It is a very common practice for investors whose capital construction projects development is not one of their core business practices to outsource the management of delivering those projects to specialized project management consulting (PMC) firms to reduce their risk exposure on such investments. Most of those investors will have a rigorous selection process to ensure that the best qualified PMC firm is selected. They will review the PMC track record in delivering similar projects, shared references and the qualifications of the project management team to be deployed. Nevertheless, few of those investors will assess the technology that the PMC will deploy to support their team in managing, monitoring, evaluating, and reporting the project’s performance.

Managing a project is no different than managing any other type of business. It includes many business processes that need to be managed, objectives to be achieved, key performance indicators to be reported on, and risks that could threaten the project’s success. Actually, projects tend to bear more risks than other types of business as in addition projects tend to be unique in terms of how they will be managed as well as project delivery involves retaining the services of multiple entities with conflicting business interests that need to collaborate and work jointly to execute the project.

Regardless of the capital project investor was a family office, special purpose vehicle (SPV) company, regional and international corporations, real estate investment company, private investor, or any other type of investment firm, as a minimum, they all will have two core key performance indicators (KPIs) that they require the PMC firm to report on. The first of those indicators is the projected cost at completion as this measure will have a direct relation to the investment Internal Rate of Return (IRR). The second indicator is the forecasted project completion date as this will determine when revenue can be earned from operating the completed assets.In addition, those investors will require the PMC to report on all issues that could threaten the project’s successful delivery and actions taken to resolve those issues. They will also require details of achieved progress to date that they can share with other stakeholders who might be either involved in funding the project or operating the project when completed. The performance report should include an executive narrative to detail in layman’s words what is the current project’s status and issues encountered as well as pictures to visualize the current progress. The layout of the investor dashboard will be designed in the format that will be agreed upon between the investor and the PMC.

To create confidence with the capital project investors in what is being reported on, the Project Management Consultant (PMC) firm needs to ensure that the data source for those performance measures is traceable and auditable. The PMC needs to allow the investor to drill down to a detailed cost report that gives insight into the data fields that were the basis for the reported measures.

For example, the performance measure “Projected Cost at Completion” will depend on a number of financial-related business processes that need to be managed on a capital construction project. The first of those is the revised budget value which is calculated from the baseline budget plus all budget adjustments and transfers that have been authorized by the investor.

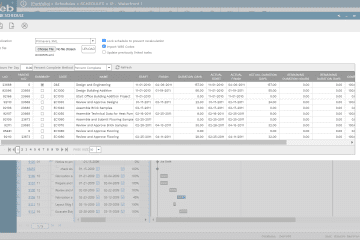

On the other hand, the revised value of awarded contract agreements will be calculated from the original value of each awarded contract plus all approved change orders to date. In addition, there is a need to capture the earned value amount for actual performance invoiced by contractors, the actual cost incurred against the earned value amount which will include values of approved interim payment certificates, and other non-contracts relates expenses. The estimate to complete amount is the balance of each awarded contract taking into consideration the balance of each awarded contract amount yet to be invoiced, pending change orders, and potential change orders or claims that are not approved or authorized by the investor. Adding this estimated cost to complete to the actual cost incurred to date will provide the measure “Projected Cost at Completion”. If this measured amount was subtracted from the revised budget amount, then the project cost overrun or variance at completion will also become available to be reported on.

Should the investor be interested to have details of the records that were the basis for the different financial related amounts being reported in the cost report, the PMC should allow the investor to drill down to those reports. For example, if the investor is interested to have details of what potential change orders or claims that could have an impact on the project’s “Projected Cost at Completion”, the potential change orders register report will be used to provide the needed insight on those potential changes. Similar logs will also need to be made available for all other transactions of budget transfers and adjustments, approved and pending change orders, interim payment certificates, miscellaneous invoices, authorized funding, and actual payments made to date.

To enforce transparency and accountability as well as trust-worthiness in reporting the financial data, all financial related transactions should be formally communicated taking into account all rules for approval authority levels as per the Delegation of Authority (DoA) matrix set for the project. Records of those transactions including all associated documents need to be made available for the investor in case there is a requirement by the internal or external auditors to review those transactions. For each record of any formally communicated transaction, the output form should include in addition to the transaction details, the list of all documents associated with the transaction as well as details of all those who have reviewed and approved the transaction. Those records will be designed to reflect the branding requirement of each investor, PMC firm, or even project.

Using a Project Management Information System (PMIS) like PMWeb, all those financial related records, as well as reports and dashboards that the PMC will share with the investor, can be managed on the same platform along with all other business processes needed for the forecasted completion date key performance indicator and raised issues as well as to manage the project’s quality assurance and quality control, health, safety and environment (HSE), risks, contracts procurement, site management, project handover and closeout, sustainable development goals among others.

PMWeb comes ready with all the business processes that are needed to capture the data for the “Projected Cost at Completion” measure. These include the processes of budget, budget adjustments and transfers, awarded commitments, potential change orders, approved and pending change orders, interim payment certificates, miscellaneous invoices, actual payments as well as the business process for project funding. For investors who also need to capture the income from those projects in terms of sale, lease, or operation revenue, PMWeb also comes ready with the processes for revenue contracts.

All documents that are associated with each financial business transaction will be attached to its relevant PMWeb record. Those documents could be in any file format such as PDF, pictures, MS Excel, MS Word, Autodesk Drawing, and others. In addition, links to other relevant transactions of other financial business processes can also be added as well as hyperlinks to third-party websites can be added.

It is highly recommended that all documents associated with any of the records, regardless of their type or source, get uploaded and stored in the PMWeb document management repository. PMWeb allows creating folders and subfolders to match the physical filing structure used to store hard copies of those documents. Access rights can be defined to each folder or subfolder to restrict access to authorized PMWeb users. In addition, users can subscribe to notifications when new documents or revisions of documents were uploaded or documents are being downloaded.

The actual actions taken by each individual from the different entities who have a role in submitting, reviewing, or approving the financial process will be captured at the workflow tab. For each workflow task, PMWeb will capture the reviewer details including the date and time on when the action was taken. The workflow log will also detail comments made and whether the input was requested from other individuals who are not part of the predefined workflow tasks.

The sequence of the workflow tasks along with the role or user assigned to a task, task duration, rules for returning and resubmitting the transaction, and action available to be taken will be defined in the PMWeb workflow module. Those workflows which could differ from one process to another can also include conditions to create workflow branches to reflect the required Delegation of Authority (DoQ) rules associated with each financial process. The assigned workflow for each financial process type will automatically forward the transaction to the role or user assigned to the next workflow task.

For those investors who have more than a single capital project investment, using PMWeb Project Management Information System will enable them to have an integrated dashboard to report on the performance of their complete projects’ portfolio. Whether the investor has a single PMC or multiple PMCs assigned to manage the delivery of those projects, PMWeb can be configured to restrict each PMC access to only those projects that they are responsible for.