can be assigned to a building, floor, or space. Further, the details of all occupants in each space, which could be the landlord or tenant, can be also captured. In summary, all details and components of the assets that could be considered in the different capitalization programs are captured and documented.

In addition, the specification or user-defined option in PMWeb allows the entity to create all additional fields that could be needed for the assessment of the existing assets. Those user-defined fields can be configured to capture text, currency, numbers, dates, Boolean, and data from a predefined list of values.

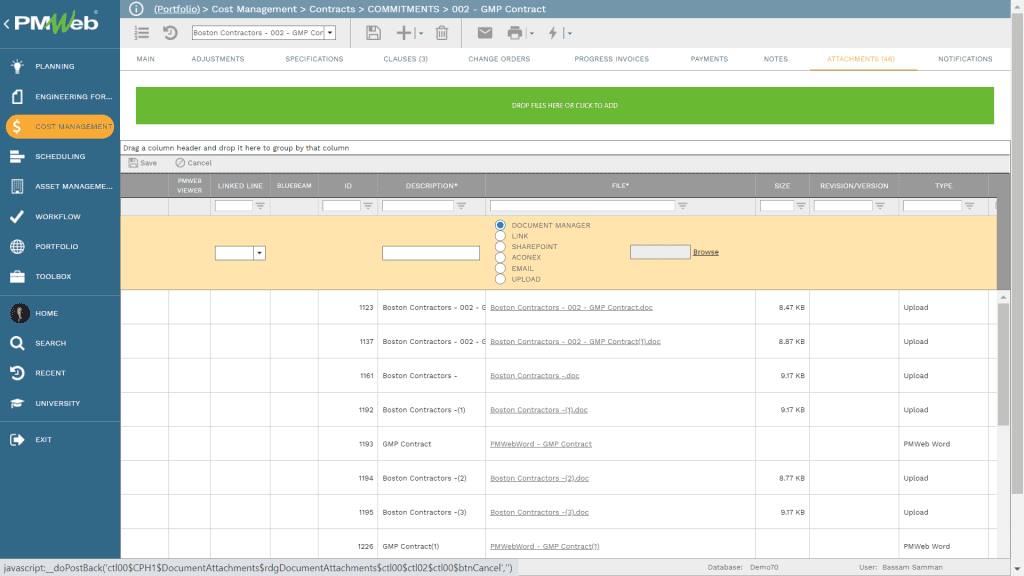

Similar to all other PMWeb project management processes, pictures, drawings, videos, and other documents that are associated with each location, building, floor level, space, and equipment can be uploaded and attached directly to those records or uploaded and stored in PMWeb document management repository and then attached to their relevant records. In addition, links to relevant PMWeb records and imported MS Outlook emails can be added to each process transaction.

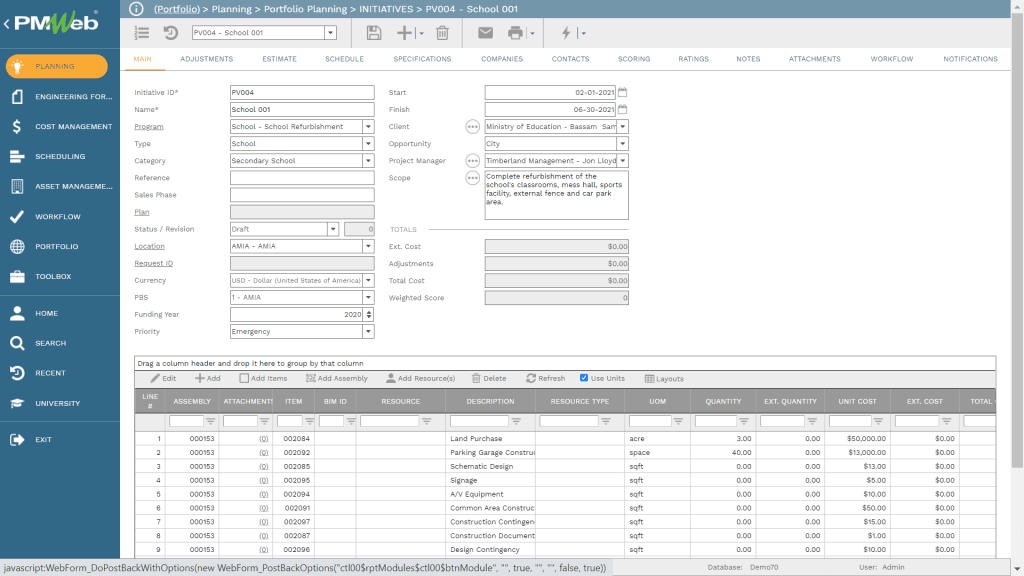

The next phase is to capture the details of all initiatives or opportunities that could become part of each recapitalization program. In addition, to the general details of each initiative such as type, category, scope of work, and current owner among others, there are three critical requirements for each initiative. The first is the recapitalization cost estimate and anticipated revenue, if this is a requirement. The second is the master project delivery schedule or milestone schedule while the third is a scoring checklist that helps in enforcing an objective assessment of the process for each possible initiative or opportunity.

There are different options for creating the initiative cost estimate which could include the use of the predefined cost database as detailed in the items module, using one of the predefined cost assemblies for similar types of projects, or just importing the cost estimate from an MS Excel template where the estimate was either created or exported from a dedicated cost estimating software. The entity can select any one of those options as well as the option to combine part or all of those options to come up with the initiative cost estimate.

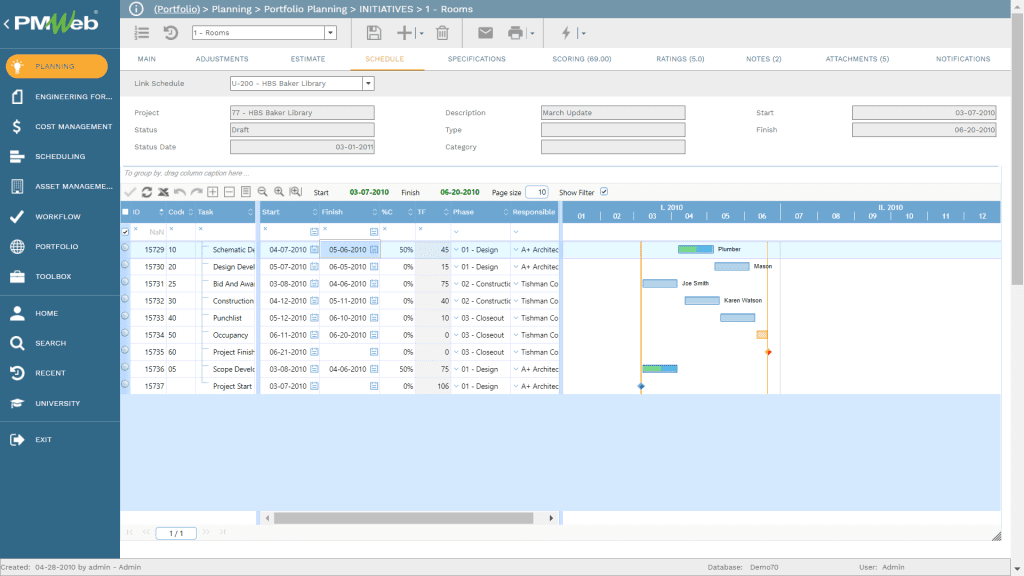

The project master or milestone schedule can be created using the PMWeb scheduling module or imported from Primavera P6 or MS Project. The project schedule usually includes the project life cycle phases including planning, tender, and award design services, concept design, schematic design, detailed design, construction documents, tender for construction, construction and testing, and commissioning. The schedule also includes key milestone dates.

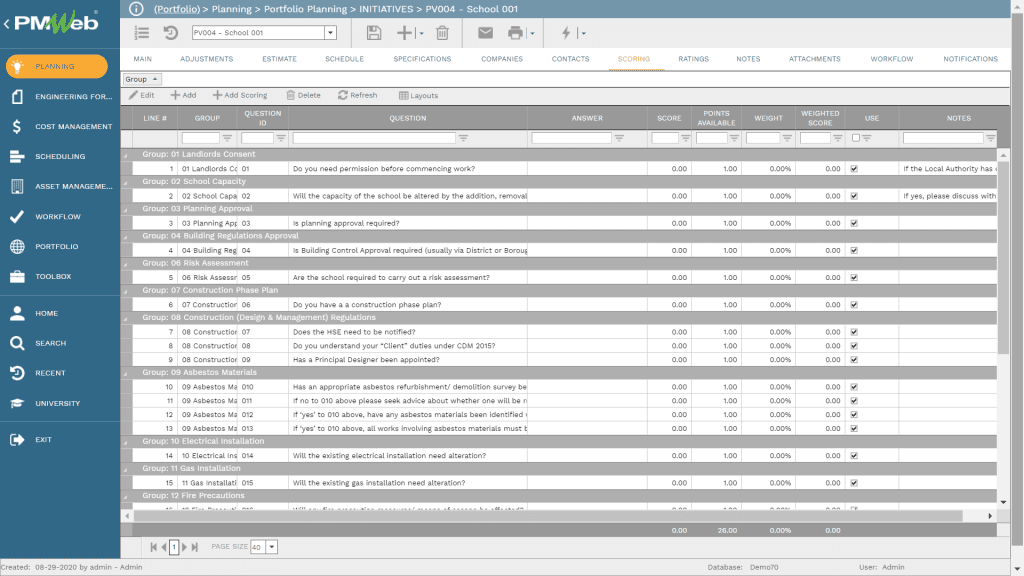

Finally, each initiative has a score checklist that could vary depending on the initiative type. For example, the scoring checklist for a school would differ from the one for hotels, parks, restaurants, banks, commercial, residential, warehouse and logistics, retail, cinema, theatre, healthcare, universities, airports, seaports, prisons, among other types of assets. The score checklist has specific questions to be answered with the option to attach supportive documents and add notes for each response. The items within a checklist could have their own weight factor to ensure a weighted total average.

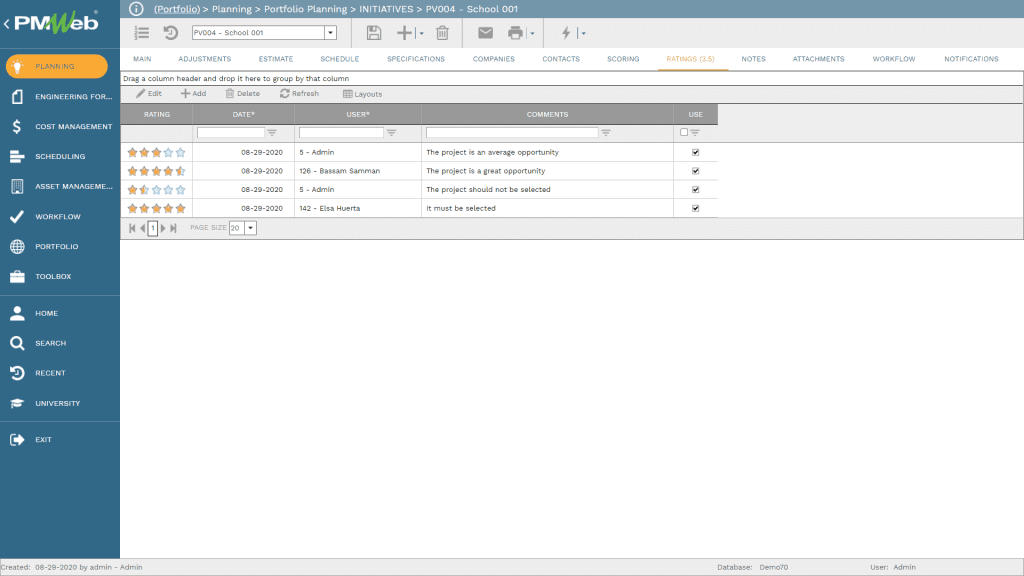

In addition to the formal scoring checklist, PMWeb also allows the entity stakeholders to provide their subjective rating on whether the initiative should be selected as a possible recapitalization project investment or not. The rating tab allows rating each initiative on a scale of five. Each rating should include a comment explaining why this rating was given. The summary of all those ratings is provided at the average rating value.

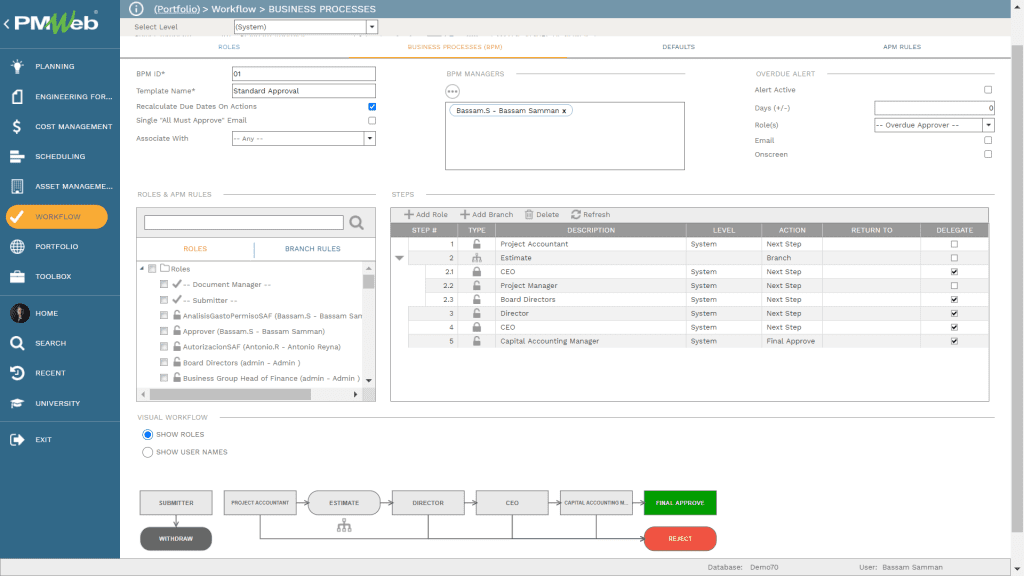

To ensure that each reported initiative or opportunity is formally reviewed and approved or rejected in terms of status, a workflow is assigned to the form. The workflow is used to map the workflow tasks, their sequence, duration, responsibility, conditions for resubmitting, and possible actions among others. The workflow could also have conditions to map the approval authority levels usually associated with financial transactions.

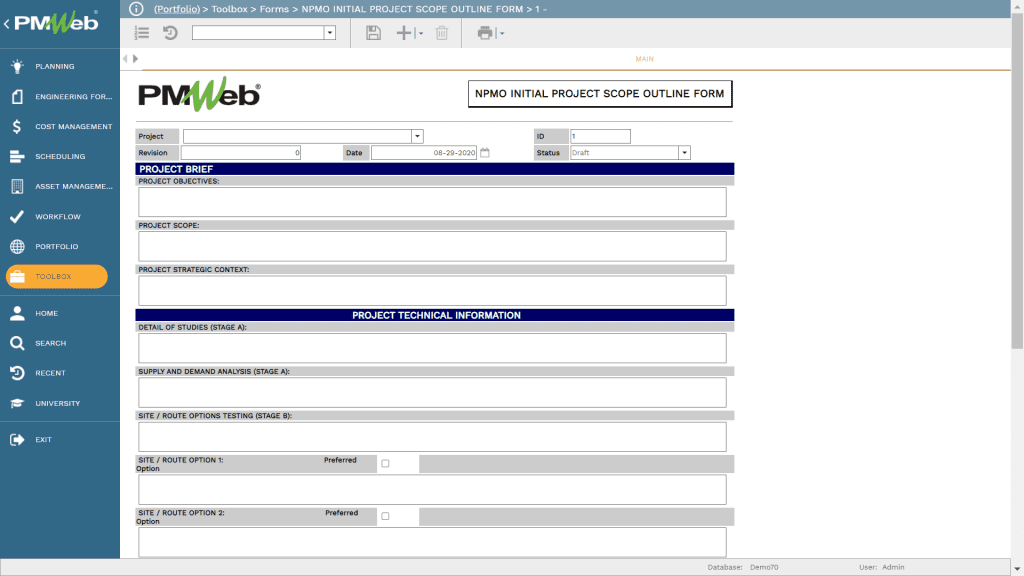

When the status of an initiative becomes approved, PMWeb allows the generation of a project from the approved initiative. This enables the project team to add the additional details that the project could require for making the decision as to whether the project should be part of the recapitalization program or not. Those projects are subjected to detailed analysis including the development of the work breakdown structure (WBS) and project execution plan, project baseline budget and planned budget spending, and the risk register. In addition, the organization might have its own project management processes to further analyze the project opportunities and anticipated tangible and intangible benefits before making the decision to proceed with the project or put it on hold. PMWeb visual custom form builder is used to create those additional processes in accordance with the organization’s own requirements.

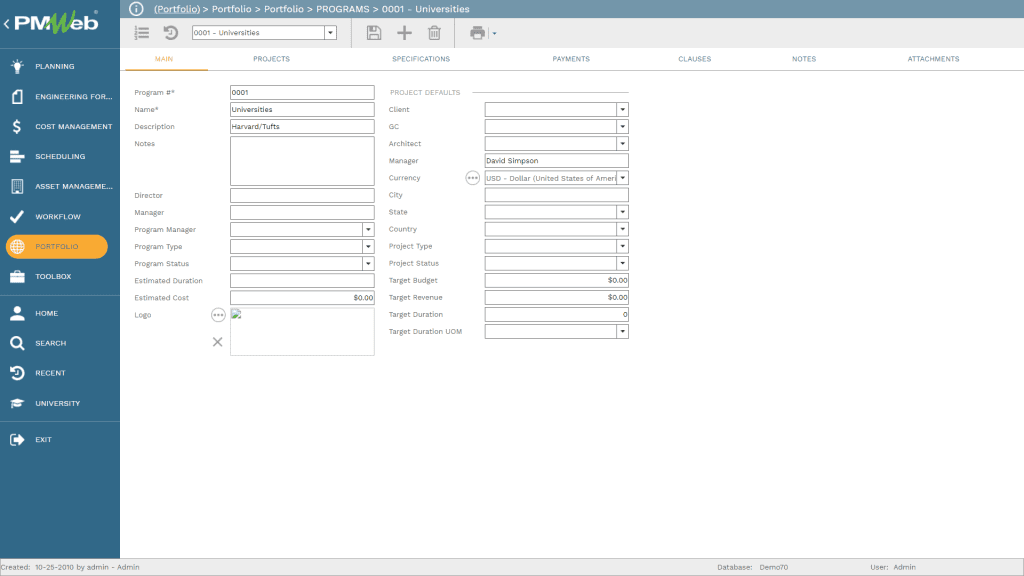

It should be noted that all initiatives, whether approved, rejected, or pending decision to approve or reject as well as all projects whether approved for execution, rejected, or pending decision to proceed or shelve, are displayed on their relative recapitalization program PMWeb program module is used to capture the details of all recapitalization programs that the organizations intend to invest in with all identified initiatives or opportunities regardless of their status and approved project investments or projects under consideration as well as those rejected.

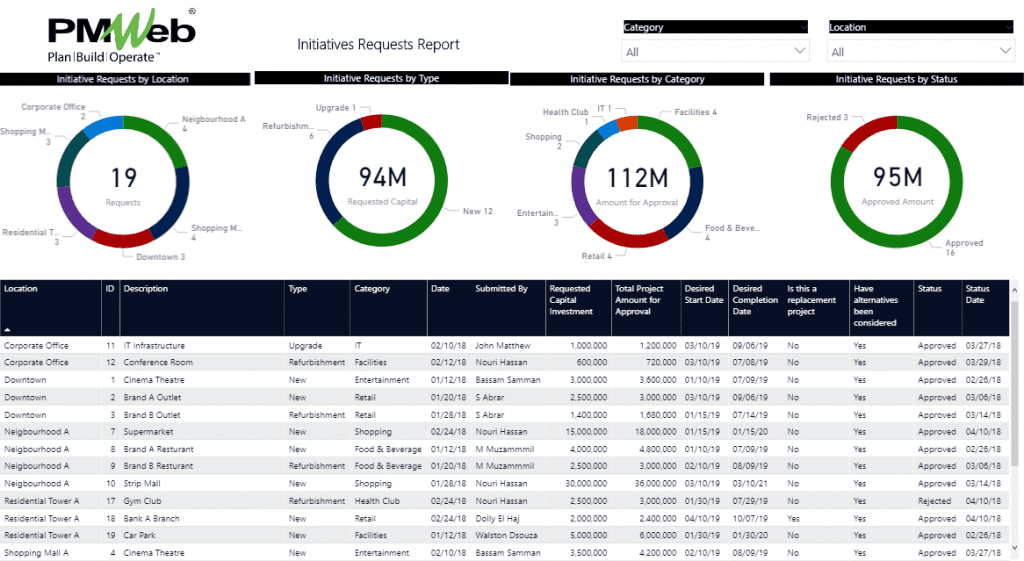

All those identified initiatives and projects can be consolidated in a single report where for each recapitalization program, those initiatives and projects are reported showing all needed details. Visuals can be added to summarize the information captured in those initiatives and projects regardless of their status.

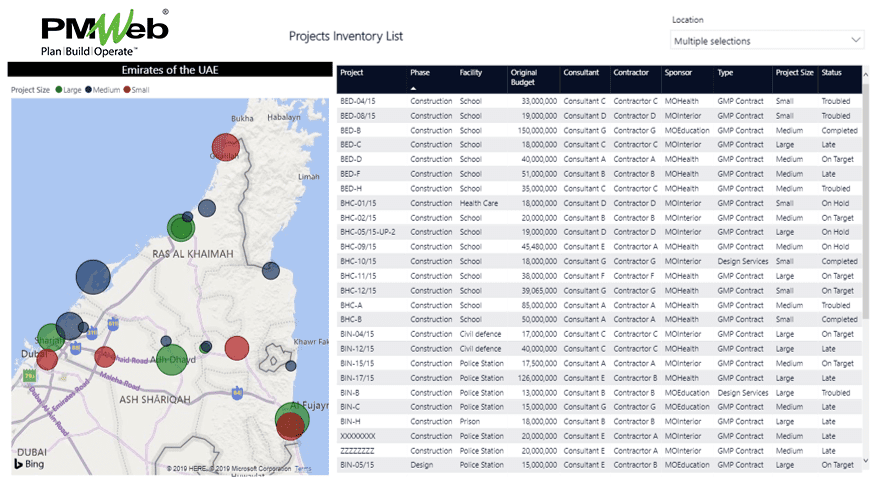

In addition, it might be necessary to show the projects of a specific program that is being considered, whether approved, rejected, or still not decided on, on a map to identify their proximity to other projects of other programs as well as other operating assets. Using the real-time trustworthy data captured in PMWeb, the organization can consume this data to give them insight for better and faster-informed decisions on building their recapitalization programs.