One of the key challenges that face organizations involved in delivering construction projects is getting paid for completed and approved work in place promptly. Payment delays have a drastic effect on the project’s success and can lead to contract termination. The issue of delayed payments applies to both cases, payments to be made also known as accounts payable (A/P), and payments to be received also known as accounts receivable (A/R).

Payments Made Against Commitment Contracts

To manage the actual payments made for approved interim progress invoices and miscellaneous invoices, the PMWeb Accounts Payable (A/P) Payment Batches module will be used. The module allows creating a new transaction for each A/P payment batch. There is a need to identify whether the payments will be made for specific projects or programs, a portfolio of projects, and all or particular vendors. If the selection is for a specific project, then there is also the option to select for which period this payment will be assigned.

Of course, there is the need to specify the amount of payments to be made through the A/P payments batch and payment method, which could be either bank transfer, check, cash, or any other accepted method. The A/P payment batch can be further defined by selecting values for type, category, and other user-defined fields.

Selecting the ‘Pay Invoices’ option identifies the approved invoices that meet the selection criteria for the A/P payment batch record. This enables selecting which invoices to pay and the amount of payment to be made for each. However, this can be manually completed by unselecting those invoices that will not be paid, then either adding the amount to be paid or the percentage of the amount to be paid on each invoice.

Nevertheless, selecting the option ‘Auto Pay’ distributes the payment as per the order of the listed due invoices. PMWeb automatically calculates the amounts of payments applied to invoices and the unapplied balance. The user can modify these amounts or percentages applied against each approved invoice.

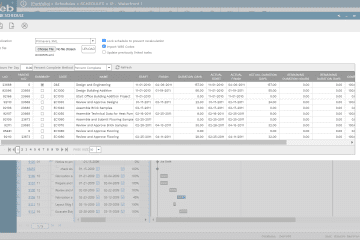

After accepting the payments to be made against approved invoices, the PMWeb A/P payments batch module lists all those paid invoices. For each paid invoice, whether it is an interim progress invoice for one of the awarded contracts or a miscellaneous invoice, the list details the related program, project, commitment contract, if applicable, invoice reference and number, vendor, payment date, invoice description, and other details.

When selecting any of these paid invoices, the PMWeb A/P Payment module launches to display all details relevant to the paid invoice. This module allows approving payments to the vendor, for which its status must be changed to approved. This approval is attained by stating the review and approval workflow assigned to the PMWeb A/P Payment module. The workflow includes the sequence of the tasks needed for approving the payment while adhering to the approval authority levels embedded in the workflow.

Approval of the payment requires providing details for the data fields related to the cost account or the CBS level the payment will be posted against, the period for which this payment relates to the payment method, and other needed details.

At this point, when the field ‘Linked A/P Invoice’ is selected, PMWeb automatically displays the paid interim progress invoice or miscellaneous invoice. The PMWeb modules for progress invoices and miscellaneous invoices have a payment tab for which all details on actual payments made against the approved invoice are captured. The payment tab displays all payments made against the approved interim progress invoice or miscellaneous invoice. For PMWeb instances that integrate with financial or ERP systems like Oracle EBS, SAP, MS Dynamics, and others, the payment details get sent to PMWeb.

The PMWeb A/P Payments module becomes the single repository that has details of all actual payments made against approved interim progress invoices and miscellaneous invoices. These payments are either done directly in the A/P Payments module, A/P Payment Batches module, or imported from financial and ERP systems. The paid payments data becomes available to be reported to provide real-time status of all payments made to contractors, subcontractors, suppliers, and other vendors.

Captured Interest Payments Due on Delayed Payments

Depending on the delayed payment sub-clauses of the agreement between the project owner and the contractor, the contractor may be entitled to claim financing charges if he does not receive the payment within the due duration of issuing of an interim payment certificate (IPC) by the contractor to the engineer. If payment is not made within the stated payment period, the contractor has two options, either give notice of its intention to suspend the works or give notice of its intention to terminate the contract. During any period of suspension, financing charges continue to accrue on the unpaid amount.

Using PMWeb, the project owner, as well as the contractor, can keep track of the payment status of interim payment certificates as well as the exposure for financing charges for delayed payment of IPC. The information captured in the PMWeb progress invoices and payments modules becomes the basis for having a real-time tracking report for the status of payment against approved interim progress certifications and the exposure for additional finance charges due to delayed payments. The report tracks the “Late Payment Certification by Engineer” by reporting the contractor IPC issuance date, IPC due date to the employer from the engineer, actual date of IPC from the engineer to the employer, and engineer’s delay to issue IPC in days. In addition, the report tracks the “Late Actual Payment by Employer” by reporting the payment due date, actual date of full payment as per IPC, delay in payment, payment amount made, and balance IPC payment not made by the employer.

The report also includes the calculations for the estimated interest finance charges per period associated with the engineer’s failure to issue the IPC for payment within 28 days from submission and the estimated interest finance charges per period associated with the project owner’s failure to make payment within 56 days from submission. The interest finance charges apply on the delayed portion of the approved interim payment certificate amount only.

The calculated interest finance charges for the two types of payment delays detailed above gets added to the commitment contract using the PMWeb change order module to keep track of those additional costs. Similar to all other PMWeb modules, supportive documents can be added to change orders. Additionally, a workflow can be assigned to formalize the review and approval process. The report can also be modified to display the actual notification reference and date issued by the contractor. This will be used to calculate the date after which suspension/ reduced rates progress is permitted under the relevant sub-clause of the contract agreement and the date after which termination is possible.

Payments Received Against Income Invoices

Actual funds received against invoices or requisitions made against revenue or income contract agreements are captured in the PMWeb Accounts Receivable (A/R) Payment module. For Project Owners, revenue or income contracts are those used for selling the project assets, which could include, for example, office space, warehouses, storage facilities, residential flats and houses, and others. In addition, those could be assets for which the beneficiaries or end users are other departments in the organization, like building a retail space for which the beneficiary will be the retail departments. Revenue or income can also be generated from term lease agreements or operating agreements.

For public-private partnerships and other types of build-operate projects, the revenue or income is the payments received from the government when these projects go into operation. The revenue or income contracts are the prime contract agreements signed with the Project Owner for contractors.

The PMWeb A/R Payment module allows capturing the details of all payments received from the project beneficiary or buyer. Those include the project name, contract agreement reference, requisition reference, the cost account or CBS the received payment associate with, payment period, payment method, payment date, and other needed details.

Should there be a need to have more details on the requisition that the actual payment was received for, selecting the requisition filed automatically drills down to that relevant requisition. This enables the PMWeb user to review the requisition details for which the payment was received.

Payments Reporting

One of the ready-to-use reports available in PMWeb is the Aging Report for Accounts Receivable. For each project, the report lists the income or revenue contracts that are part of the project. The report lists the approved requisitions and their payment status for each of these contracts. Depending on the payment terms associated with each income or revenue contract, the report details the aging bracket for each invoice. Assuming that payment terms are 30 days from invoice approval dates, these brackets will be current or less than 31 days, 31-60 days, 61-90 days, 91-120 days, and more than 121 days.

Another out-of-the-box report is the one that provides all details of accounts payable-made payments. The report includes the data fields for program, project, contract, and progress invoice paid. The report also includes the data fields for the progress period, invoice amount, payment amount, CBS the payment is associated with, payment method, payment date, and payment type and category. A similar report is also available for accounts receivable collected payments.

In addition, a report can be created to combine the actual payments made and actual payments received. This report provides the cash exposure a project could be exposed to and for which there is a requirement to secure funds to finance this exposure. This cash-in cash-out report provides a single version of the truth of what collections need to be made to ensure that the project is self-financed. The option of delaying the release of due payments might not be viable as all contract agreements consider this an action that would lead to a contract breach. In addition, the project owner is required to make payments for interest charges for delayed payments.

Reference

The content of this article was extracted from the book titled “Let’s Transform: Enabling Digital Transformation of Capital Construction Projects Using the PMWeb Project Management Information System – 2nd Edition” written by Bassam Samman. The book provides project owners with oversight on how technology available today can support their efforts to digitally transform the management of their projects’ portfolios. For each capital project life cycle stage, PMWeb is used to detail how the relevant project management business processes can be digitalized to enforce transparency and accountability in delivering projects. In addition, MS Power BI was used to show how the real-time, trustworthy data captured in PMWeb can be aggregated, modeled, monitored, evaluated, analyzed, and reported at anytime, anywhere using any device.