Whether the project control system (PCS) is being managed by the project owner or contractor, they both need to manage, monitor, evaluate, and report on the funding that has been authorized for the project. Funding can come from different sources depending on the funding recipient.

The PMWeb funding module enables project owners as well as contractors to manage the project funding business processes needed for their capital construction projects’ portfolios. The PMWeb funding modules are highly configurable to allow the project owner to manage the project’s funding process following their pre-defined policies and procedures.

The first task is to identify the funding sources that could be made available for a project, program, or portfolio of projects. Funding sources usually include government funding, loans from banks, development banks, and other financial institutions, credit funding, etc.

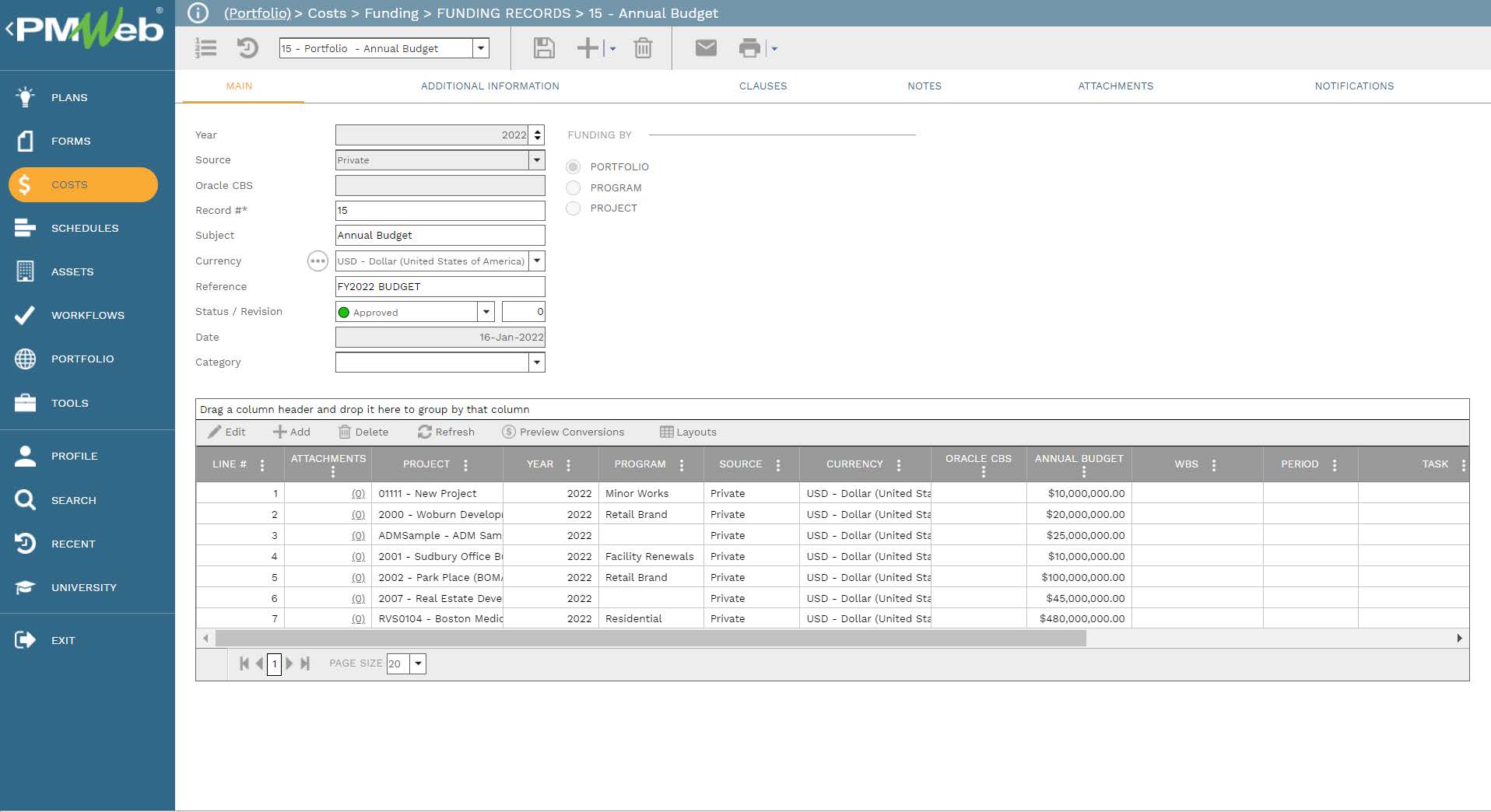

Depending on the process followed by the organization for capturing the funding requirements for their projects, the funding records could be specific to a single project, program of projects, or even the complete projects portfolio. For example, some organizations might define buckets of the budget to be spent on the approved group of projects or programs. Those could be funding buckets for commercial, residential, capital improvement, etc.

Each funding record captured in PMWeb needs to be detailed in the projects it covers and the amounts of funding required for each project for each fiscal year. The level of detail of itemizing the funding records depends on the level of control needed by each organization to monitor, evaluate, and report on their project funding status.

The required supporting documents or transaction records from business processes managed in PMWeb can be either attached or linked to their relevant fund record. A workflow can also be assigned to the funding record template to formalize its review and approval by the designated individuals while adhering to the preset approval authority levels.

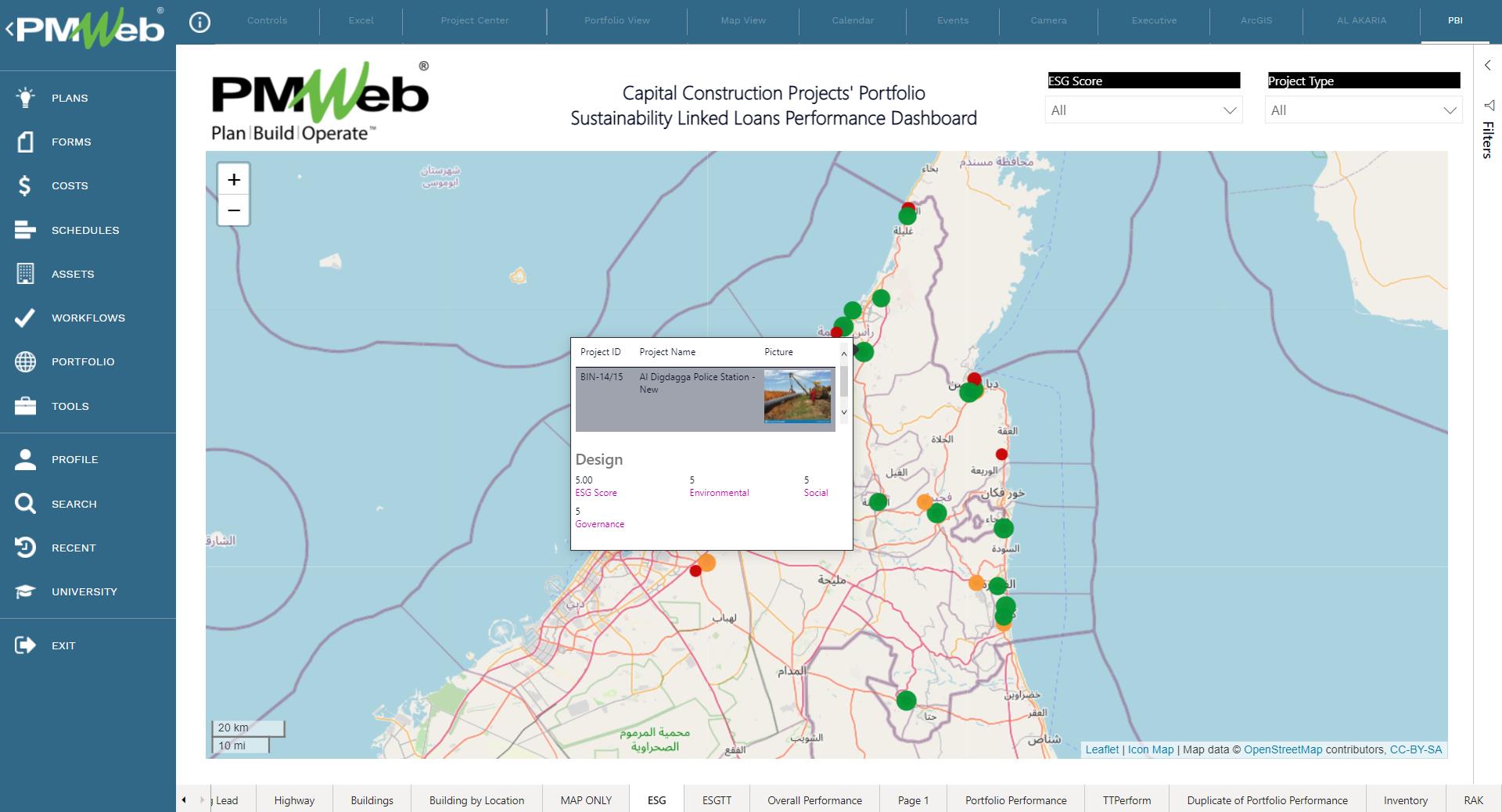

One new type of project funding that is available for construction projects is the “Sustainability linked loans aim to facilitate and support environmentally and socially sustainable economic activity and growth. The Sustainability Linked Loan Principles (SLLP) have been developed by an experienced working party, consisting of representatives from leading financial institutions active in the global syndicated loan markets.” (LSTA, 2021)

Sustainability-linked loans are loan instruments and contingent facilities (such as bonding lines, guarantee lines, or letters of credit) that incentivize the borrower to achieve ambitious, predetermined sustainability performance objectives. The borrower’s sustainability performance is measured using pre-defined sustainability performance targets (SPTs), as measured by pre-defined key performance indicators (KPIs). These may comprise external ratings and equivalent metrics, which measure the borrower’s sustainability profile improvements.

Accordingly, real-estate developers keen to get their capital construction projects financed by Sustainability Linked Loan Principles (SLLP) must implement the actions needed to achieve the required performance targets for the environmental, social, and governance (ESG) categories of sustainable development. These performance targets associate with the agreed KPI for the environmental category, which could include KPIs for energy efficiency, greenhouse gas emissions, waste disposal, renewable energy, water consumption, sustainable sourcing, and others. For the social category, the KPIs could include human rights and community relations, employee health and safety, employee engagement, diversity and inclusion, employee training, and others.

For all these agreed-upon KPIs, an audit verifies what was achieved against what was planned at the end of each audit period. This becomes the basis for scoring each KPI on a scale of 5, where five is On Target, three is Slightly Behind Target, and one is Behind Target.

In addition, there are weights for each KPI to bring the total weight of all KPIs in the audit assessment to 100%. This provides a weighted Sustainable Development Performance Indicator (SDPI) which ranges from 5 for On Target, 3 for Slightly Behind Target, and 1 for Behind Target. The SPDI becomes the basis for determining the extent of compliance of each real-estate development project with the rules and conditions set for the Sustainability Linked Loan.

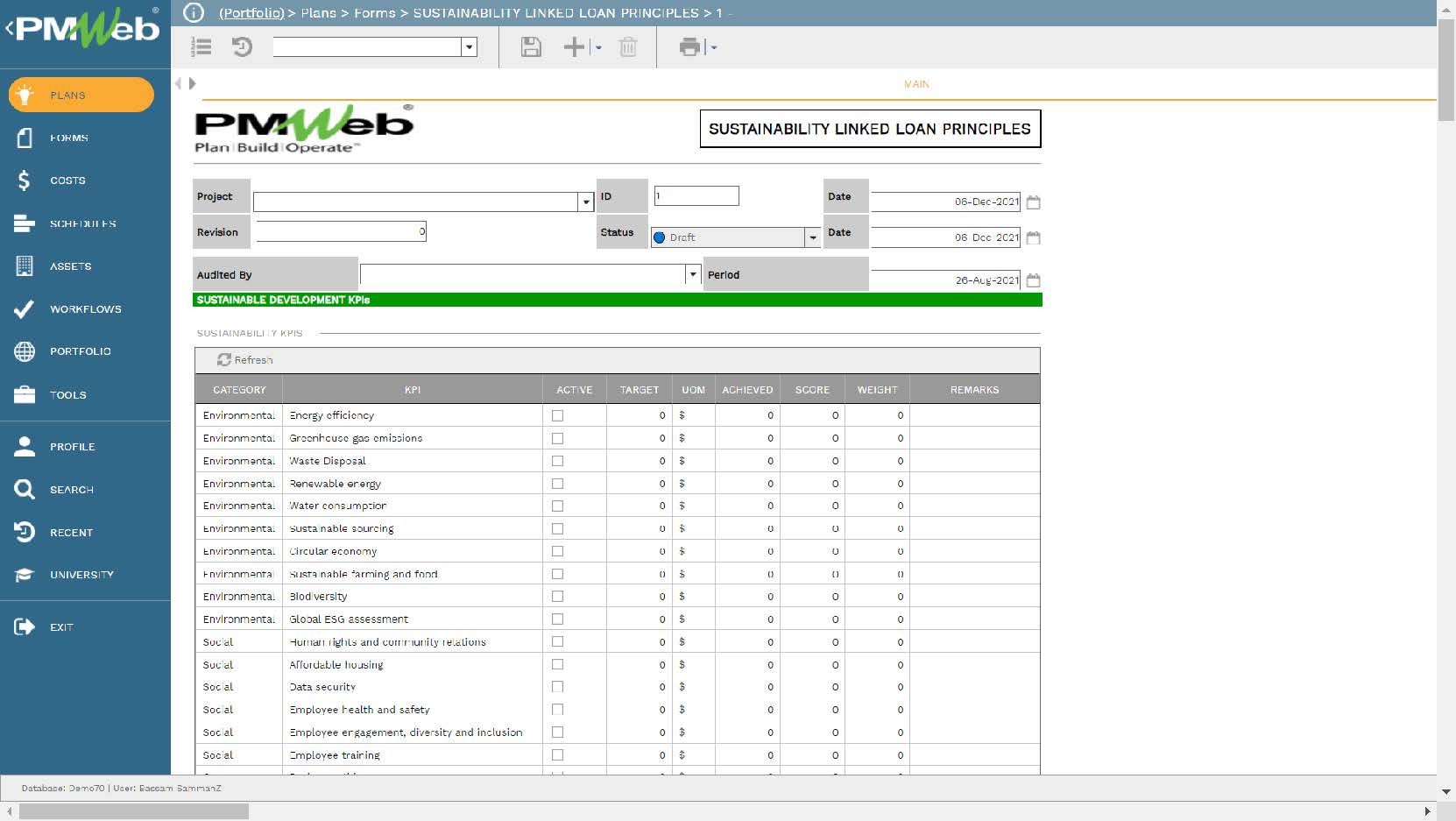

Using PMWeb, a business process gets added to manage the monitoring, evaluating, and reporting of the key performance indicators (KPIs) for the Sustainability Linked Loans. The PMWeb visual custom form builder is used to create the template, including the list of agreed KPIs that will be audited at the end of each period. For each KPI, there is a table for the target value, unit of measure, achieved KPI value, the weight of the KPI, score value, and remarks.

All supporting documents used to assess the KPIs need to be attached to the assessment template. It is also highly recommended to add comments to each attached document to understand better what the document is for. The attachment tab also allows the user to link other records for business processes implemented in PMWeb and associate URL hyperlinks with websites or documents not stored in the PMWeb document management repository.

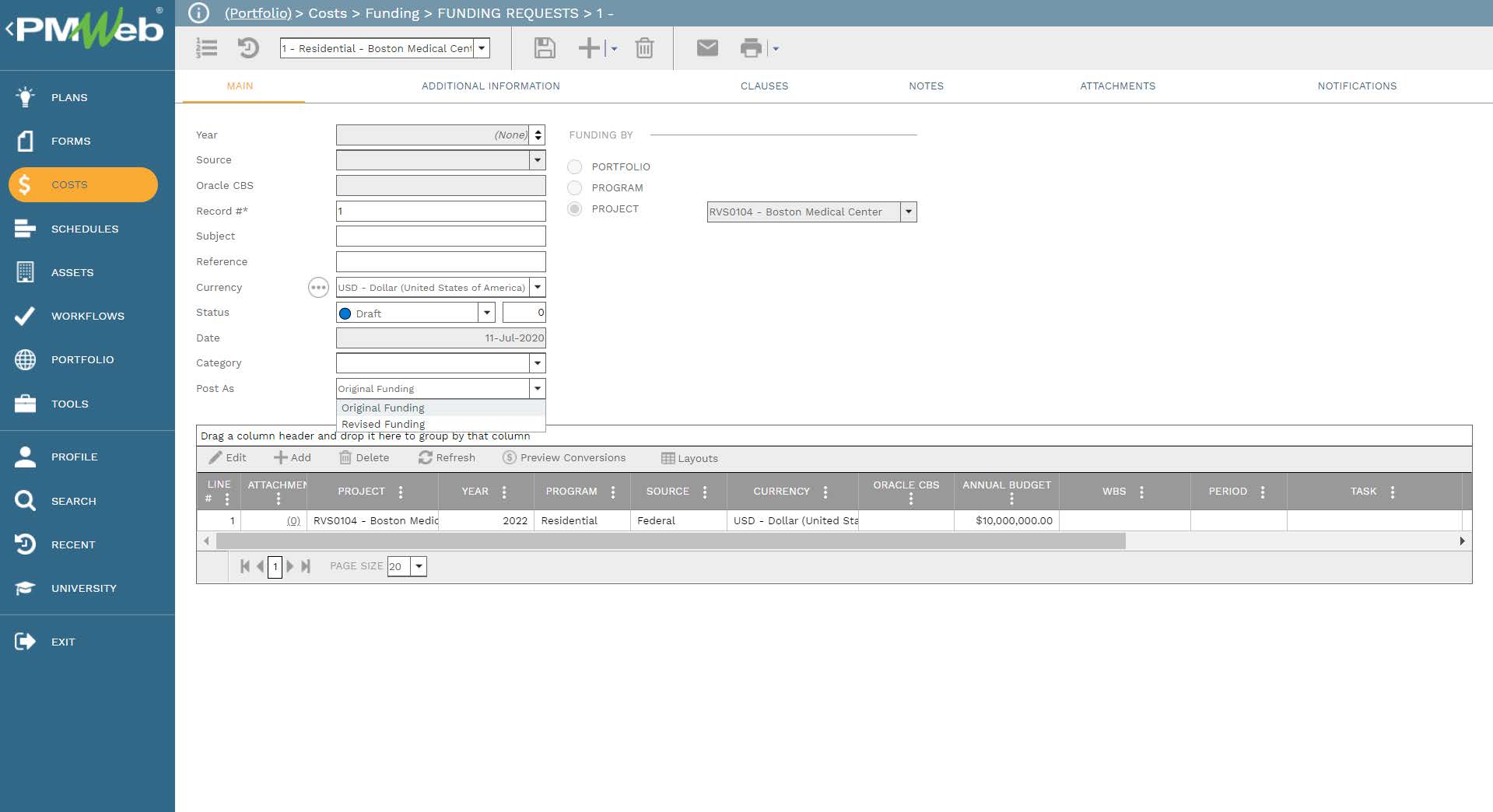

The second funding module is the PMWeb funding request module, which captures any changes associated with the initially requested project funding. This module can also capture all project funding requests issued by the recipient organization instead of using the PMWeb funding record module to capture these details. To differentiate between funding requests that are changes to what was originally requested and funding requests that are considered the original funding requests, the funding request transaction can be either posted as original funding or revised funding.

The advantage of using the PMWeb funding request module is that it provides organizations with an audit trail of all issued funding changes or funding requests for projects. In addition, there is the option of attaching supporting documents and linking transaction records from business processes to each funding request transaction. Further, one should assign a workflow to formalize the review and approval tasks for all funding requests. PMWeb allows adding different workflow scenarios to address the review and approval tasks for either funding changes or funding requests. The workflow aligns with the individuals’ approval authority levels set in the delegation of authority (DoA) matrix.

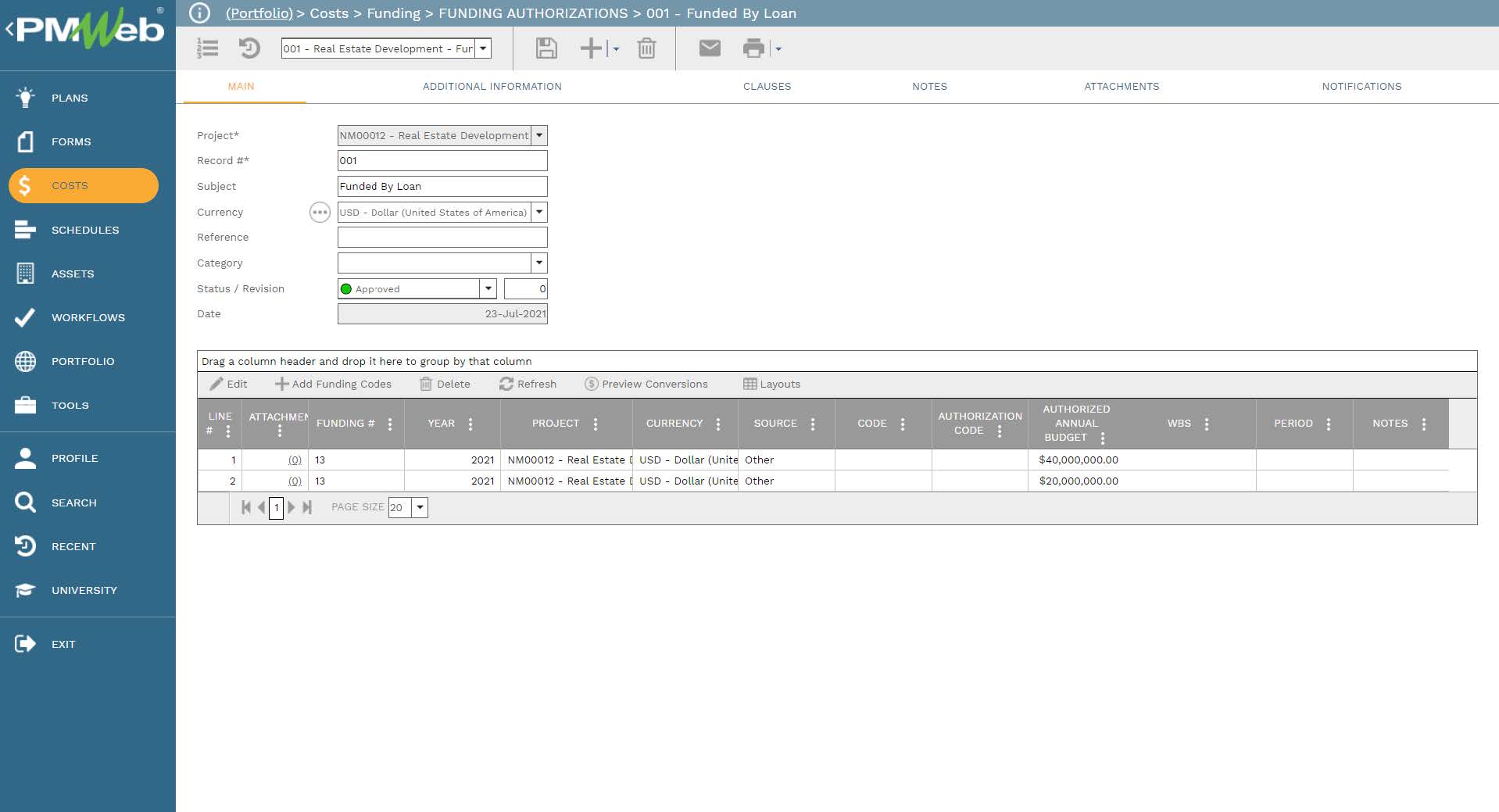

At this point, neither the original funding requests nor revised funding requests have been authorized to fund the project’s portfolio. The PMWeb funding authorization will be the business process used to capture the details of what has been authorized for funding projects.

Unlike the modules for funding records and funding requests that could be applied to a project, program, or portfolio of projects, the funding authorization module is specific to a single project. Similar to the other funding business processes, documents can be attached to the funding authorization module, and transaction records of other business processes can be linked to each funding authorization transaction. Further, a workflow will be assigned to map the review and approval tasks while adhering to the approval authority levels.

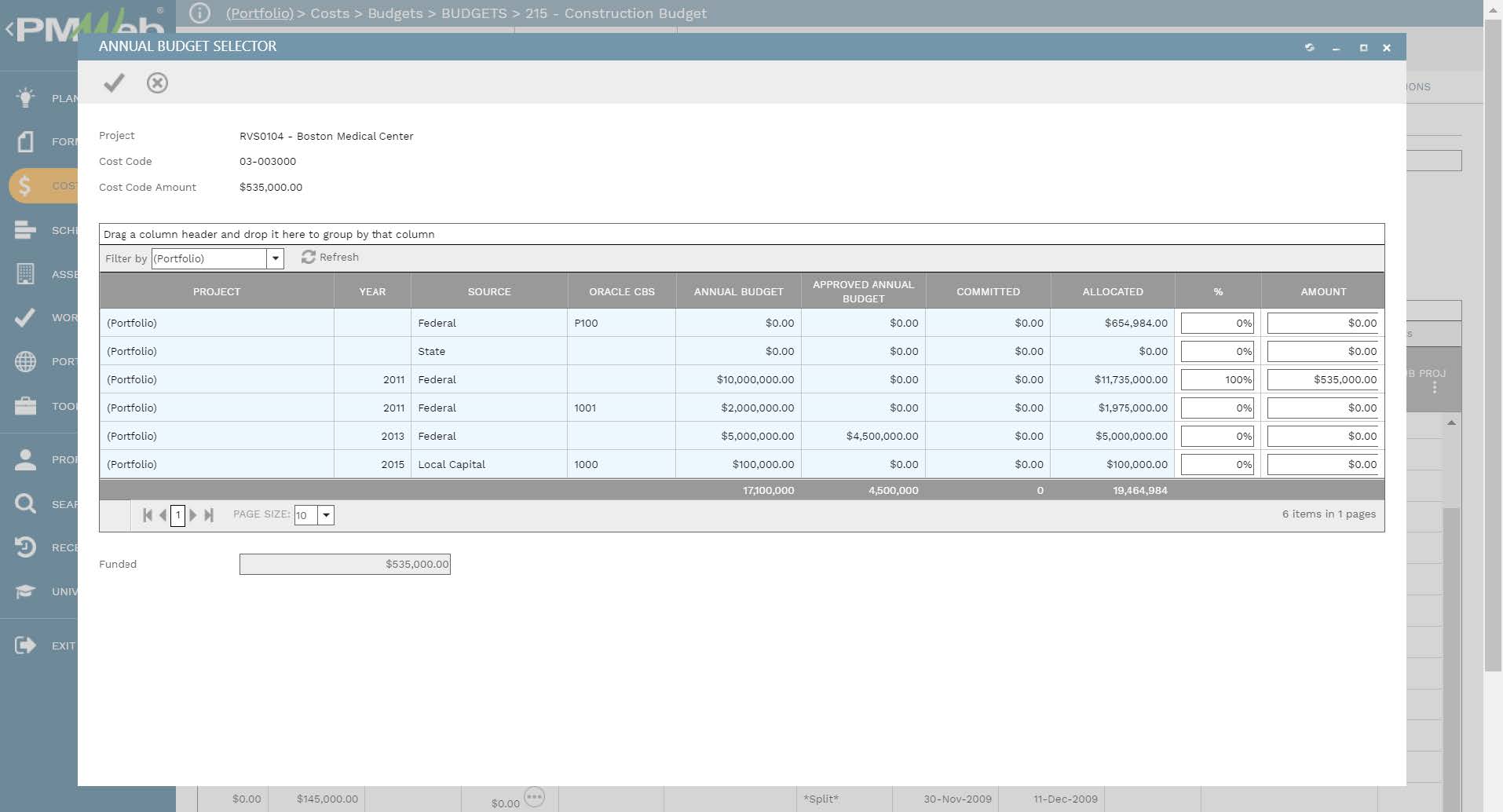

The authorized budget spending will become the basis for the annual budget allocation amounts for the approved project budget. Each line item in the PMWeb budget module will be allocated with the amount of the authorized budget for the relevant fiscal year. Each budget line item will have its cost account or cost breakdown structure (CBS) level value.

A budget line item could have funds allocated from different fund sources with authorized funding. The allotted amounts can be added as a percentage of the total authorized fund source amount or the exact value of the authorized fund source amount. In addition, a single authorized funding source can be used to fund more than a single budget line item for which each will have its cost account or cost breakdown structure (CBS) level value.

PMWeb allows two different ways of managing project funding. The first is ‘transactional,’ which manages all the transactions associated with the project funding. The second is ‘automatic,’ which is required to allocate the annual budget and then automatically report on all commitments and expenditure transactions against the allocated budget.

For the ‘automatic’ funding management method, when the project budget is assigned with the allocated annual budget amount, PMWeb automatically captures the commitment amounts associated with the same cost account or CBS level of the budget line item. These amounts are part of each commitment agreement captured in the PMWeb commitment module.

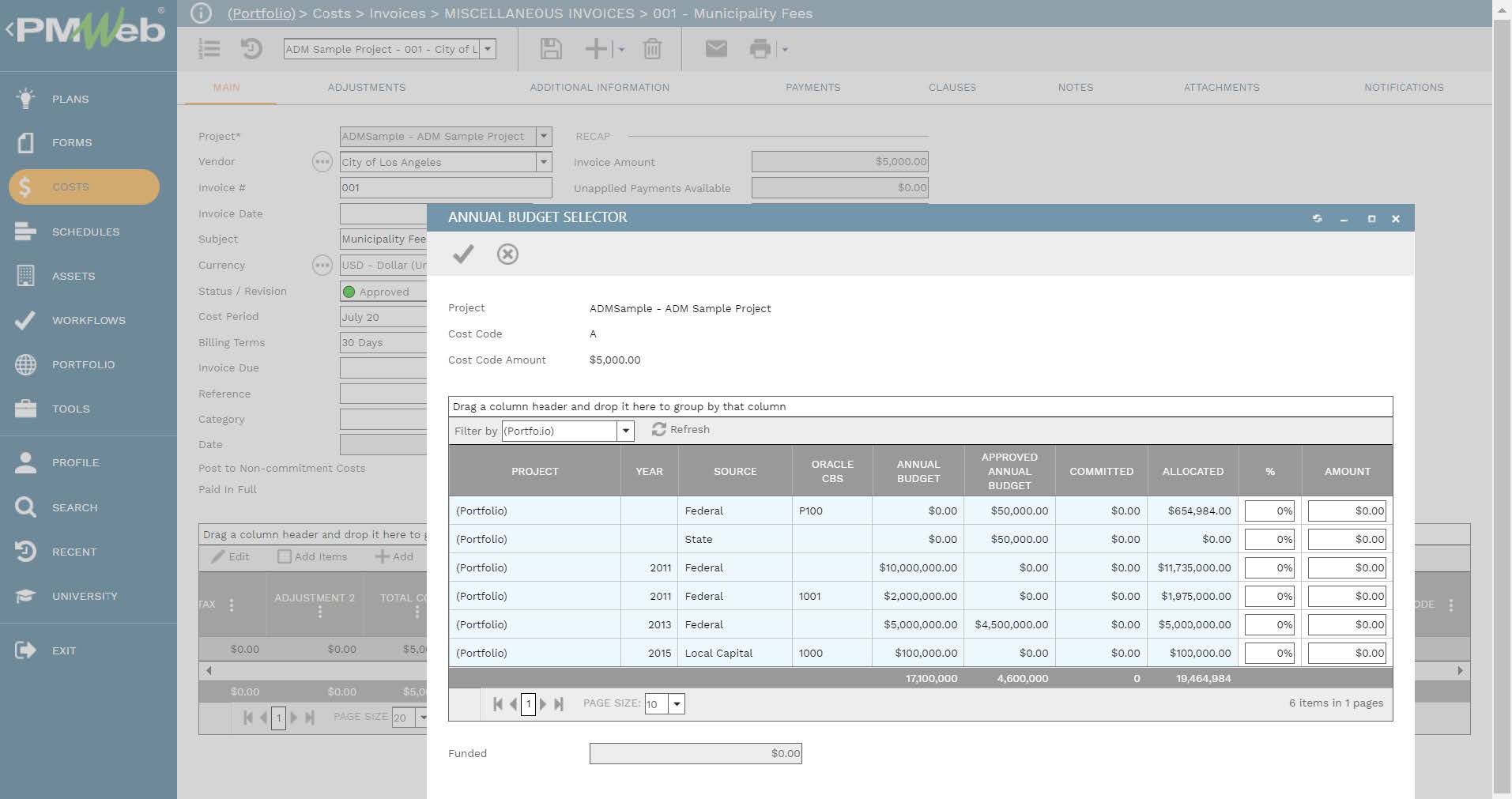

In addition, PMWeb automatically captures the spending amounts associated with the same cost account or CBS level of the budget line item. These are the amounts captured in the PMWeb modules for commitment progress invoices and miscellaneous invoices.

On the other hand, for the ‘transactional’ funding management method, there is a need for the PMWeb users to capture the funding details for every individual commitment agreement, interim progress invoice, and miscellaneous invoice transaction. The assigned funding amount follows the same approach used for adding the funding amount for the annual budget allocation.

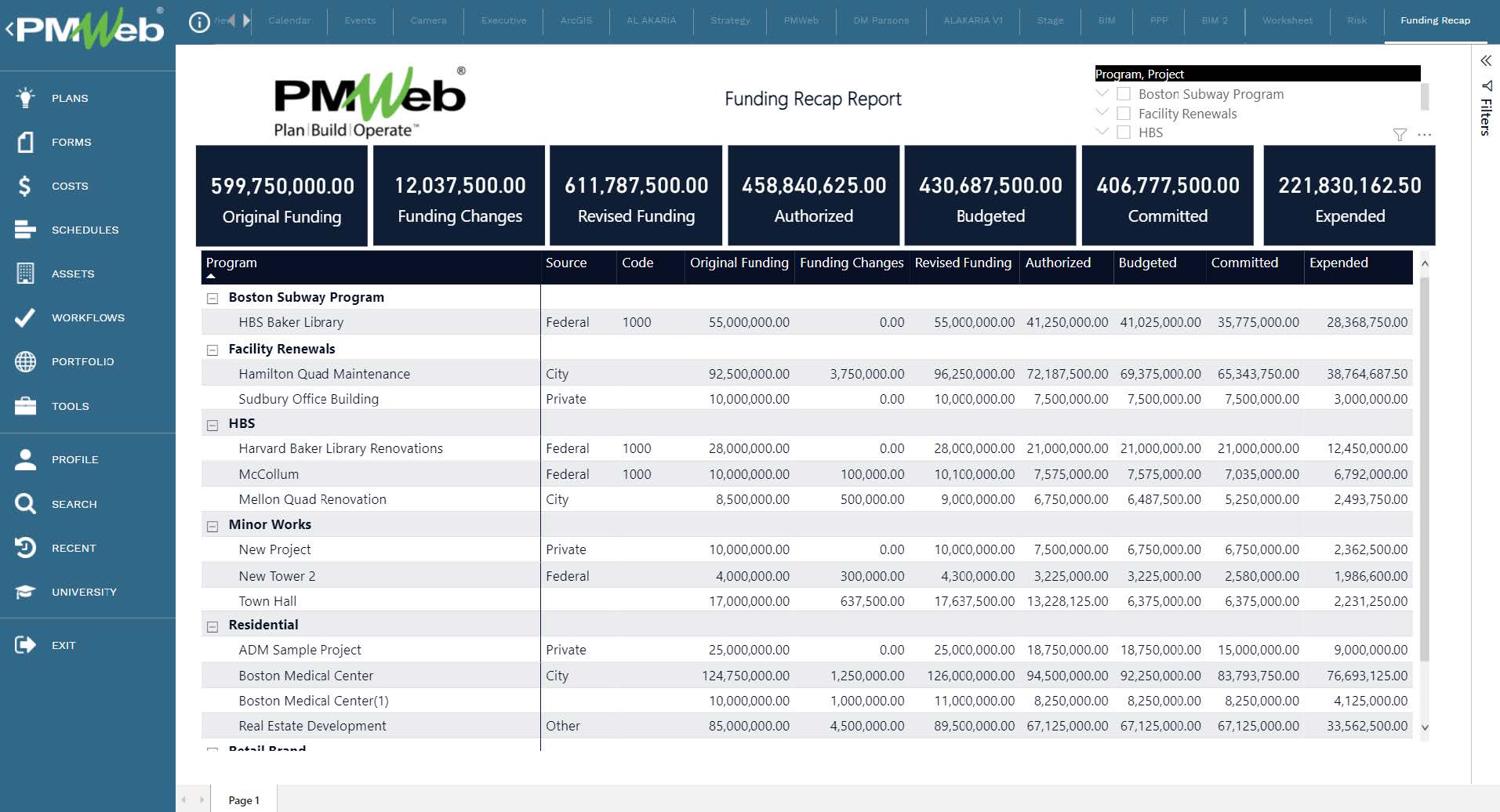

The digitalization of the project funding and related business processes using PMWeb immediately provides the data needed for a single real-time version of the truth funding recap report. The report details the total amount of funding requested for each project, adjustments made to what was originally requested, revised funding requests, funding authorized to the project, allocated annual budget, commitment, and expended. It also includes fields to display the variance between the amount of authorized funding and the allocated yearly budget and a field for the amounts expended and the allocated annual budget. In addition, the budget performance index (BPI) is calculated by dividing the sum expended by the allocated yearly budget amount.

Reference

The content of this article was extracted from the book titled “Let’s Transform: Enabling Digital Transformation of Capital Construction Projects Using the PMWeb Project Management Information System – 2nd Edition” written by Bassam Samman.

The book provides project owners with oversight on how technology available today can support their efforts to digitally transform the management of their projects’ portfolios. For each capital project life cycle stage, PMWeb is used to detail how the relevant project management business processes can be digitalized to enforce transparency and accountability in delivering projects. In addition, MS Power BI was used to show how the real-time, trustworthy data captured in PMWeb can be aggregated, modeled, monitored, evaluated, analyzed, and reported at anytime, anywhere using any device.