The capital investment revenue projects are the projects managed by the sales team to generate the anticipated revenue of the investment. The revenue will be the investment assets that will be offered for sale, leases, and management agreements with hotel operators, public sector entities, regional and international corporations such as banks, logistics, and warehousing, supermarkets, movie-theater operators, retailers among others. As detailed in the last article, revenue projects, as well as the engineering and construction projects, also known as execution projects, needed to produce the investment assets, will be part of a single program which is the overall investment.

Although it is very common to apply the earned value method for engineering and construction projects, applying the earned value method on the investment revenue projects will provide investors with an objective solution to monitor, evaluate, report, and forecast the performance of investment revenue earnings. This will be achieved by comparing the planned earnings (PV), which will be extracted from the approved budget baseline, and earned value (EV) of earned revenue, which will be the percent complete from the revenue contract or contracts multiplied by the baseline budget. The variance between those two measures will be the schedule variance (SV) showing if earnings are achieved when they were planned to happen. This performance indicator has a direct impact on the investor’s cash flow. The difference between the actual revenue (AC) received from each revenue contract and the earned revenue (EV) measures will be the cost variance (CV) showing the actual earning amount for completed assets are in line with the planned earning amount for the same assets. This performance indicator has a direct impact on the investor’s profitability.

Using a Project Management Information System (PMIS) like PMWeb, the anticipated target revenue for the assets to be leased or sold will be captured in the PMWeb budget module. The budget for the investment revenue project will be unit-based where the budget line items will detail the components of the assets to be leased or sold. Those items will be measured in terms of areas, units among others where the revenue for each unit will be captured, for example, US$ per square meter or foot, hotel rooms among others. This will be the Budget at Completion (BAC).

In addition, PMWeb budget module allows establishing the expected revenue collection dates for each budget line item, also known as the Planned Value (PV). The investment revenue for each line item will be assigned to the different periods to simulate the realistic dates for collecting the revenue for which part of will be during the project’s execution while others could be during the project’s operation which is much longer than the project’s execution period.

For the signed revenue contracts for each project, PMWeb contract module will be used to capture the details of those contracts. The option for unit rate contracts will be selected to provide the quantity and unit price of all leased and sold assets. The revenue agreement should associate the revenue components with the same cost account levels used in creating the revenue budget. This is essential to compare the actual signed revenue agreements with the approved revenue budget baseline. It is very common that the revenue source for a specific cost account could be contributed by different sales or lease contracts. For example, the retail leased space could be the result of agreements between the investor and different retailers, and so on.

The actual income earned on the revenue contracts will be captured using PMWeb requisition module. Those requisitions will be issued on the dates agreed to make those payments which are part of each sale or lease agreement. This will be the Actual Cost (AC).

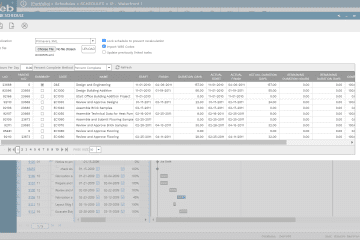

The data captured in the above PMWeb modules will become the basis for the Earned Value Performance report for the revenue projects. The report will include a tabular report to show the performance at the end of each elapsed period for each cost account. The information will include the budgeted revenue at completion (BAC), planned revenue earning value (PV), earned value of actual revenue (EV), actual revenue (AC), schedule variance (SV), cost variance (CV), schedule performance index (SPI), cost performance index (CPI), estimate to complete (ETC), estimate at completion revenue (ETC) and variance at completion for revenue earned (VAC). The report will also include histogram visual for schedule and cost variance amounts for elapsed periods and a line visual for the trends for the schedule and cost performance indices for the elapsed periods.