Commitments are the contract agreements for which the actual cost for delivering the project’s scope of work is per the awarded contracts for the outsourced scope of work. For a project owner, commitments are the contract agreements with consultants for design, site supervision, cost management, project management, and other types of professional services as well as the contracts with contractors and vendors for construction, and material and equipment supply. On the other hand, for a contractor, commitments are the contract agreements with subcontractors and purchase orders issued to suppliers and vendors.

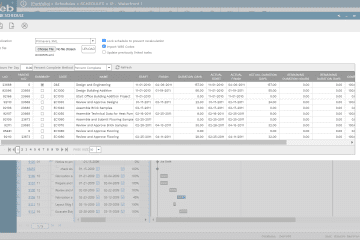

In general, the commitment details should be aligned with the Bill of Quantity (BoQ) or Schedule of Value (SoV). The PMWeb commitment module allows copying and pasting the BoQ/SoV line items from MS Excel. Another option would be to generate the project commitment from the approved definite cost estimate. Regardless of the option selected, to create the commitment, each commitment line item should be associated with a cost breakdown structure (CBS) or cost account level, WBS level, project schedule activity, work package reference for EWP, PWP, CWP, or SWP, and the BIM object identification. In addition, and like other cost management processes in PMWeb, the commitment line items can be in different currencies. Further, a commitment can be selected to be either a unit price or a lump-sum agreement.

As the project progresses, consultants and contractors submit their interim payment certificates for the approved work in place. Those certificates need to be formally reviewed and approved before they can be paid. The amount for each line item in the interim payment certificate is also known as the actual cost which can have the status of being approved or pending approval. The actual cost is also known as the actual cost of work performed.

The actual cost is another important measure for earned value management. The difference between earned value and actual cost is the cost variance, whereas the cost performance index is calculated by dividing the earned value by the actual cost. A positive cost variance or a cost performance index that is greater than one indicates that the project is under budget. On the other hand, a negative cost variance and a cost performance index that is less than one indicates that the project is over budget.

Adding the estimate to complete amount to the actual cost amount provides the estimate at completion value. The difference between the budget at completion and estimate at completion is the variance at completion.

For remeasured contracts or contracts where the interim payment certificate depends on the actual quantities in place that have been accepted, the PMWeb joint measurement module allows recording the details of those work items on daily basis. With this, at the end of each week, the captured work in place can be formally reviewed and approved. Those quantities become the basis for quantifying the approved work in place in the interim payment certificate.

Although most actual costs are captured using commitments, nevertheless, there are other actual costs known as non-commitment costs. PMWeb provides two modules to capture those non-commitment costs. The first is the miscellaneous invoices module which is used to capture and record all expenses incurred on a project but not associated with any commitment contract. Similar to other cost management processes in PMWeb, the miscellaneous invoice line items can be in different currencies. In addition, each miscellaneous invoice line item should be associated with a cost breakdown structure or cost account level, WBS level, project schedule activity, work package reference for EWP, PWP, CWP, or SWP, and the BIM object identification.

The second PMWeb module to capture non-commitment actual costs in the timesheet module. This module calculates the actual hours and costs associated with labor and equipment resources utilized on the project but not covered by any of the awarded commitment contracts. Those labor and equipment resources can be the resources of the organization managing the project whether being the project owner or contractor. The timesheet module allows identifying the pay types for the resources. These can be regular, weekend, overtime, and holiday pay types for labor resources. As a minimum, each line item in the timesheet should be associated with the relevant cost breakdown structure or cost account level and project schedule activity.

The cost performance report is one of the reports that can be created to monitor, evaluate, and report on the actual costs, commitments, and non-commitment that the project incurs and record it against each cost breakdown structure or cost account level. The report also captures the details of the calculated cost variance and cost performance index values.

This can be helpful for contracts where there might be a requirement to adjust the approved interim progress invoices and miscellaneous invoices for retention, recovery of advance payment, VAT taxes, withheld taxes, and other types of adjustments that could affect the net amount due to these invoices. Like all other captured projects’ information, there is always a need to monitor, evaluate and report on these adjustments at the project, contract, and invoice levels, whether those invoices were interim payment certificates or miscellaneous invoices.

The PMWeb adjustments module allows capturing the details of all such adjustments in a single location for the organization’s complete projects portfolio. These adjustments could apply to the different PMWeb cost management processes like those for cost estimates, budget, revenue or income contracts, and others. These adjustments could also differ from one project to another, and they can be specific to certain contractual agreements within the same project.

All PMWeb cost management business processes have a tab called adjustments to enable this functionality. The adjustments tab allows the organization to define, calculate, and manage the markups of various types, automatically integrated with the details tab of each business process. The details tab is where the cost data relevant to each cost management business process is captured. The adjustments already defined in the adjustments register can be dragged and dropped into the Adjustment tab. In addition, there is also the option to define new adjustments on the fly.

PMWeb calculates adjustments by applying percentages to the various cost types in the details tab, or the user can manually enter them. The selection made at the cost type field will determine which lines in the details tab will be the basis for calculating adjustments. This is a multi-select dropdown list that includes standard type field values and ‘All’ to have all lines in the details tab as the basis of adjustment calculations, whether they include a cost type or not. Further, there is the option of ‘No-cost type’ to have only the lines in the details tab that do not contain a cost type.

In addition, PMWeb allows adjustment amounts to be calculated because it includes all adjustment amounts from the lines above the current one in the adjustments tab table. The cumulative checkbox should be enabled to enable this option.

PMWeb allows setting these adjustments to be automatically recalculated each time the adjustments tab table is saved by selecting the ‘Auto Calculate’ checkbox. Otherwise, the PMWeb user must click the ‘Calculate Now’ whenever they wish to recalculate the latest saved adjustments data. Calculating adjustments means transferring the preview amounts in the adjustments tab table to the correct lines and columns in the details tab table of the business process record.

Other options that relate to adjustments are displaying those adjustments against each line item in the cost management business process or showing those adjustments as new line records. Finally, PMWeb allows grouping those adjustments into three groups, Adjustment 1, Adjustment 2, and Taxes. The different adjustment values blend into the details tab lines and appear in the columns carrying the same group title.

Reference

The content of this article was extracted from the book titled “Let’s Transform: Enabling Digital Transformation of Capital Construction Projects Using the PMWeb Project Management Information System – 2nd Edition”. The book was written by the author of the posted article, Bassam Samman.

The book provides project owners with oversight on how technology available today can support their efforts to digitally transform the management of their projects’ portfolios. For each capital project life cycle stage, PMWeb is used to detail how the relevant project management business processes can be digitalized to enforce transparency and accountability in delivering projects. In addition, MS Power BI was used to show how the real-time, trustworthy data captured in PMWeb can be aggregated, modeled, monitored, evaluated, analyzed, and reported at anytime, anywhere using any device.