Blog Forms Plans Portfolio Risk Issue Management Schedules Tools Uncategorized Workflow

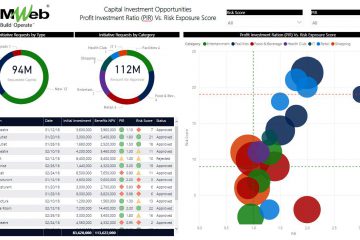

Evaluating and Shortlisting Capital Investment Opportunities Using Profit Investment Ratio (PIR) and Risk Exposure Measures

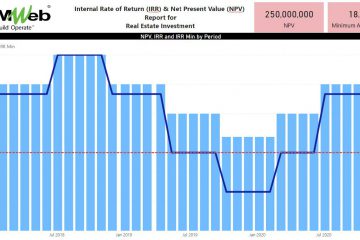

When it comes to evaluating and shortlisting capital investment opportunities, an organization needs to consider selecting and investing in them as capital projects. With this, they must decide if the profit investment ratio (PIR) or value investment ratio (VIR), which is a capital budgeting measure that gauges the potential profitability Read more…