One of the growing requirements for financial institutions that provide finance for capital projects is to have a periodical valuation of the capital asset being built and for which project finance is provided for. Capital asset valuation is the process of determining the fair market of the present value of assets by using absolute valuation models like discounted cash flow analysis or the relative valuation model which determines the value based on the market prices of similar assets. For both options, the accuracy of the valuation model depends on having the right anticipated revenue and charges for the capital asset being financed.

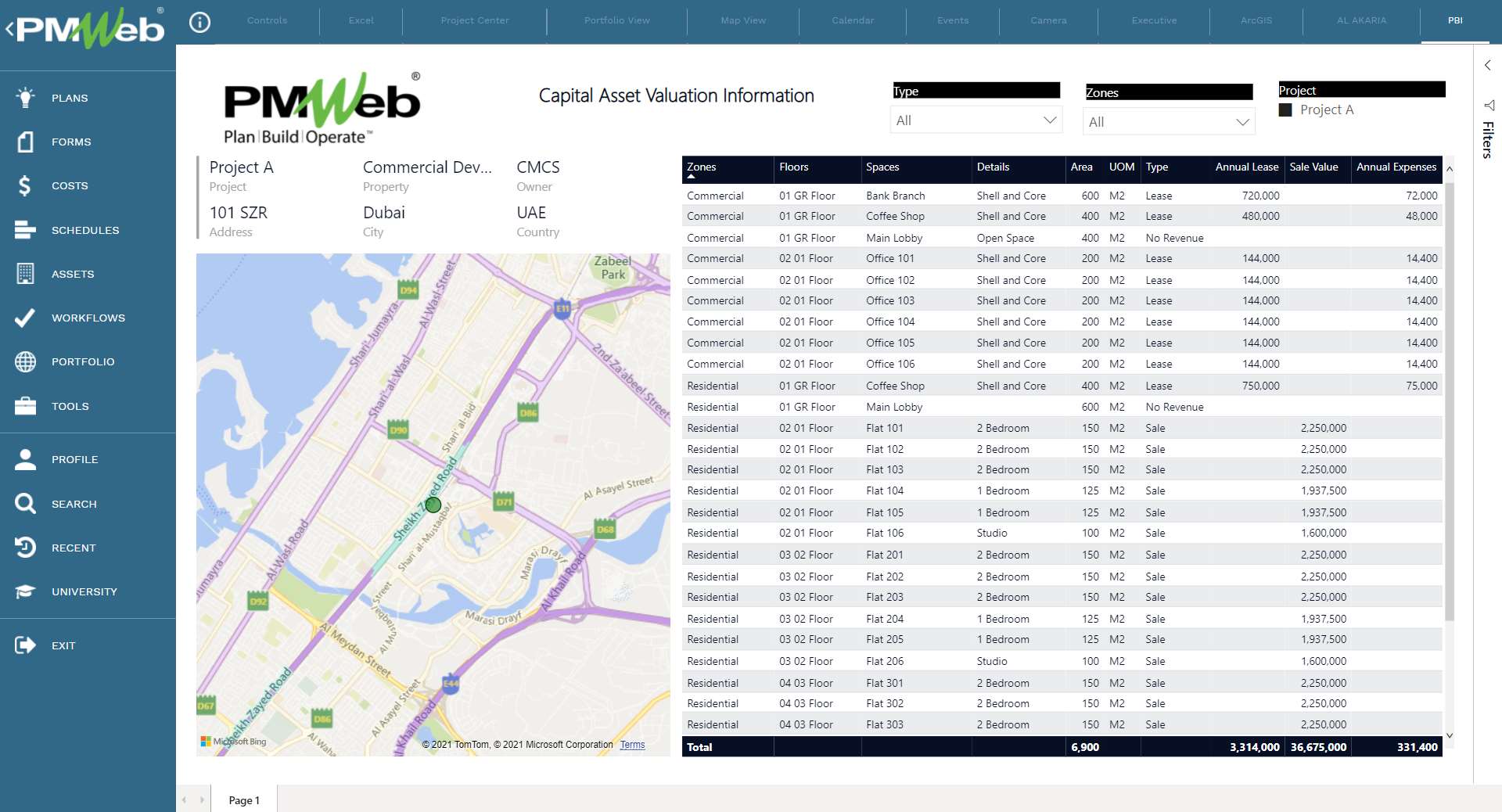

Using Project Management Information Systems (PMIS) that have a module for asset management, like PMWeb, can be used to capture the information needed for the capital asset valuation. PMWeb asset management module allows decomposing the project into the specific assets that generate the value when the project is completed. The value could be in terms of the sale value or anticipated annual lease and commercial income of the completed asset such as a villa, apartment, office, showroom, or serviced plot among others.

The PMWeb asset management module can be used for current capital assets being developed or an active project, properties that are already in operation or completed projects, as well as future properties that could be planned by the real estate developer for which a project could be added to capture the details during the pre-contract stages.

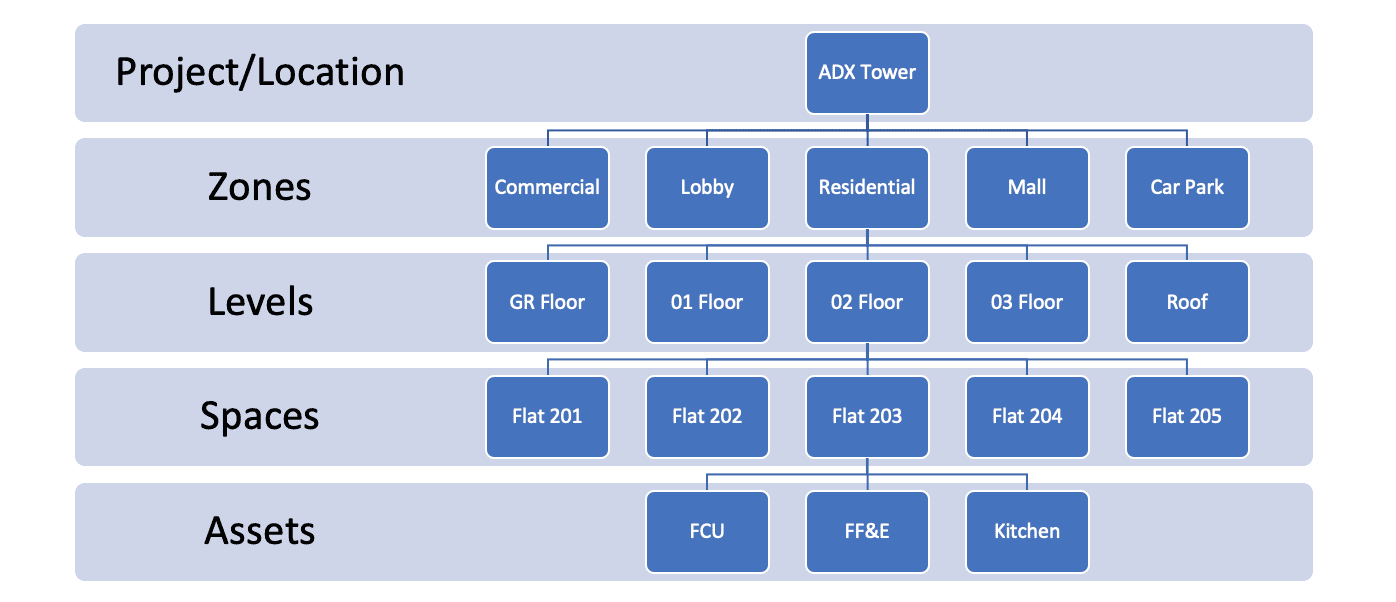

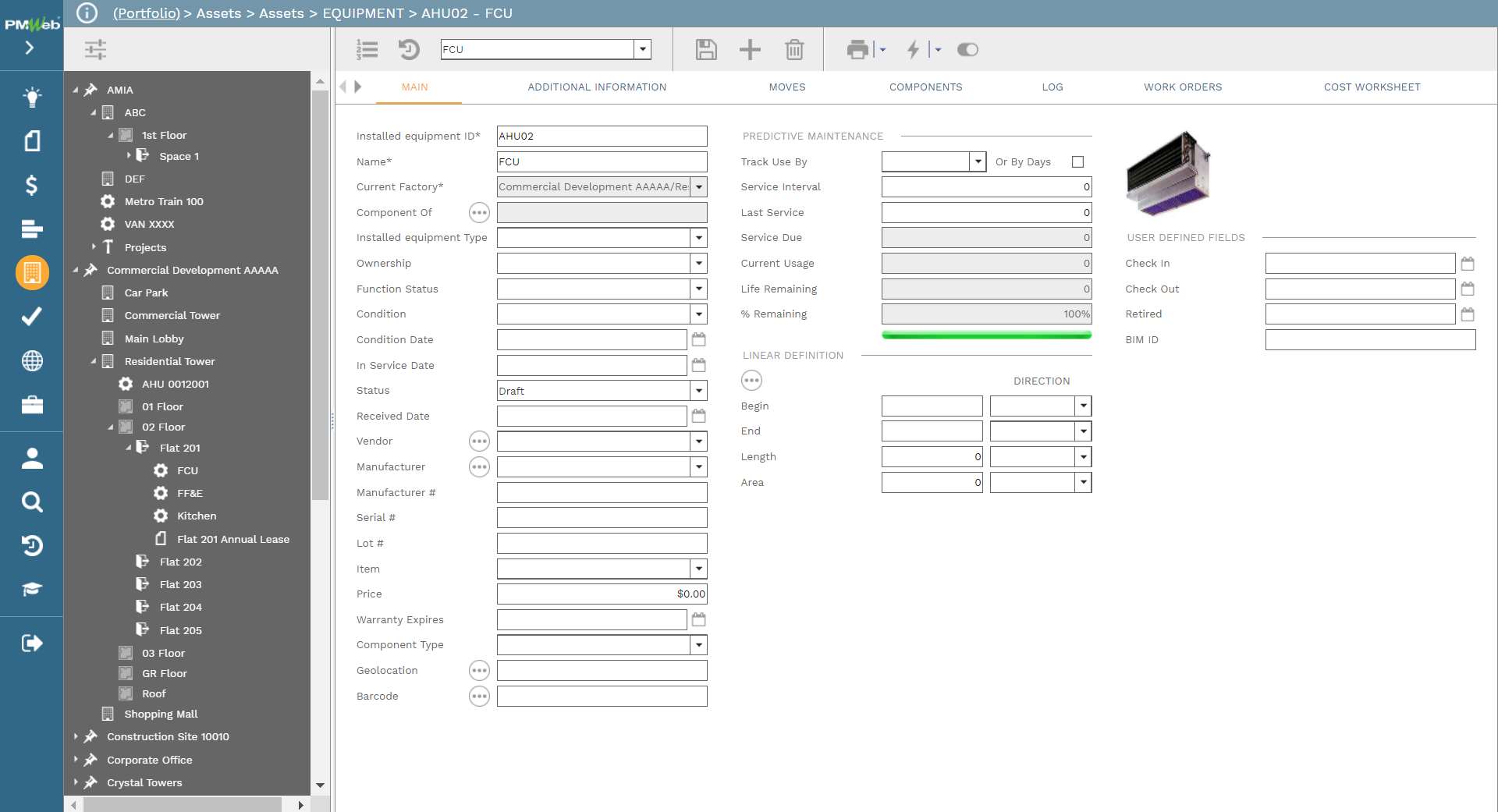

Using the PMWeb location breakdown structure, each project will be divided into five levels. The first level is the overall project while the second level is the zones within a project such as commercial towers, residential towers, etc. The third level will be the floor level for each zone, such as the ground floor, first floor, second floor, etc. The fourth level will be spaces and apartments within each floor level. The fifth and last level is the equipment level within each space.

If the project was a residential compound, the zones level will be Residential Zone, Commercial Zone, Infrastructure, etc. The levels’ level will be for the sectors within the development such as sector 1, sector 2, and so on. The spaces’ level will be the plot number or villa number, while the equipment level remains the same. PMWeb also allows capturing linear assets such as highways, roads, pipelines, etc. In this case, the space level could be each highway section where toll or income is generated.

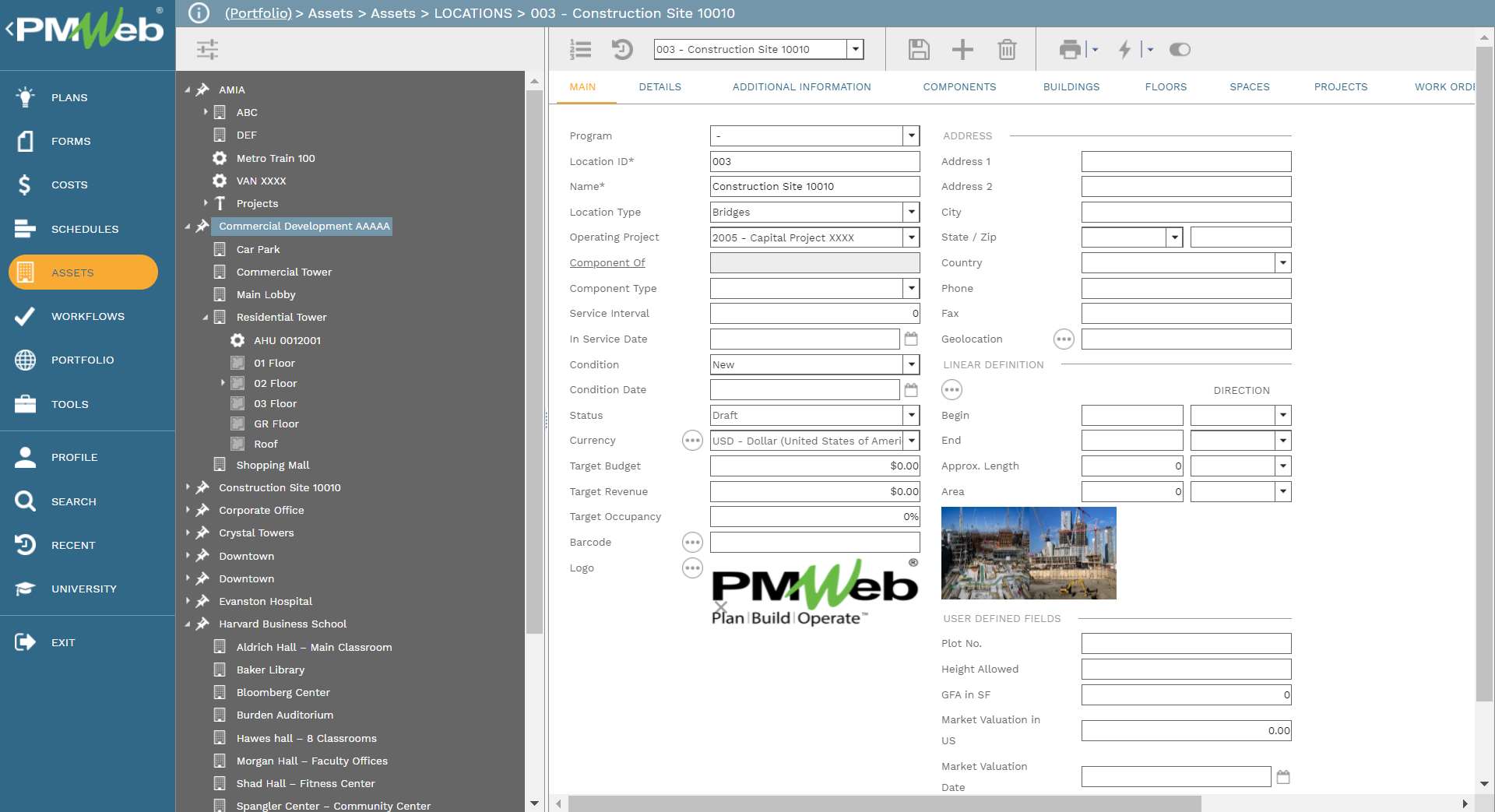

Accordingly, the first level for the example property development will be the project location, for which all information that is relevant to the project will be captured including the total development area and the total area that can be sold or leased. In addition, details on the project location including latitude and longitude coordinates, and project owner among others will be captured. Like other PMWeb modules, the specification tab can be used to add other user-defined fields. In addition, the attachment tab can be used to upload documents such as land ownership documents and permits. The location page, similar to all other asset pages, can display pictures and layouts of the assets.

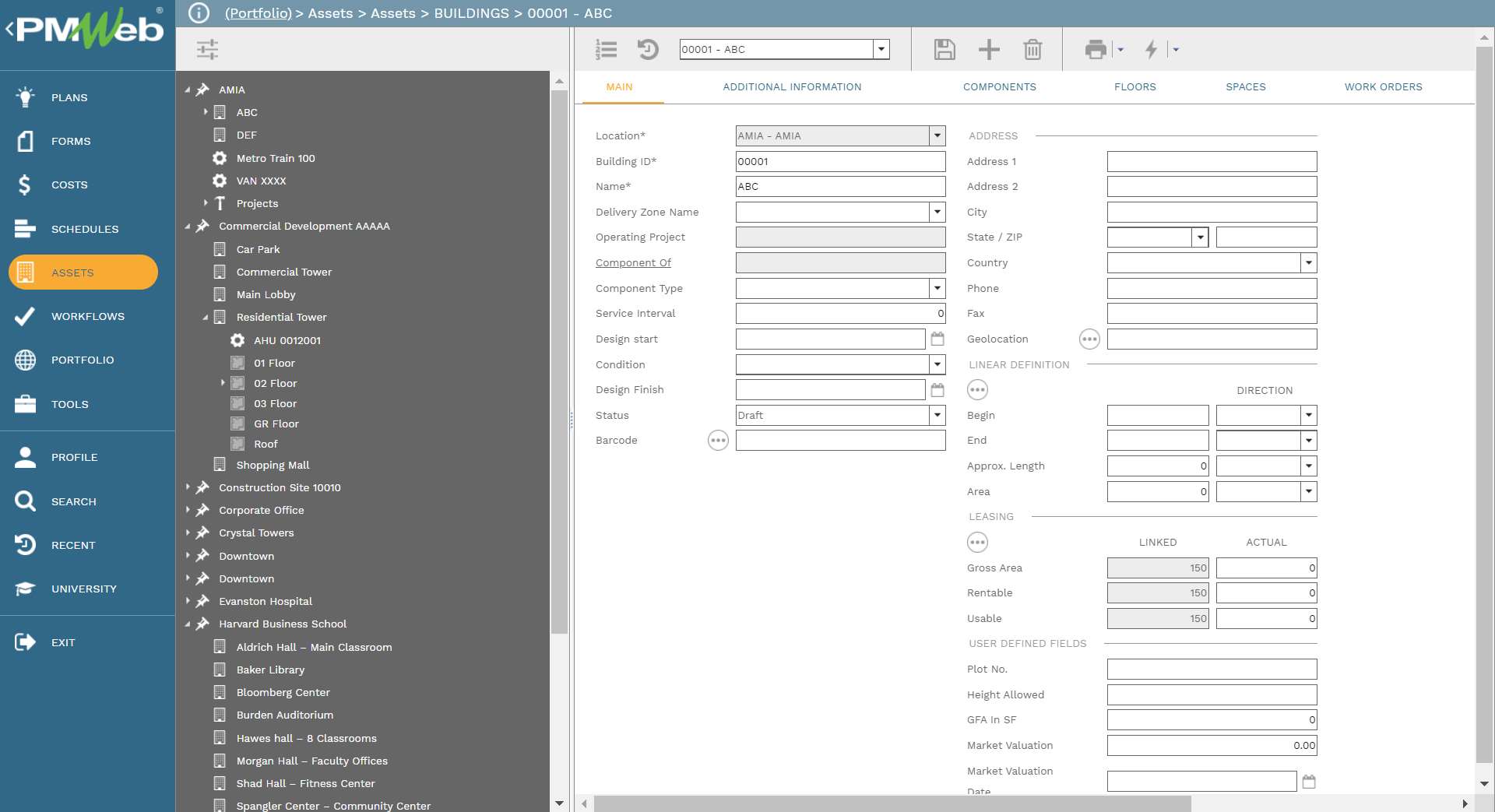

The zones or buildings level helps capture the details of the residential, commercial, shopping mall, and other main zones of the project. Those include the total built and total sellable or leasable area of each tower among other needed details.

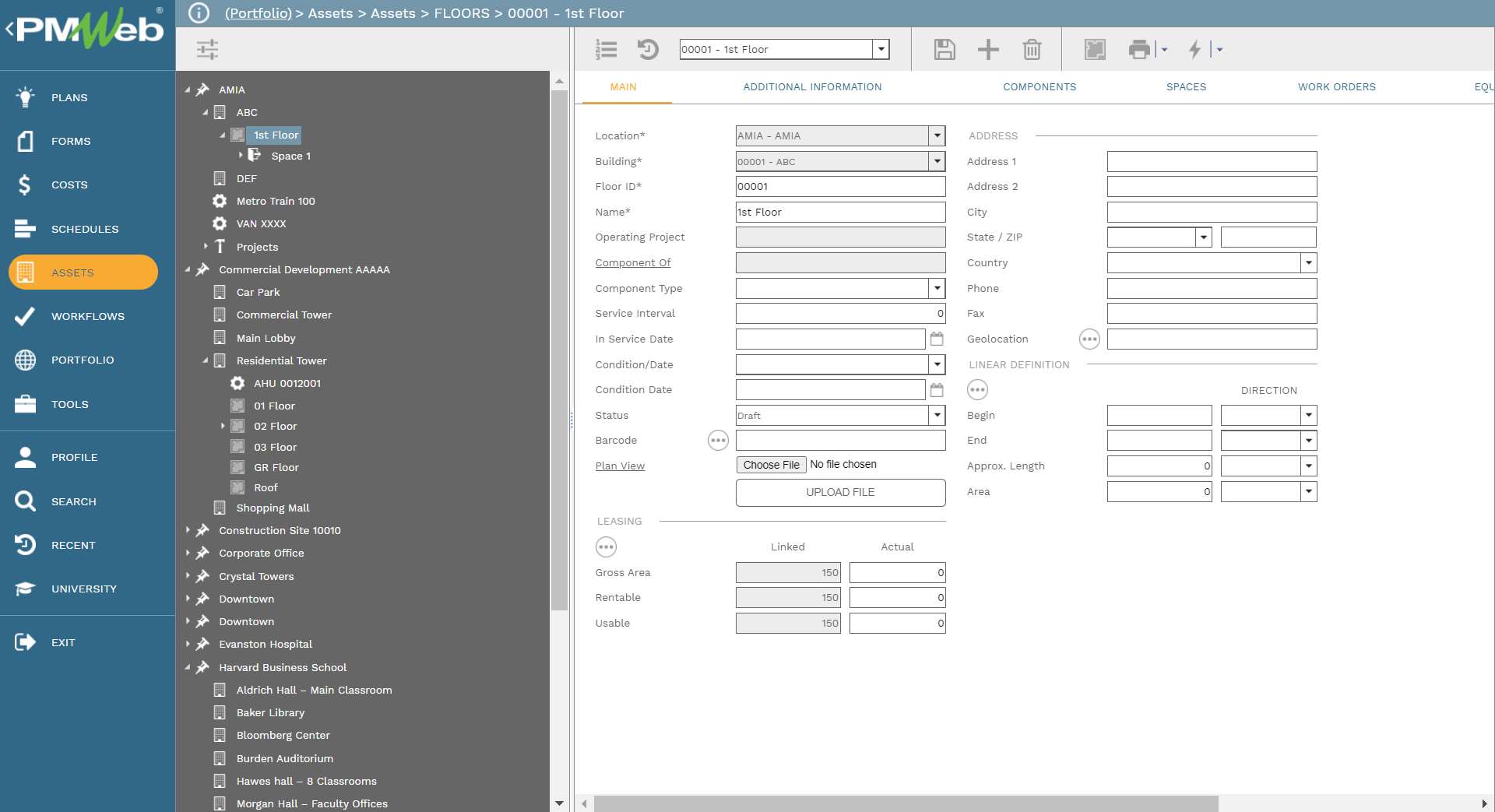

The floor level helps capture the details of all floors for each zone or building. Those include the total built and total sellable or leasable area of each tower among other needed details. Those also include the mechanical floors and roof where much of the electromechanical and HVAC assets are installed. The floor plan for each floor needs to be attached, and there is the option to display the floor plan for each level.

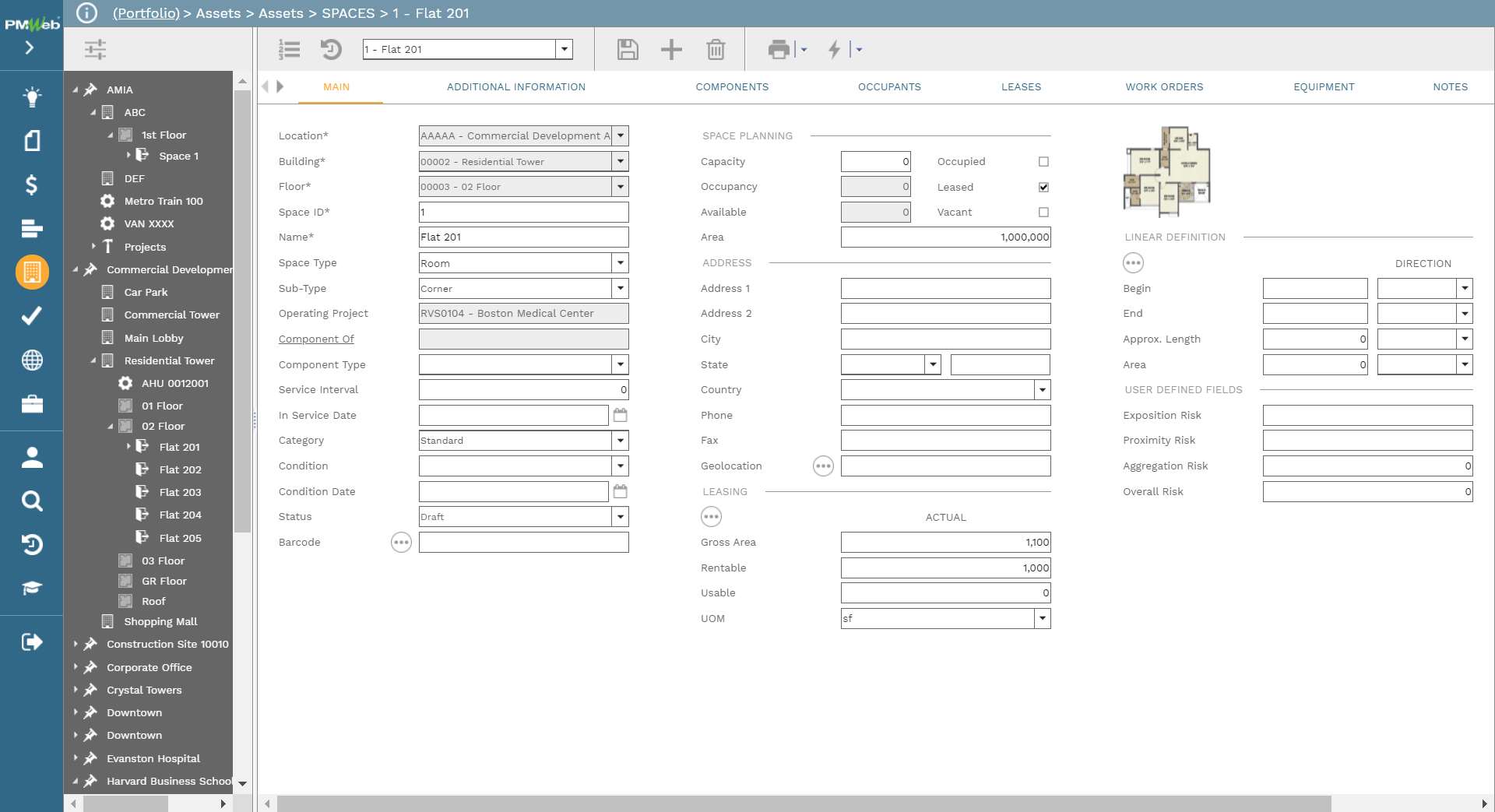

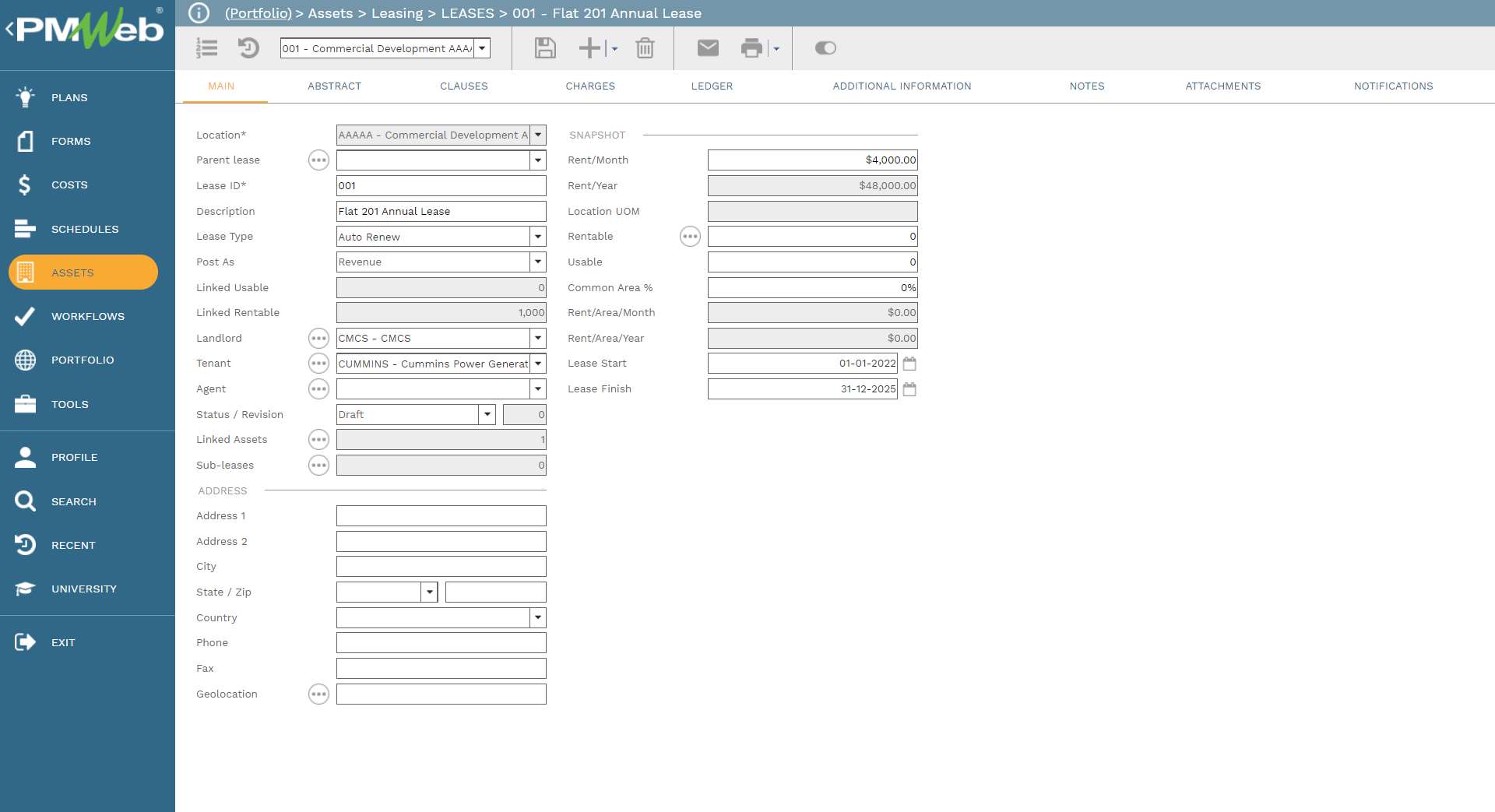

The space, flat, or villa level is the level where it matters most for determining the project valuation. Those will be the assets that generate the revenue in terms of sale value or the anticipated lease. The leases tab captures those details from the leases and sale agreements module.

The last level for the assets’ location breakdown structure is the equipment level which provides functions to capture the asset details similar to the location, zone, level, and space details. In addition, it provides a tab to capture the cost and book value of each asset depending on the depreciation method used for the selected asset. PMWeb allows using the straight line, double-declining balance, and sum of years digits for the asset depreciation. It also allows capturing the cost to operate the asset, which could be considered when determining the asset valuation.

The leases and sales value details for the project assets get captured in the leasing module. For assets to be sold, the lease amount allows capturing the one-time sale value of the asset. For each lease agreement, all charges such as management fees, utilities, insurance, maintenance and repairs, property taxes, and other expenses can be added to the lease or sale agreement. The attachment tab allows uploading and attaching the actual agreements signed by the tenants and new property owners to confirm the provided information.

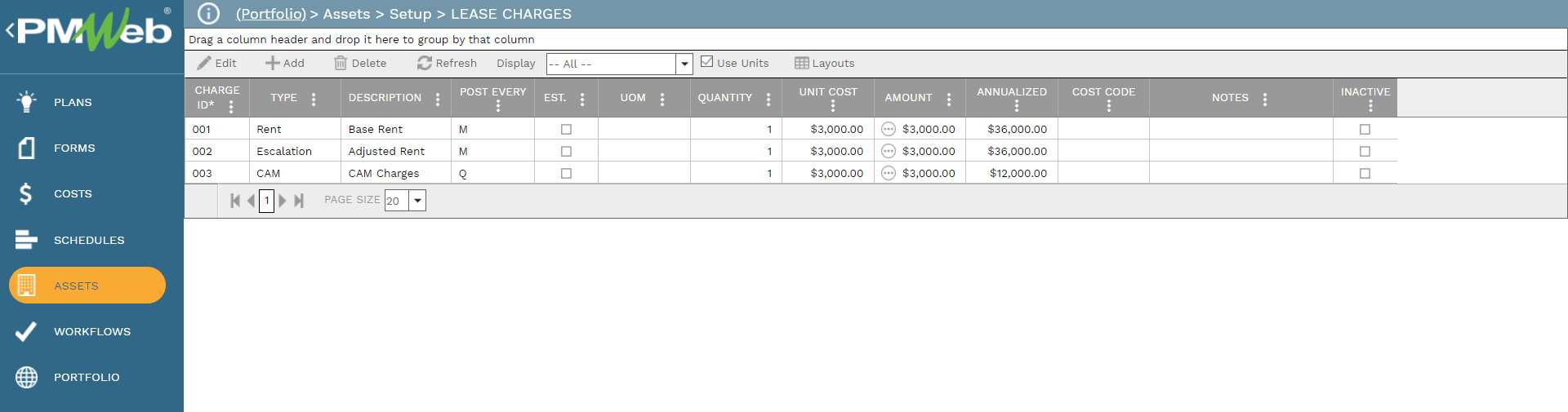

The details of all charges such as management fees, utilities, insurance, maintenance and repairs, property taxes, and other expenses get captured in the PMWeb lease charges module. This enforces maintaining a comprehensive and updated register of all possible expenses and charges that could affect the overall asset valuation.

Having this level of granular data on the project’s assets provides the asset valuation team with trustworthy information to run their asset valuation model. This information can be used by the asset valuation team whether they will use the absolute value models which value assets based only on the characteristics of that asset or the relative valuation and comparable transactions models which determine the value based on the observation of market prices of similar assets.The actual capital asset valuation can be created using MS Excel or a dedicated capital asset valuation software applications like Argus.