One of the important requirements in construction projects is the requirement for obtaining, verifying and monitoring the contractor certificates of insurance and bonds. Those documents need to be valid during the project construction’s period and some need to continue to be valid during the defect liability period. The contract documents will provide details of all required insurance and bonds certificates to be issued and maintained.

After the contractor starts the work, required insurance and bond certificates should be monitored to verify that the coverage is maintained in force, and proper renewal is obtained by the contractor and provided to the project owner. A register needs to be created capture the details of all insurance and bonds certificates as well as provide an early notification to identify which certificates will expire in the next sixty (60) days.

The insurance and bond certificates required for a project could differ depending on the contract requirements. Some of the common insurance and bonds certificates that are required for construction projects include Contractors All Risks (CAR) – Building Construction, Contractors All Risks (CAR) – Civil Works and Infrastructure, Erection All Risks (EAR), Commercial General Liability Insurance, Automobile Liability Insurance, Workers’ Compensation and Employer’s Liability Insurance, Umbrella/Excess Liability, Builder’s Risk Insurance, Asbestos Liability Insurance, Installation Floater Insurance, Contractor’s Pollution Coverage policy, Professional Indemnity, Performance Bond, Advance Payment Bond, Retention Bond among others.

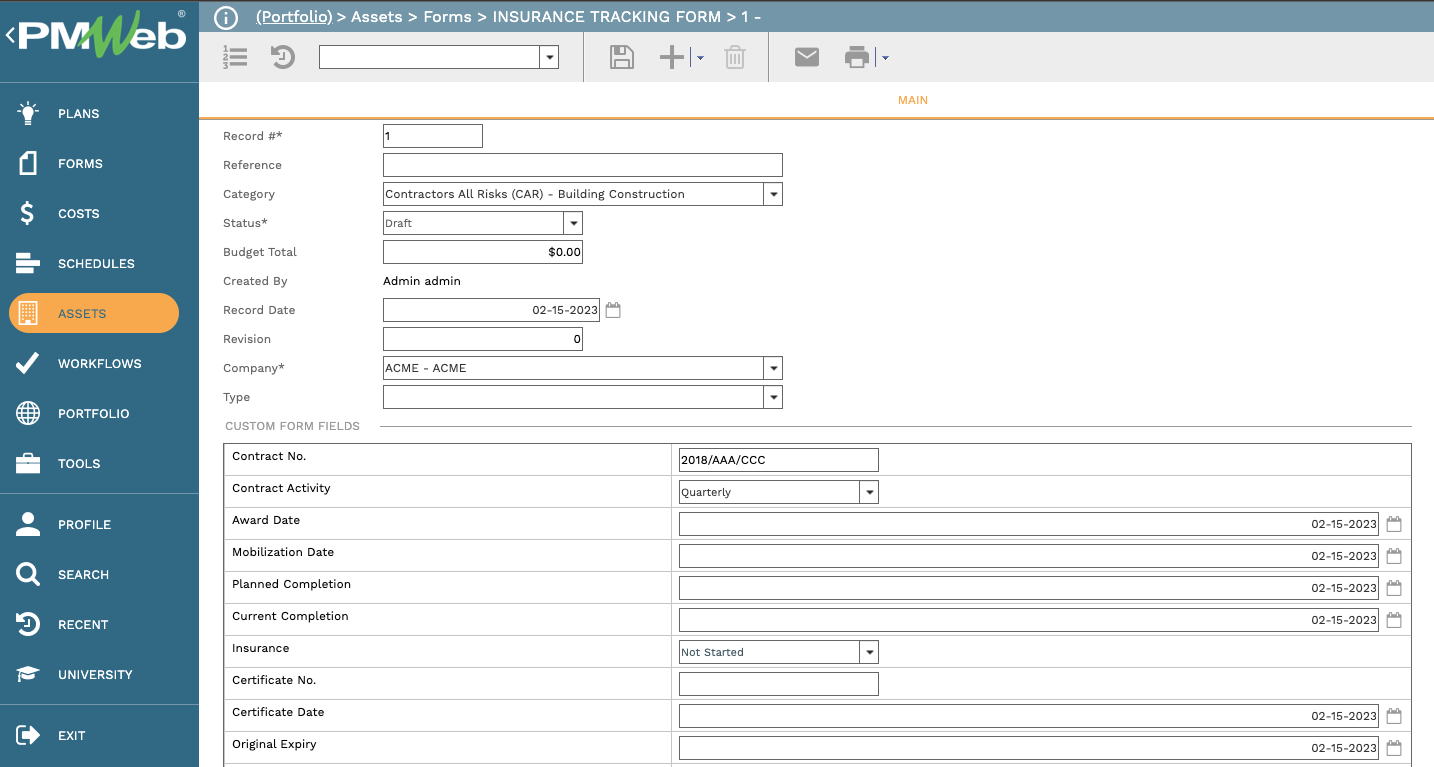

Using a Project Management Information System (PMIS) like PMWeb will be used to monitor and track the status of all insurance and bond certificates. PMWeb custom form builder will be used to create a document template to capture the details of each insurance and bond certificates. The form will be used to capture the Contract Number, Contractor Name, Contract Project Schedule Summary Activity, Contract Award Date, Mobilization Date, Contract Planned Completion Date, Contract Current Completion Date, Certificate Type, Certificate Category, Insurer, Certificate No., Issuance Date, Original Expiry Date and Current Expiry Date.

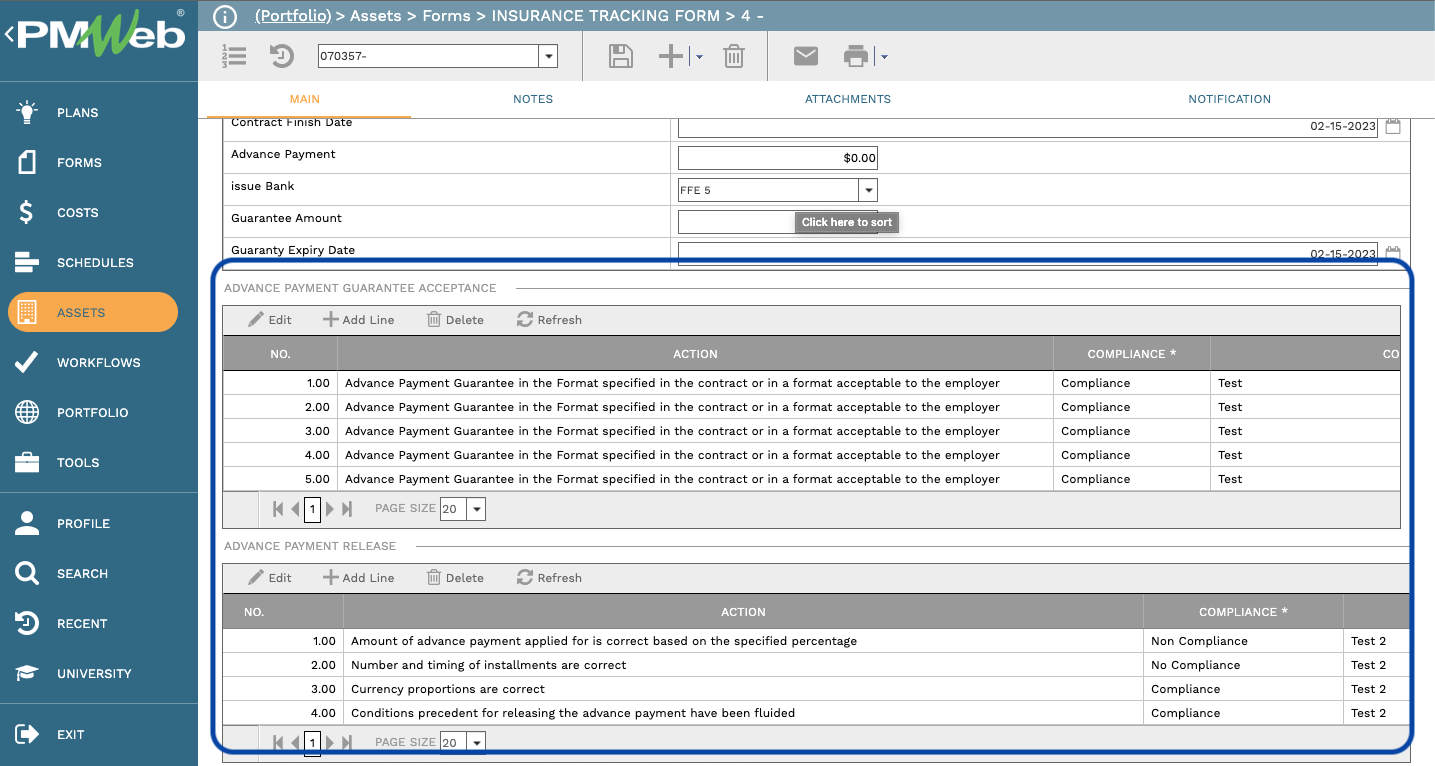

Of course, there is also the option of creating a separate document template for each insurance or bond certificate category where it will be possible to add a checklist that is specific for each certificate category. For example, for the advance payment certificate bond, the specific document template created for this bond document included two checklists. The first was for Advance Payment Guarantee Acceptance while the second was for Advance Payment Release.

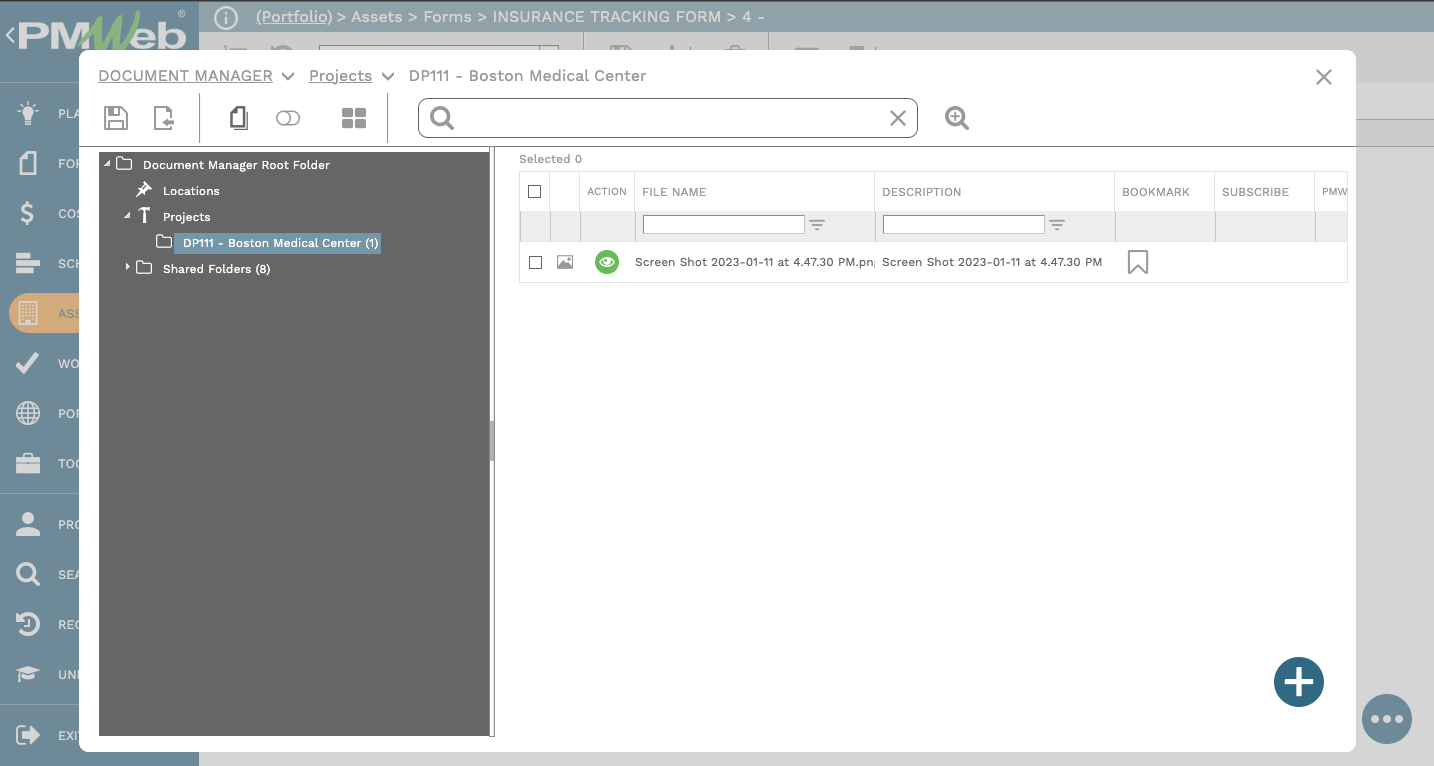

The attachment tab will be used to attach copies of the relevant insurance or bond documents to the form. Those documents will be uploaded and stored in their relevant PMWeb document management repository file folder. It should be noted that for the Insurance Tracking document template there will be no workflow for reviewing and approving the process unless this is needed.

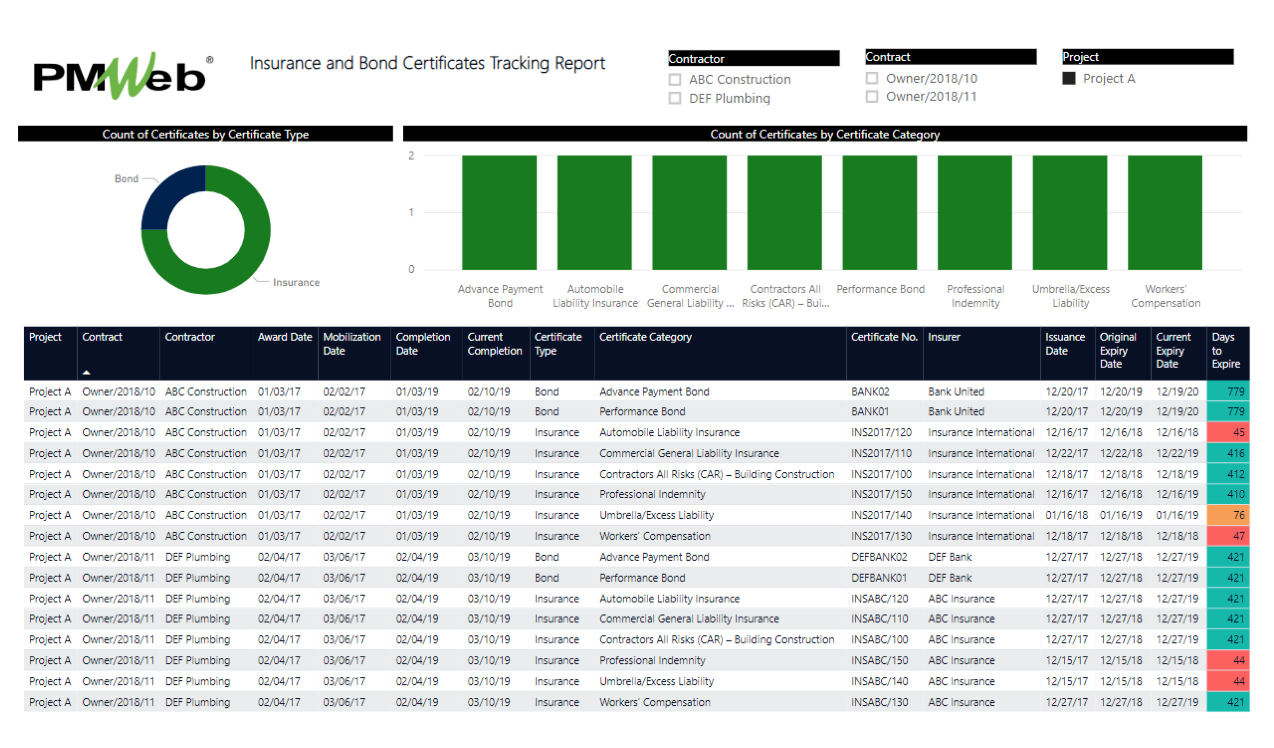

The Insurance and Bond Certificates Tracking report will be used to monitor and track the status of all insurance and bond certificates issued on the project. The most important field on this report is the Days to Expire field which is a calculated field that will calculate the difference between “Today’s Date” and the certificate “Current Expiry Date”. The field background will be colored in “Red” for those certificates that are due to expire in 60 days or less, “Cyan” for those that are due to expire in 90 days and “Green” for those certificates that have more than 90 days to expire.