When it comes to evaluating and shortlisting capital investment opportunities, an organization needs to consider selecting and investing in them as capital projects. With this, they must decide if the profit investment ratio (PIR) or value investment ratio (VIR), which is a capital budgeting measure that gauges the potential profitability of a capital project investment, is in an acceptable range. The evaluation and shortlisting of initiatives that could possibly be considered for selection and execution also takes into account the risk or threats exposure associated with each opportunity.

The profit investment ratio (PIR) is calculated by dividing the net present value of future benefits by the initial investment cost of the project opportunity. The initial investment cost includes the costs of site acquisition, professional services, construction, marketing, legal and other cost types needed to build the project. The net present value of future benefits includes all sources of revenue that the project will generate which is adjusted by the costs of refurbishment and renewal, operation, maintenance and end of life or assets disposition.

The profit investment ratio (PIR) equals the Present Value of Future Benefits divided by the Initial Investment needed to build the project. A profit investment ratio (PIR) of 1 indicates breaking even, which is an indifferent result for the investor. If the result is less than 1.0, then this investment should be avoided. Whereas, if the result is greater than 1.0, then this investment should be considered and be further analyzed to support the decision on whether the investment should be selected as a project or not.

As for the opportunity risk or threats exposure, it is based on the weighted risk exposure assessment for all risks or threats identified for the opportunity. The risk exposure is based on a score of 25. The score is a multiplication of a risk that is likely to occur which will be 5 points and a has catastrophic impact if it occurs which is also be 5 points. A risk exposure below 9 points is considered low, between 9 and 17 is moderate and above 17 as high. Of course, the common sense would be the highest risk exposure provides the highest profit investment ratio.

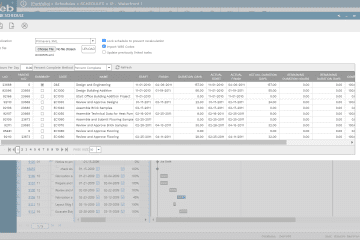

Using a Project Management Information System (PMIS) solution that address the pre-project stage of capital investments like PMWeb enables capturing the estimated initial investment costs as well as the anticipated benefits or revenues of the operation stage and costs during this stage. PMWeb initiative module allows capturing this estimate information and the investment life cycle schedule which is associated with the cost and revenue estimates needed to calculate the net present value of future benefits. The module also allows setting the scoring criteria for which initiatives with a PIR is greater than are analyzed against.

For the risk exposure analysis, it is recommended to use PMWeb custom form builder to create a simplified risk checklist template which has all risk categories and items pre-defined along with the weight for each. Of course, there is also the option to use PMWeb Risk Analysis module if needed.

The attachment tab for the initiative and risk register checklist templates allows attaching all those supportive documents. It is also highly recommended to add comments to each attached document to provide better understanding of what was the document for. The attachment tab also allows the user to link other records for business processes implemented in PMWeb, emails imported to PMWeb from designated email servers as well as associate URL hyperlinks with websites or documents that are not stored in PMWeb document management repository.

All those supportive documents need to also be uploaded into PMWeb document management repository so they can be stored and used. Those documents could be uploaded into folders or subfolders, so they are better organized and secured. PMWeb allows setting access rights to each folder to identify the users who have access rights to view documents stored in a folder. In addition, PMWeb allows setting notifications for individuals to receive emails when new documents are uploaded, or existing documents are downloaded or deleted.

To enforce accountability for all business processes required for the initiatives and risk assessment business processes, PMWeb workflow module helps create a workflow to formalize the review and approval tasks of those business processes. The workflow maps the sequence of the review and approval tasks along with the role or user assigned to the task, duration allotted for the tasks, rules for returning or resubmitting a document and available for each task. In addition, the workflow could be designed to include conditions to enforce the authority approval levels as defined in the Delegation of Authority (DoA) matrix. It should be noted that those involved in the workflows can include other members of the organization that are not part of the project management team.

When any of those business processes is initiated, the workflow tab available on the template captures the planned review and approve workflow tasks for each transaction as well as the actual history of those review and approval tasks. PMWeb captures the actual action data and time, done by who, action taken, comments made and whether team input was requested.

The Profit Investment Ratio (PIR) and Risk Exposure report includes filters to enable stakeholders to select only those initiatives that have a PIR value that is more than 1.00 as well as a risk or threats exposure below 19 or those with low or moderate exposure. The selected filter automatically adjusts all visuals and reports included in the report to only display the information relevant to the selected initiatives.