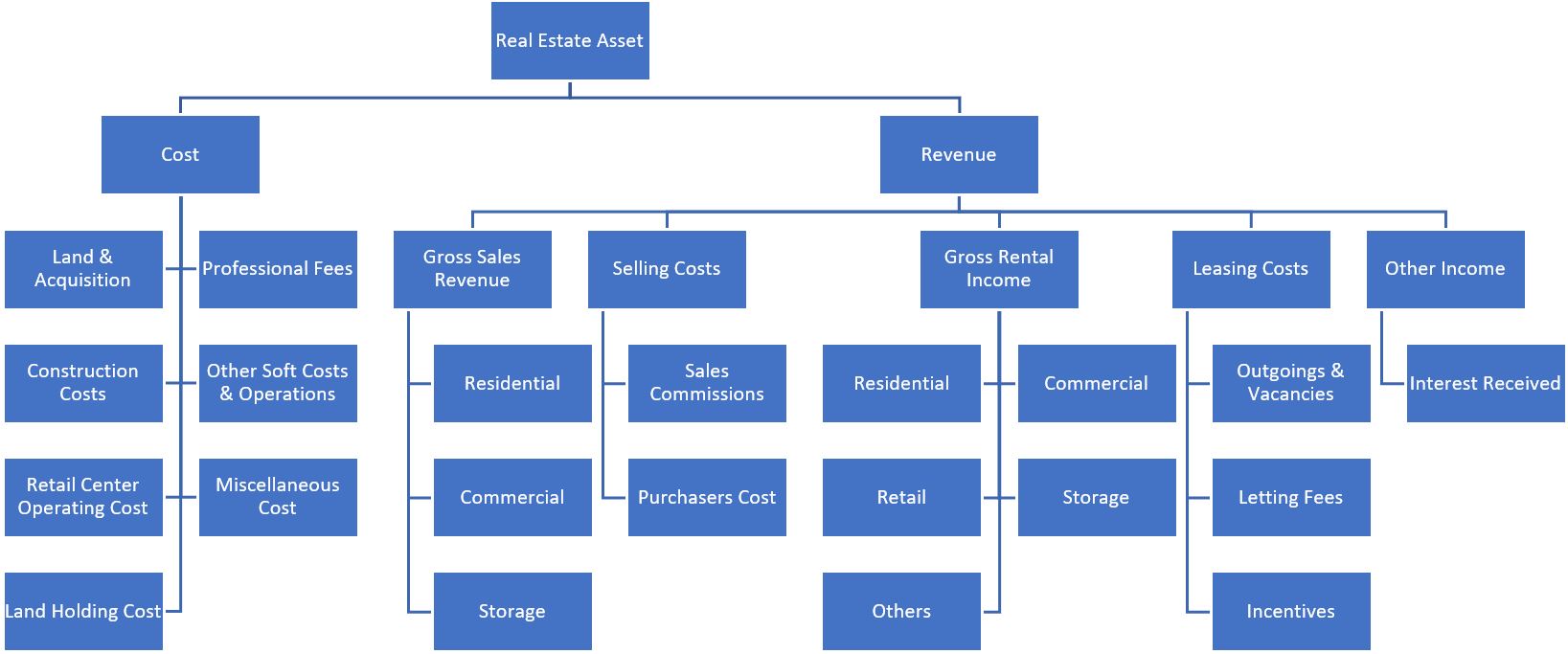

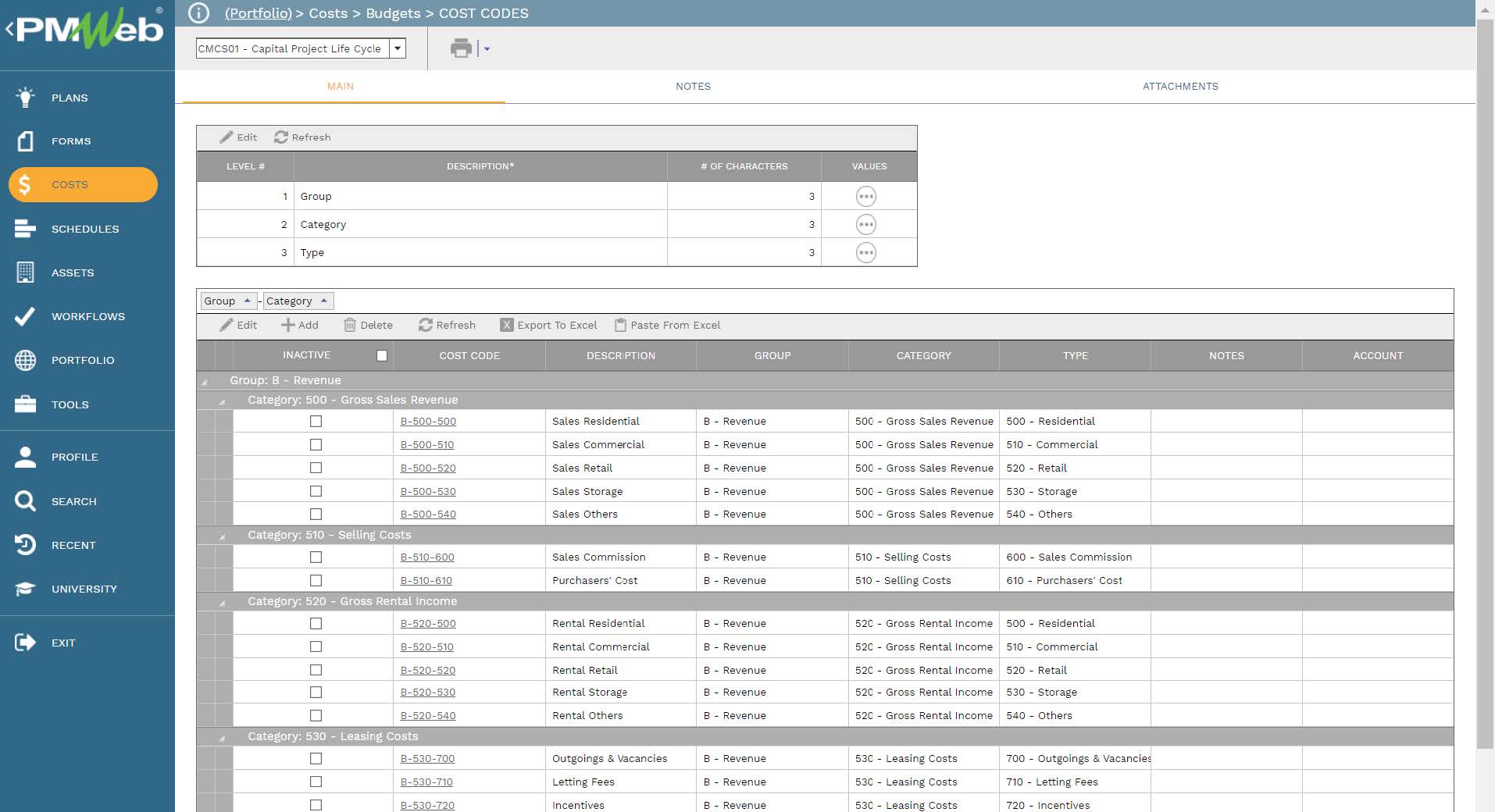

For most of those involved in delivering capital construction projects, the cost breakdown structure (CBS) or cost accounts mainly focus on the cost for delivering the project’s real estate investment. The cost breakdown structure details all soft and hard costs required to deliver the project including the costs associated with the land acquisition. Nevertheless, very few project owners include the cost breakdown structure (CBS) for revenue and operation costs in their projects. The revenue and other benefits associated with the capital construction project are the basis for selecting the project for execution. Therefore, the cost breakdown structure (CBS) should include all levels associated with the project revenue or benefits.

Using a Project Management Information System (PMIS) like PMWeb, not only can the cost breakdown structure (CBS) be configured to capture the revenue and benefits items, but it can also manage the business processes associated with those items. For example, a cost estimate for revenue or benefits can be created for which it becomes the basis for defining the baseline for the revenue and the projected revenue or income plan. In addition, an income contract agreement can be created to capture the revenue from all sale and lease contracts. Further, the PMWeb commitment module helps capture the contracts for maintaining and operating the completed facilities as well as sales commissions and purchasers’ costs.

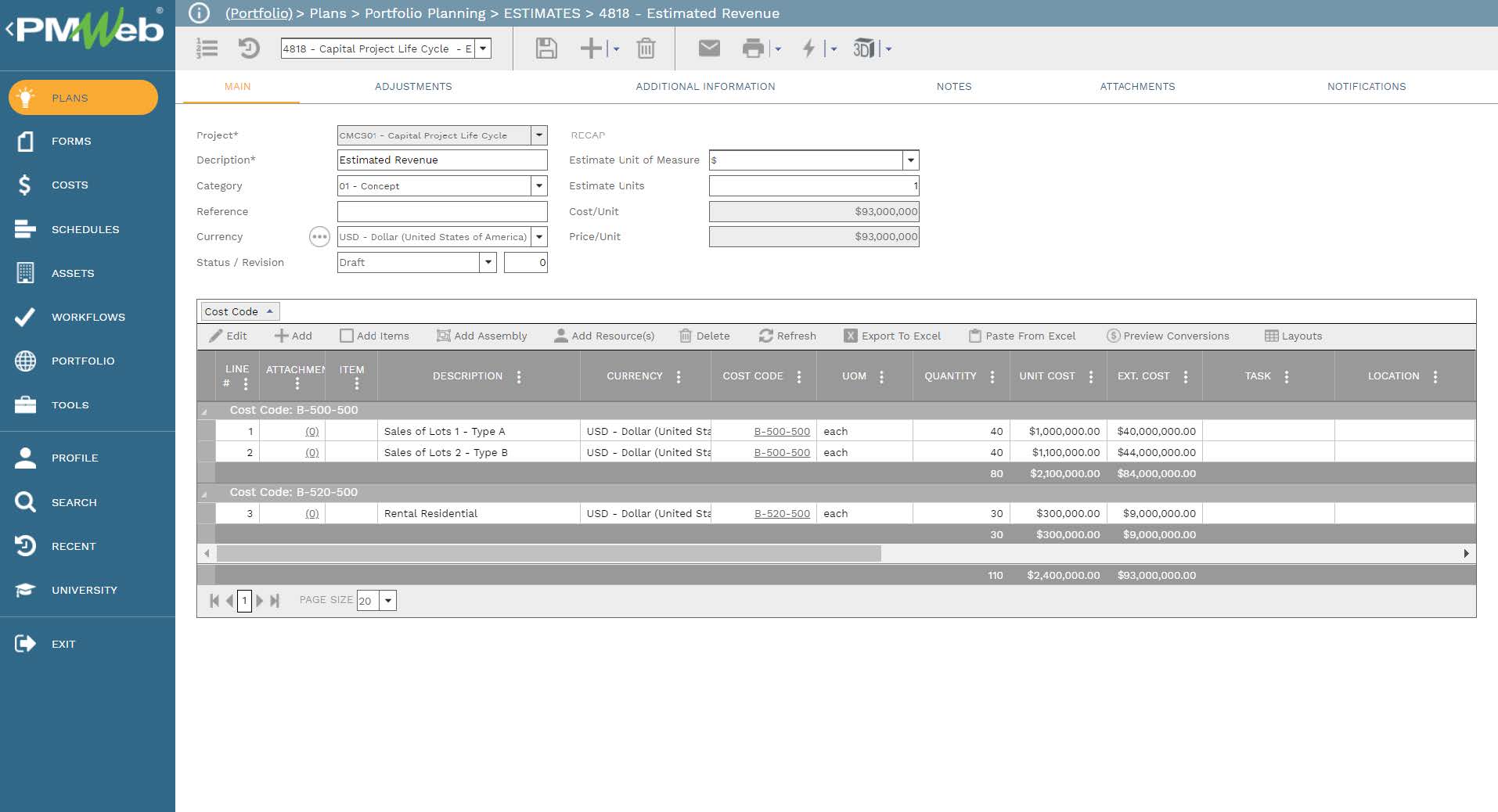

PMWeb estimate module captures the details of the estimated revenues and benefits associated with each project. Usually, this is a unit price estimate to enable defining the revenue or benefit from each residential unit sold or leased as well as space areas in square meters sold or leased. The estimated revenues or benefits are one of the criteria for which the project investment is selected.

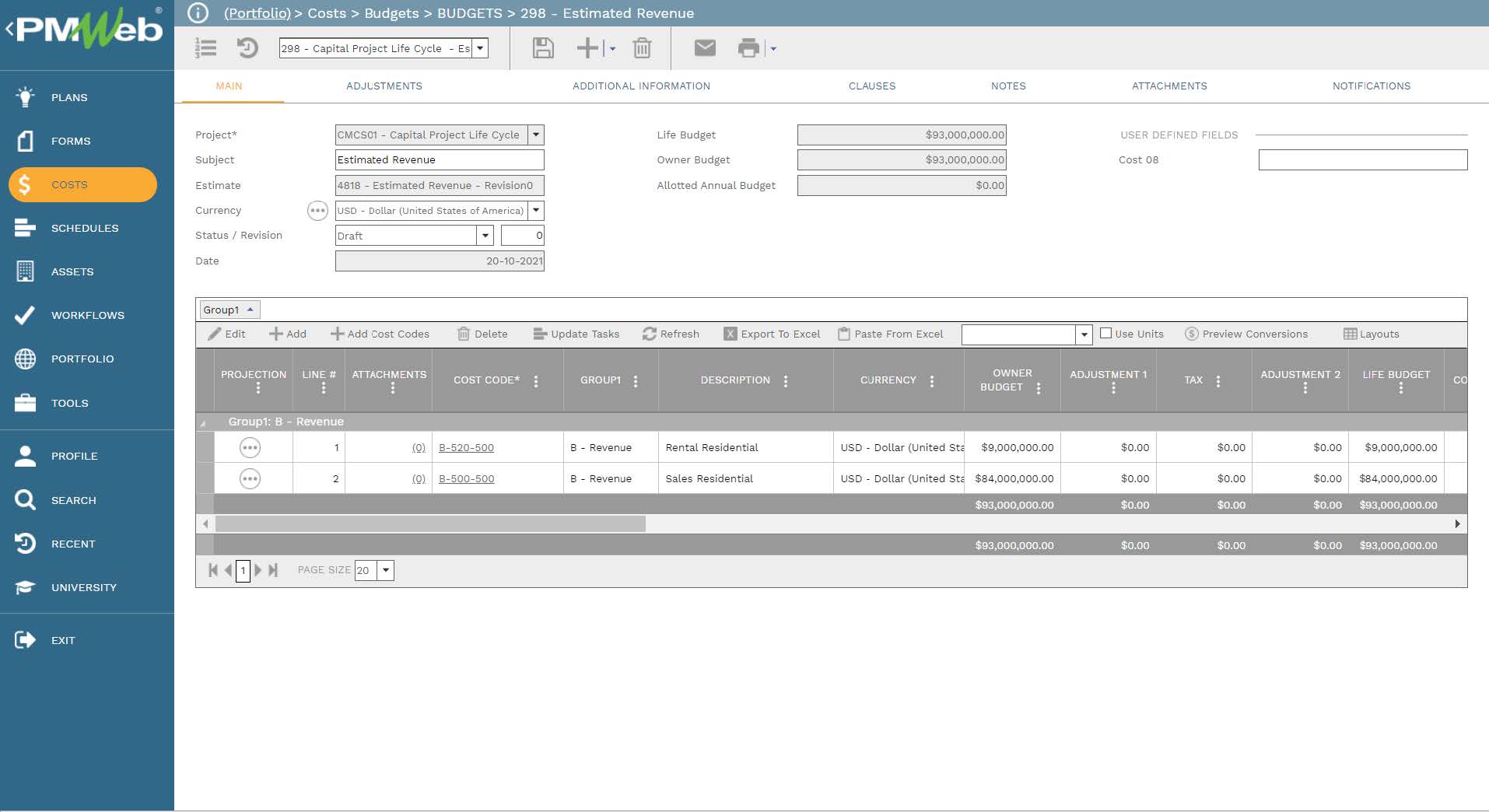

The approved estimate for revenues and benefits becomes the basis for generating the revenue budget. PMWeb budget module allows creating the earning projection for each revenue or benefit item. It should be noted that the revenue budget summarizes the estimate for revenues to the cost breakdown structure (CBS) levels that they are associated with. Therefore, it is very important that the cost breakdown structure (CBS) levels are defined to incorporate the control level that the project owner wants to have.

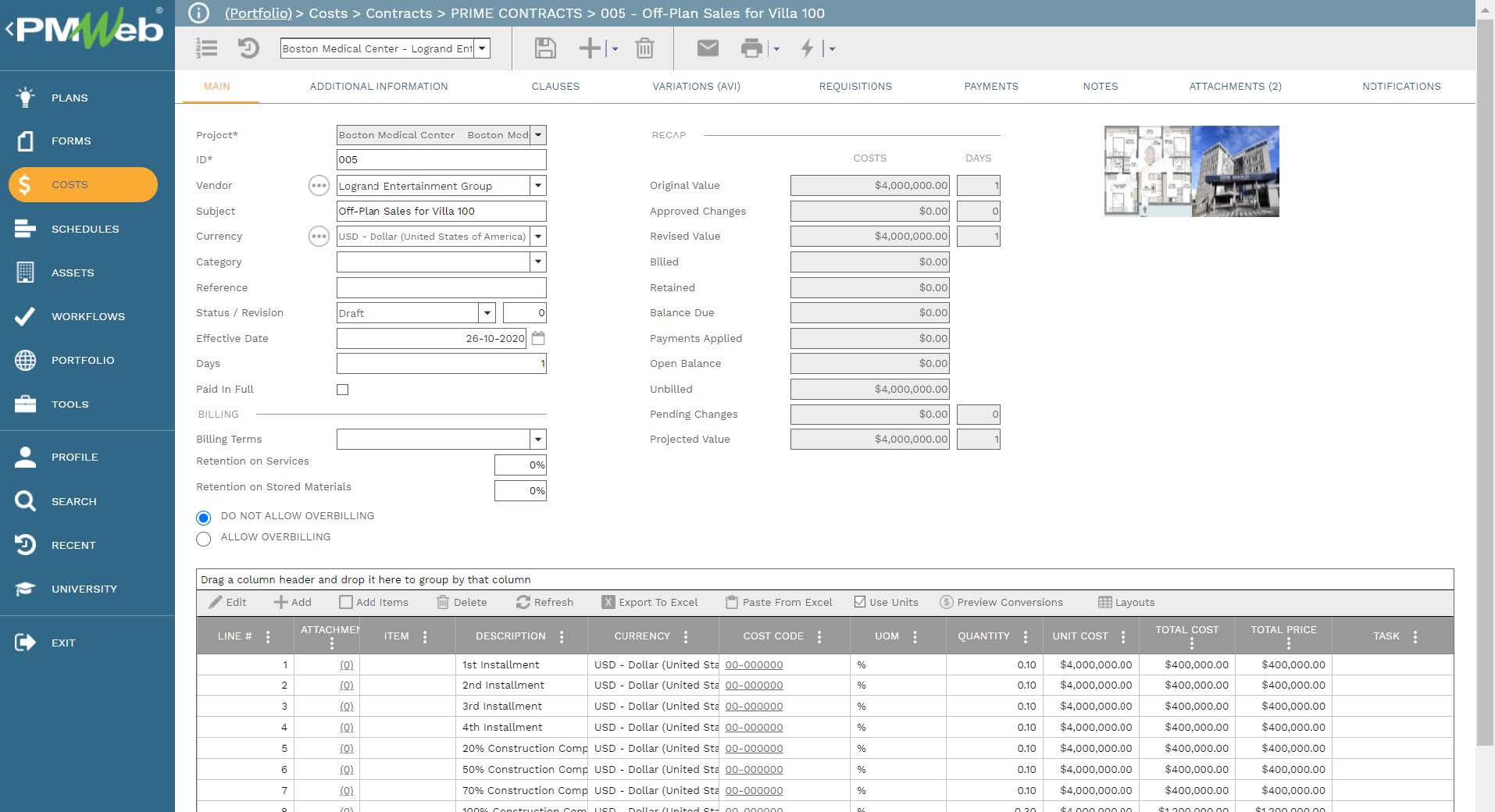

The approved estimate for revenues and benefits also becomes the basis for generating the revenue contracts for sales and short-term and long-term lease agreements. Those agreements which are specific to each buyer or tenant become the basis for managing any changes that might occur to those agreements as well as the issued invoices as per the payment terms and conditions and actual payments received against those invoices.

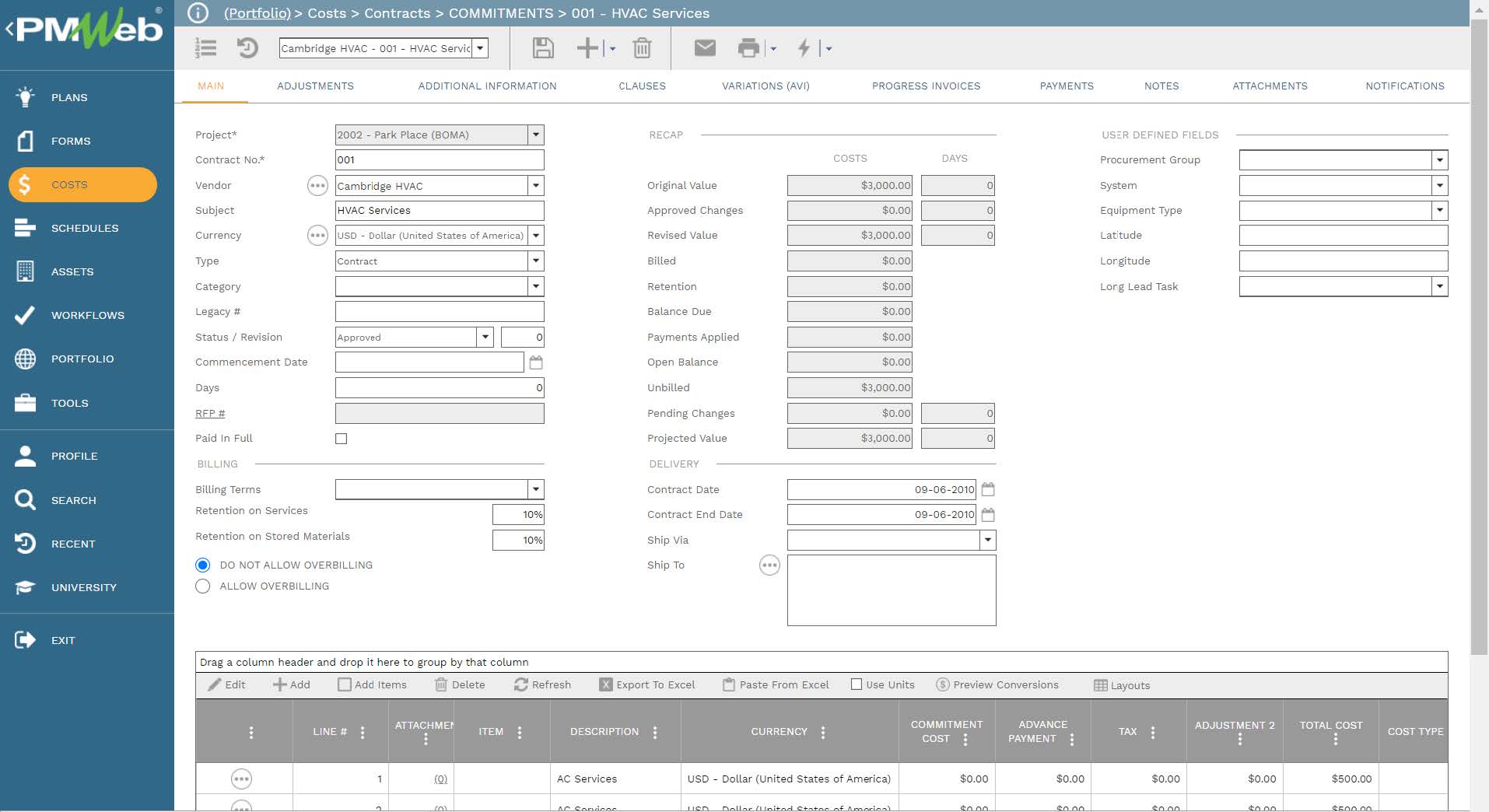

Further, the approved estimate for revenues and benefits helps generate the commitment contracts associated with the maintenance and operations scope of work of the completed assets. In addition, commitment contracts help capture other contracts associated with sales commissions and purchasers’ costs. As a rule, all possible sources of revenues, as well as costs, need to be captured in a contract to enforce the policy of “No Contract, No Pay”.

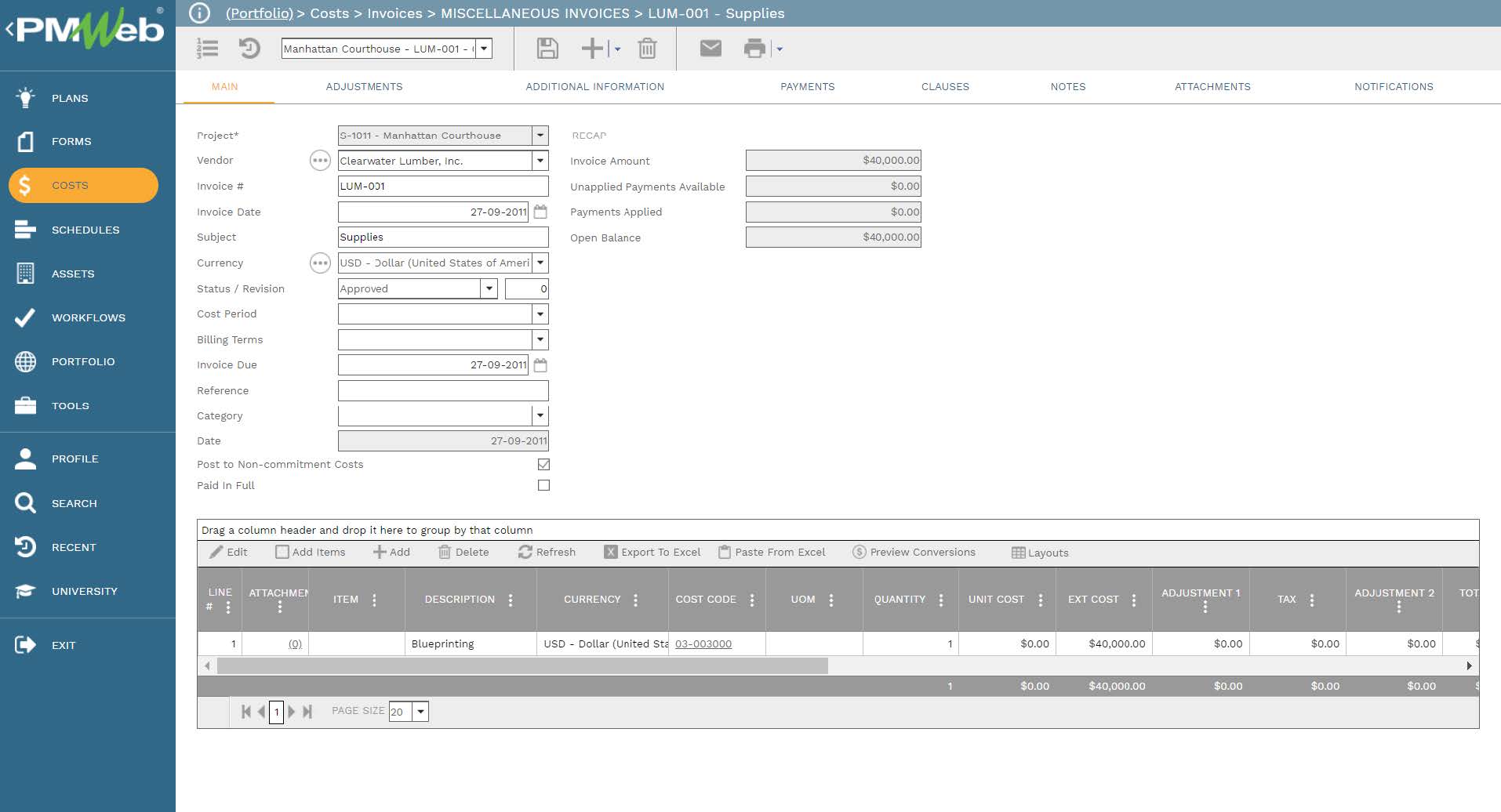

Of course, for any expenses that were not accounted for in any of the commitment contracts, the PMWeb miscellaneous invoices module captures those expenses. Those expenses are categorized as non-commitment expenses.

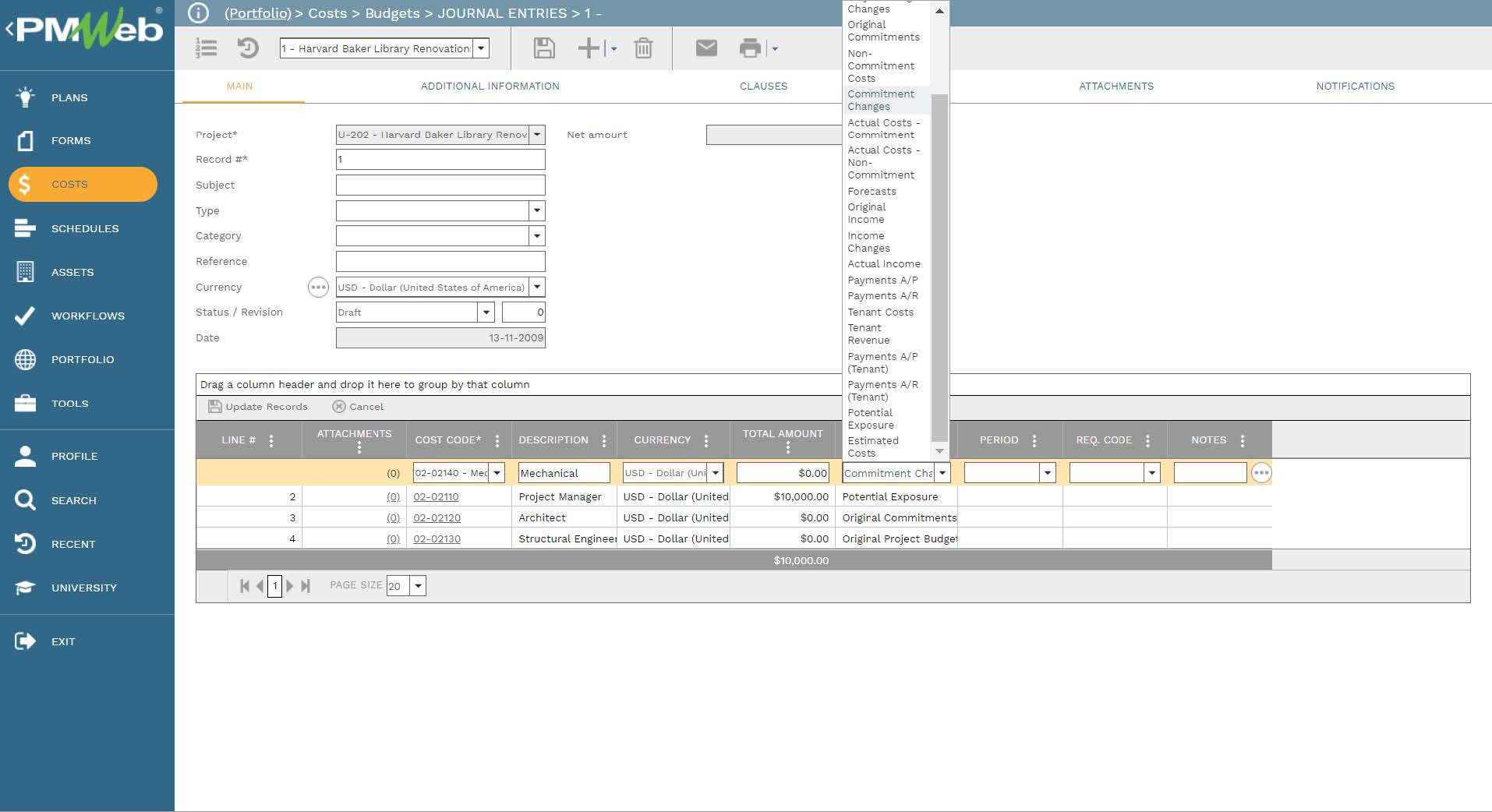

On the other hand, revenues that are part of a revenue contract such as interest earned or received among others, PMWeb journal entries capture those details and post as income or revenue. PMWeb journal entries can also capture expenses that were not associated with either a commitment contract or miscellaneous invoice. For revenue or expense entries, PMWeb allows posting those revenues as income, non-commitment cost, tenant revenue, or tenant cost.

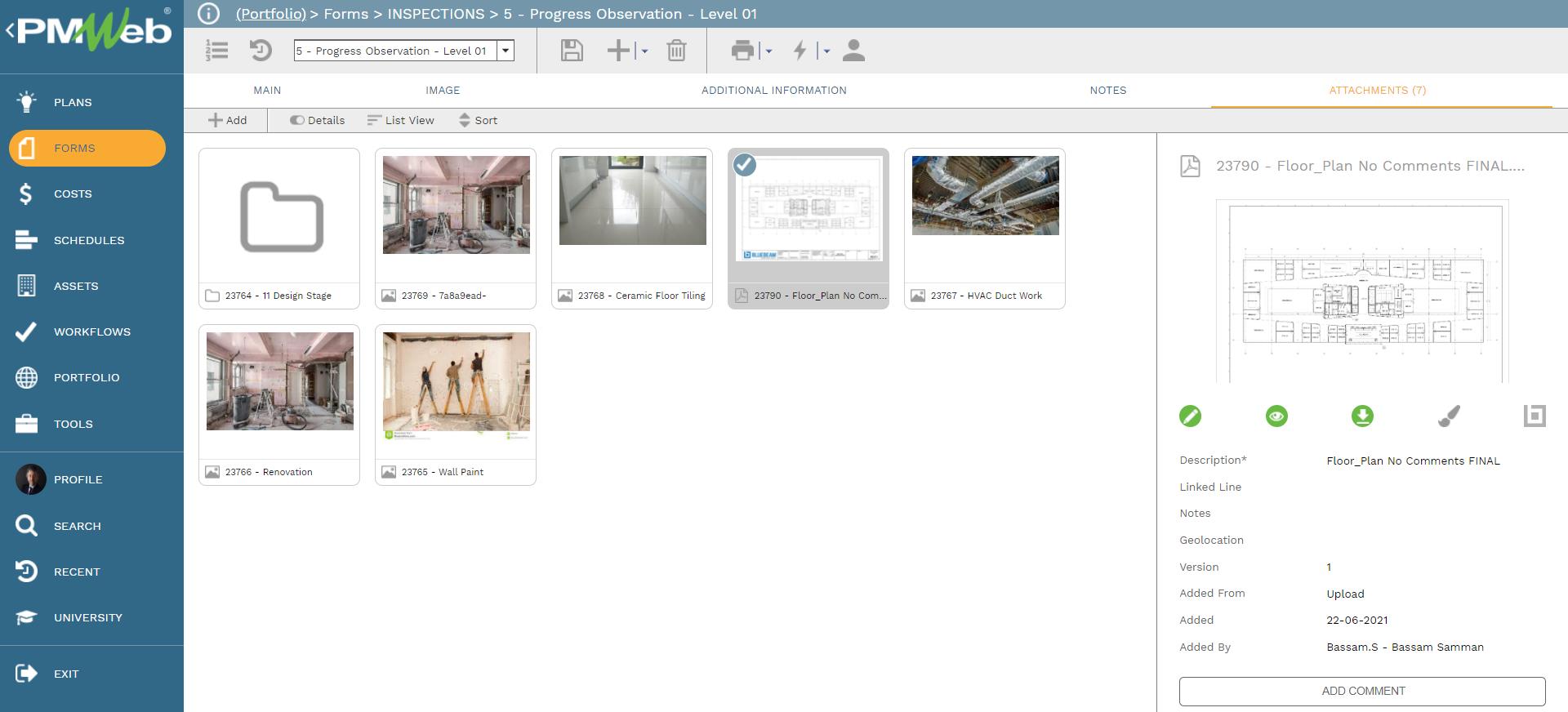

Although the template for each business process should be comprehensive in the extent of the data fields needed to capture the required information, nevertheless, it is also very common that each transaction of each business process could include supportive documents associated with that transaction. PMWeb allows attaching those documents to each transaction of each business process template. It is highly recommended to add details to each attached document to better explain to the reader what is being attached and viewed. In addition, links to other relevant transactions or records of other business processes managed in PMWeb can also be added

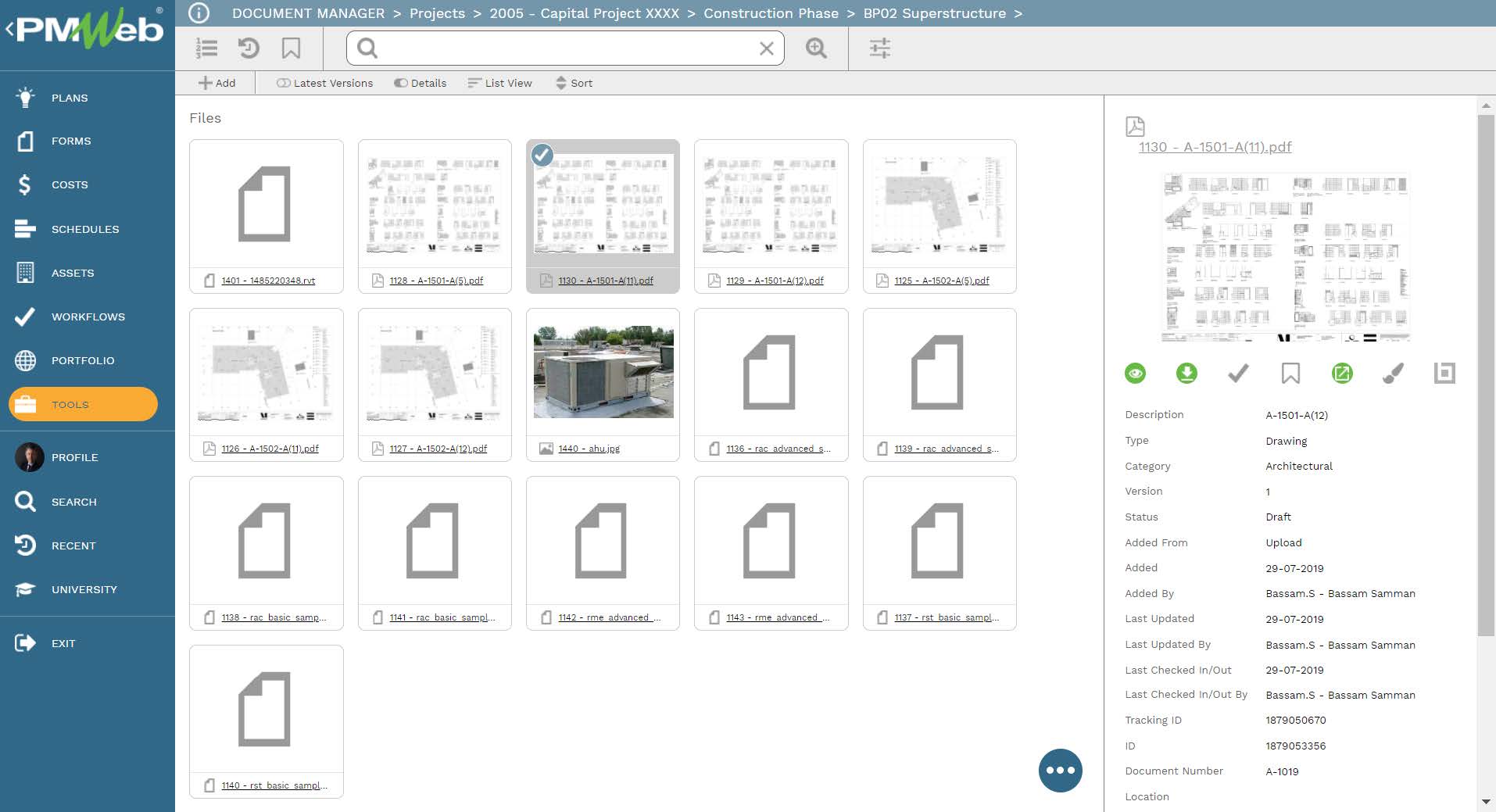

It is highly recommended that all those supportive documents, regardless of their type or source, get uploaded and stored on the PMWeb document management repository. PMWeb allows creating folders and subfolders to match the physical filing structure used to store hard copies of those documents. Permission rights can be set to those folders to restrict access to only those users who have access to do so. In addition, PMWeb users can subscribe to each folder so they can be notified when new documents are uploaded or downloaded.

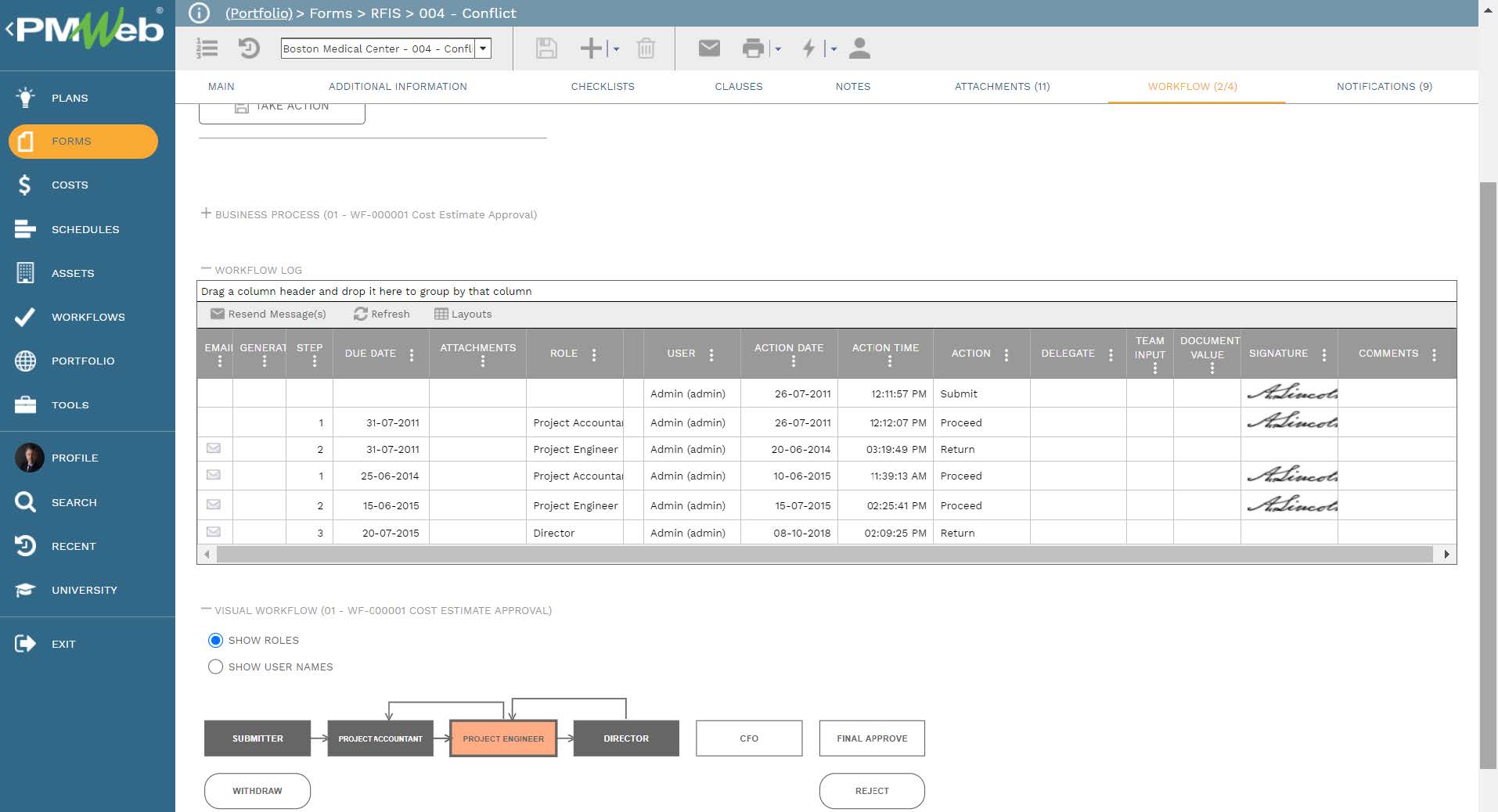

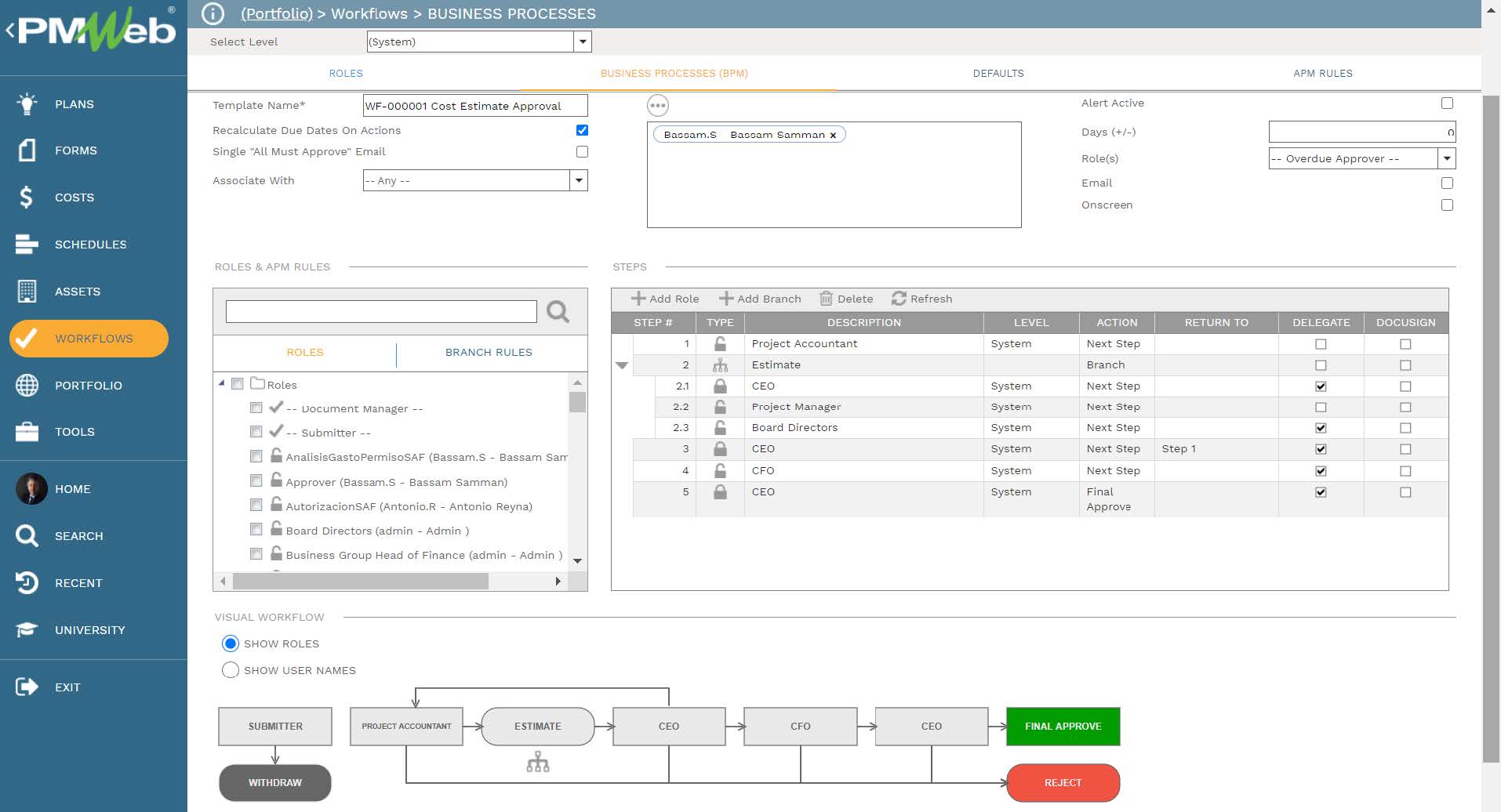

To enforce transparency and accountability in reporting the performance of the different cost management business processes, a workflow needs to be added to the contract, periodical reporting and changes templates to map the submit, review and approve tasks, role or roles assigned to each task, task duration, task type and actions available for the task. In addition, the workflow can be designed to include conditions to enforce the approval authority levels as defined in the Delegation of Authority (DoA) matrix.

When any of the cost management business processes’ transactions are initiated, the workflow tab available on the relevant template captures the planned review and approve workflow tasks for each transaction as well as the actual history of those review and approval tasks. The captured workflow data includes the actual action data and time, done by who, action taken, comments made, and whether team input was requested.