Credit risk is the potential risk that a bank borrower will fail to make payments by agreed terms. Credit risk management practice aims to mitigate losses by maintaining credit risk exposure within acceptable parameters. In most countries, there are regulatory requirements to demand more transparency when it comes to managing credit risks. They wanted to know that a bank has a thorough knowledge of customers and their associated credit risk.

Nevertheless, banks face many challenges in having successful credit risk management, particularly credit provided to construction projects. Those include the inability to access the right project’s schedule and financial performance data, proper risk management practice, and spreadsheet-based reporting that lacks data accountability and real-time status, among many others.

Implementing an integrated, quantitative credit risk management solution is the key to reducing construction project loan losses. Implementing Project Management Information Systems (PMIS) like PMWeb provide banks with an integrated solution to manage credit risk across their projects’ portfolios. PMWeb allows for the collection and capture of data from the different processes needed for credit risk management. In addition, PMWeb’s data visualization capabilities and business intelligence capabilities get important information into the hands of those who need it when they need it.

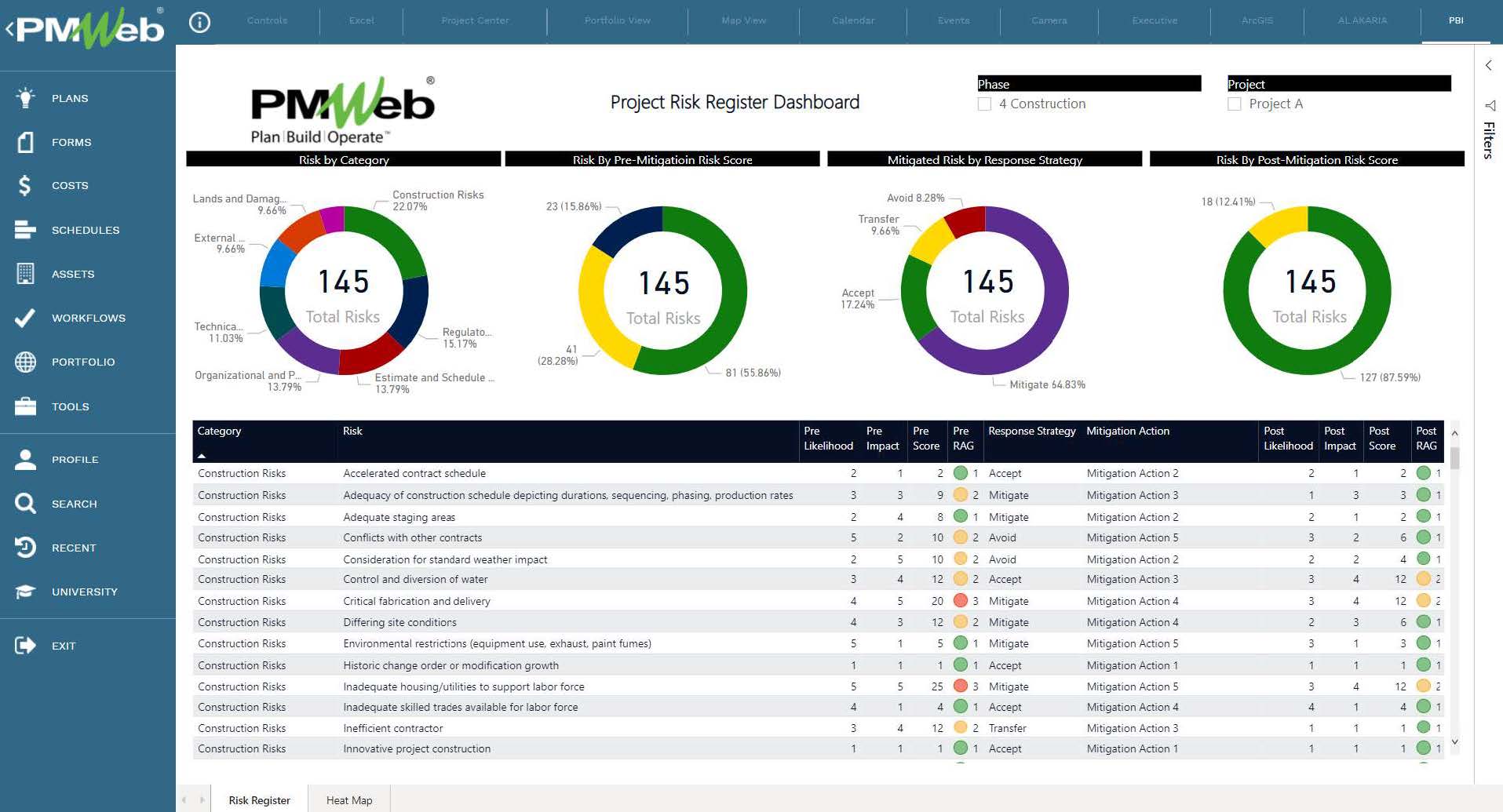

Assessing the Project Risk Exposure

Like any other loan requirement, banks should have a detailed risk register that becomes the basis for assessing the project’s risk exposure. The log should include risks related to the borrower’s organizational capabilities, the project’s technical risks, the borrower’s project management practices, the project owner, and external risks, among others. The PMWeb risk analysis module allows creating a repository of those risks so the credit risk team can assess the likelihood of those risks, which are needed to determine the project’s risk exposure.

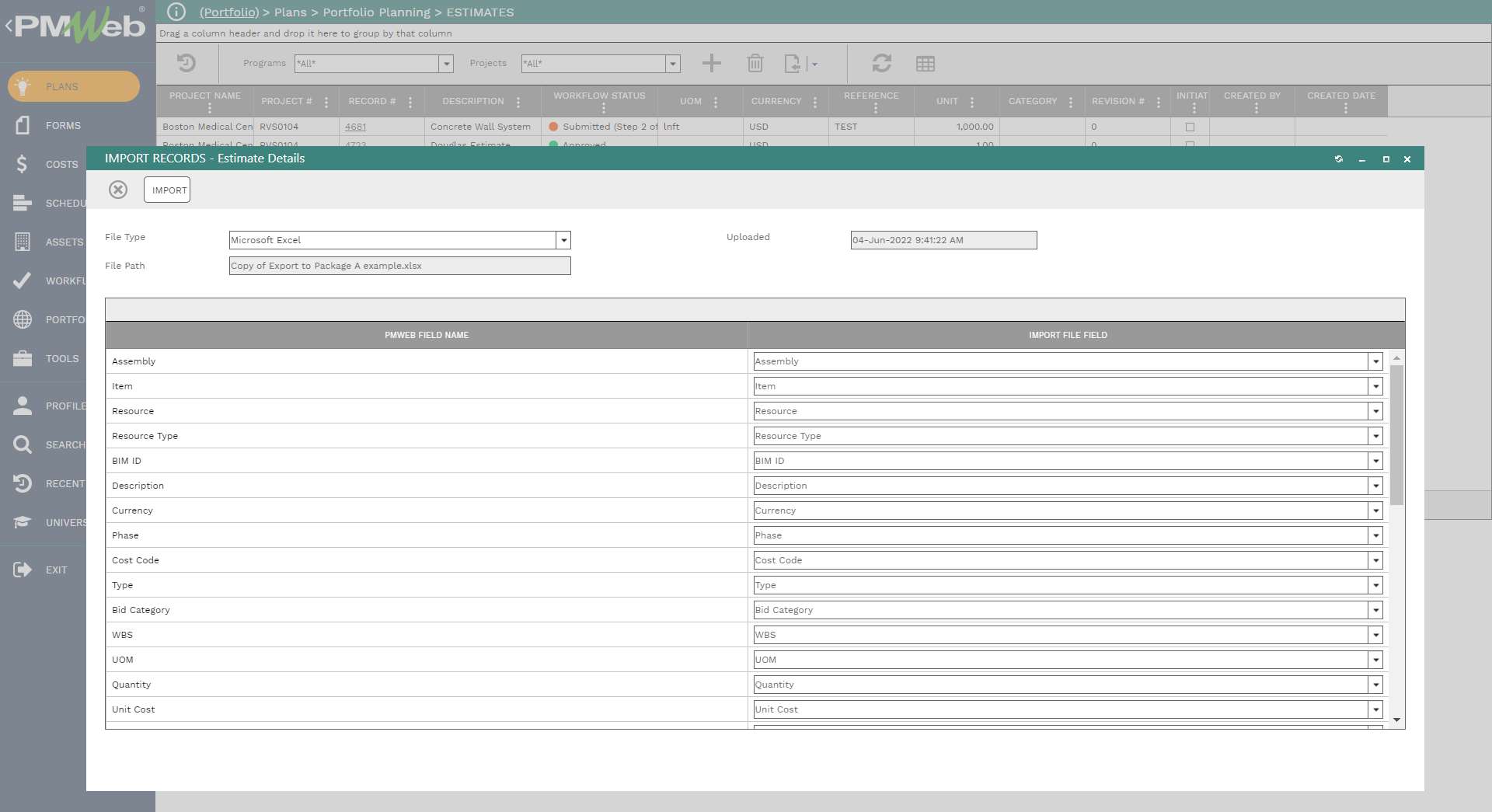

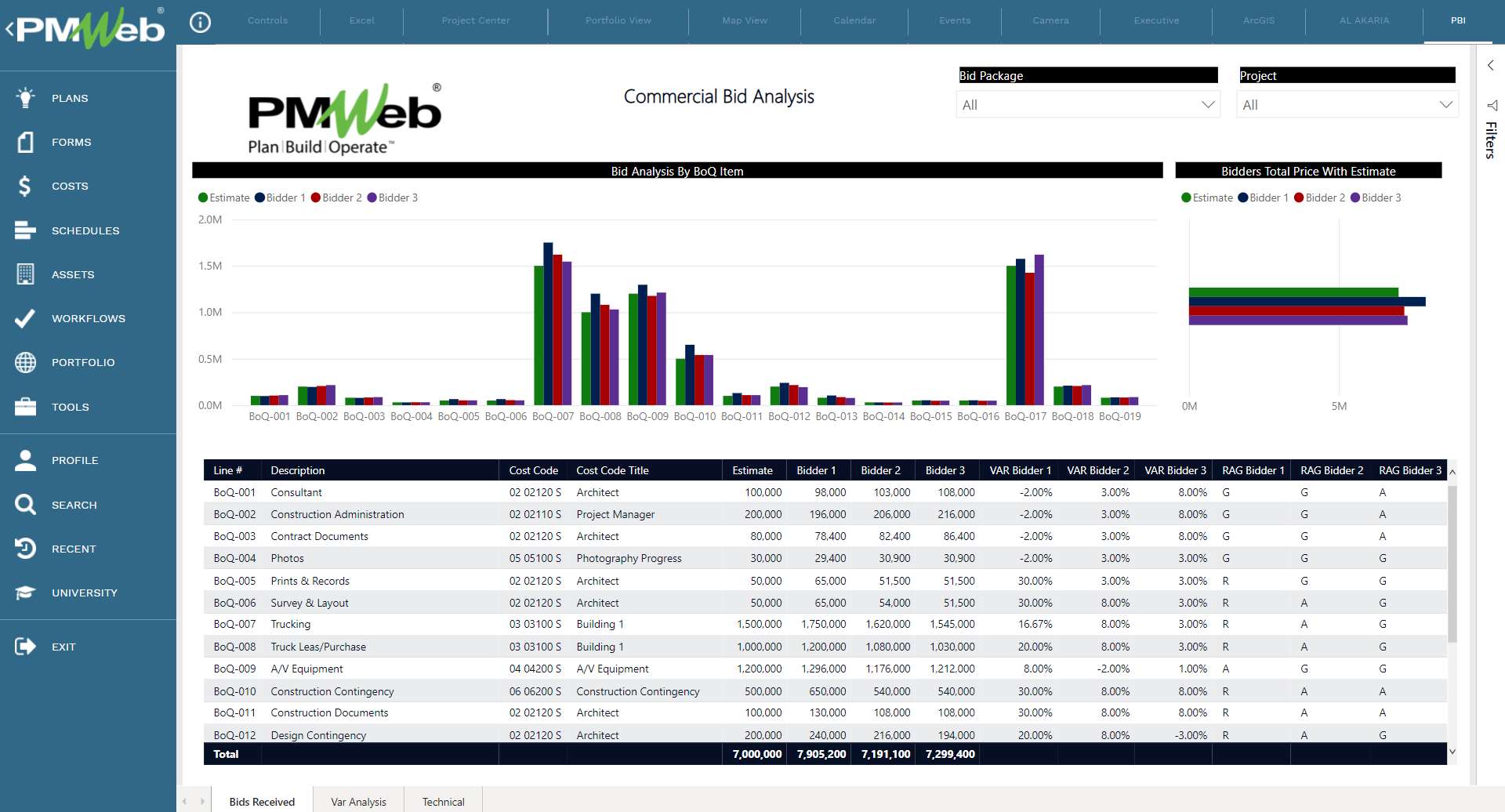

Verifying the Project Cost Estimate

In many countries where unbalanced bids are not prohibited, contractors front load their bill of quantity to ensure early earning of their project’s profit and contingency. For a bank, this could be a dangerous practice to allow, as the revenue earned on the project does not cover the actual cost of the remaining scope of work. Therefore, banks must verify the project cost estimate, usually using the services of a qualified cost management consultant. PMWeb cost estimate module allows importing the cost estimates prepared by the contractor and the cost management consultant to verify the estimate’s correctness.

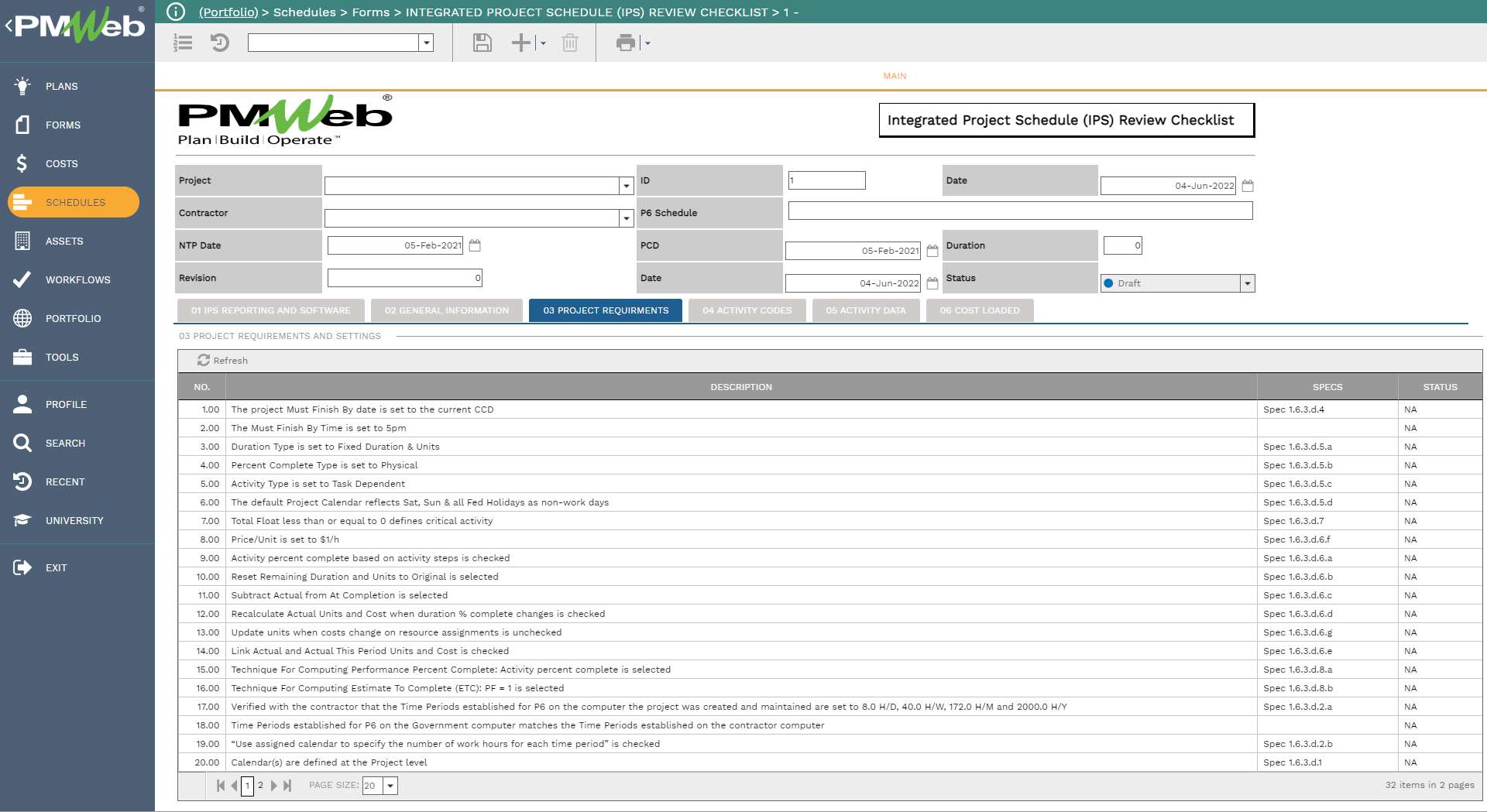

Verifying the Project Schedule

The bank needs to review and analyze the project’s integrated project schedule to ensure that schedule-related risks are incorporated into the plan. The PMWeb custom form builder allows the creation of a schedule review and analysis checklist to provide a consistent and complete analysis of the project schedule.

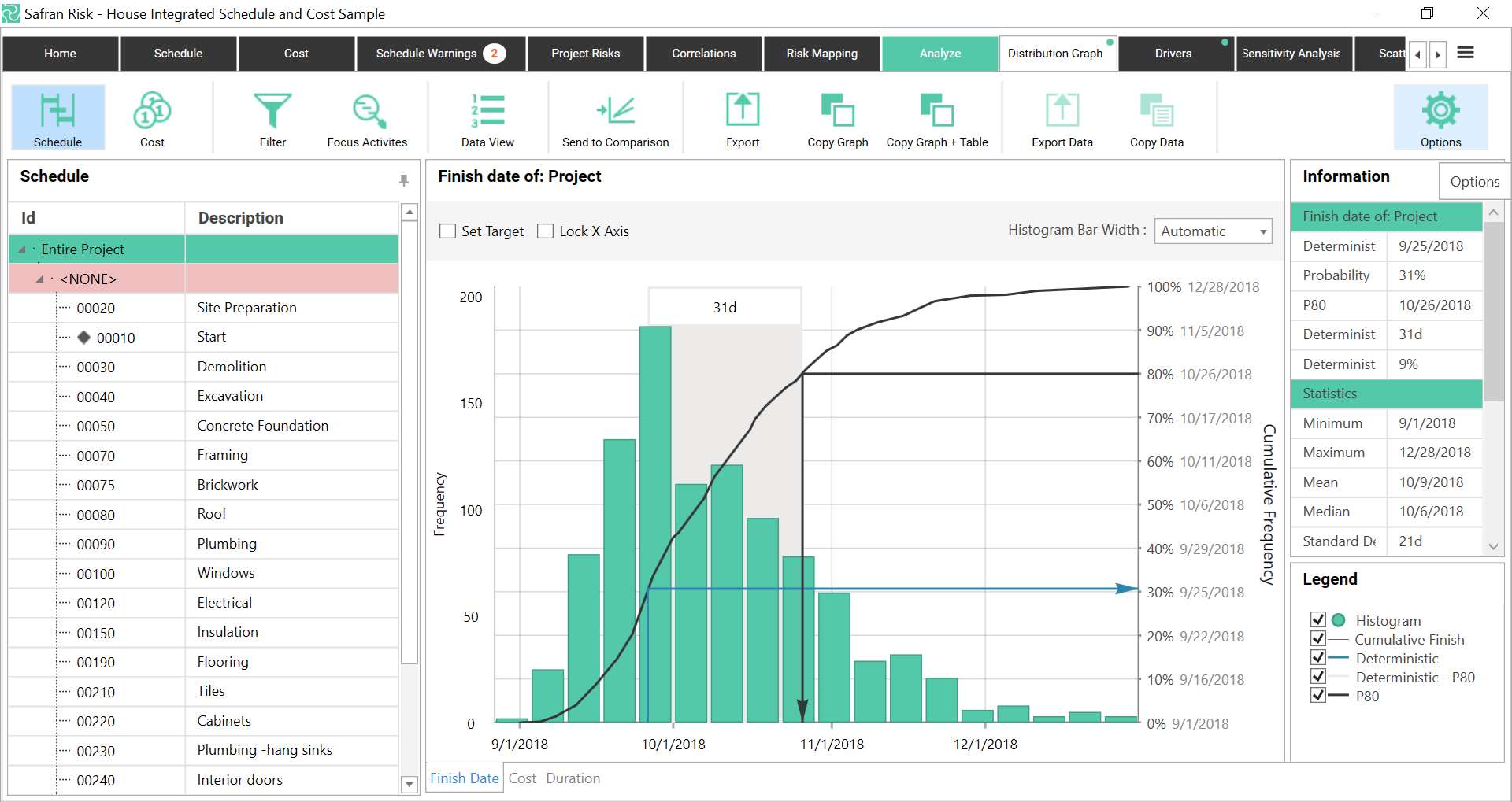

Applications like Acumen Risk or Primavera Risk Analysis can be used to run the Monte Carlo simulation. In addition, Monte Carlo simulation can be used to run a stress test on the project’s schedule to identify the likelihood of meeting the project’s completion date. The Monte Carlo simulation also determines the high-sensitivity activities that control the project’s critical path, for which they need to be subject to further analysis and review.

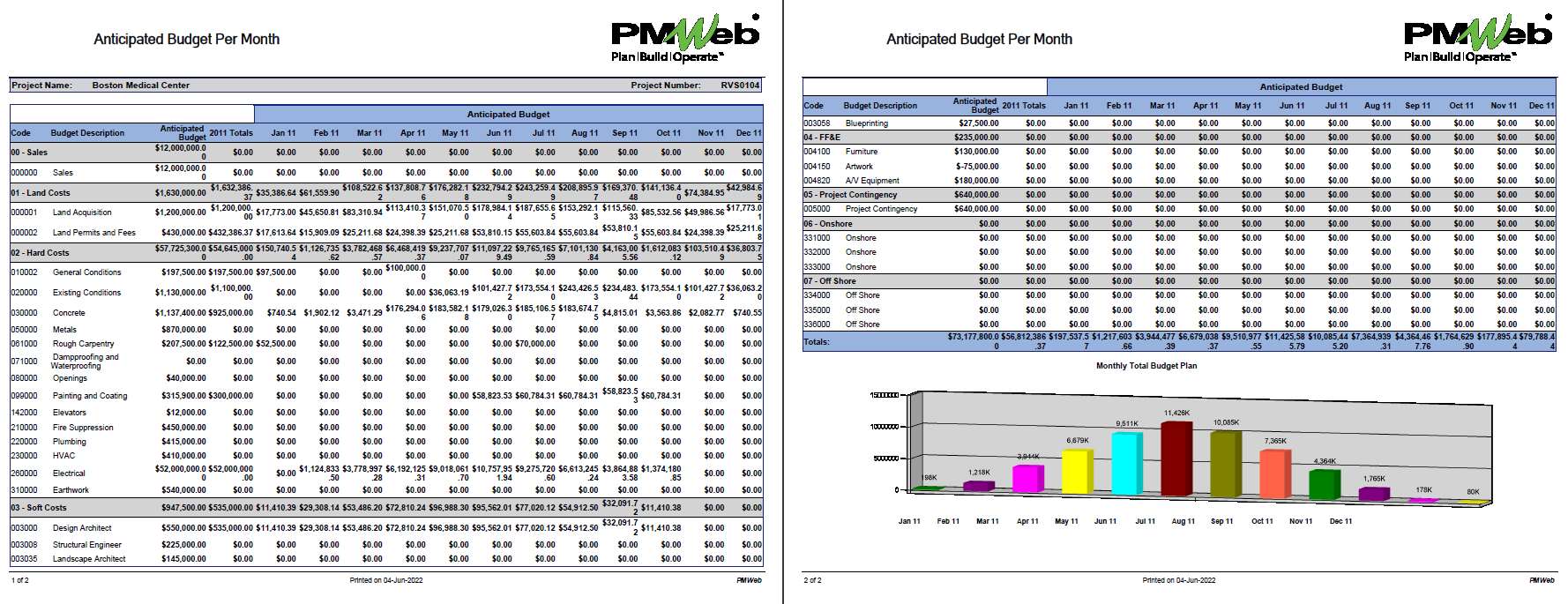

Establishing the Project Budget

The approved project cost estimate becomes the basis for establishing the project’s budget and the proposed spending plan of this budget. The project budget should be aligned with the approved loan given by the bank. Sometimes, the loan provided by the bank could be used to fund only parts of the total project cost estimate, while the balance could be financed from equities to be provided by the borrower. The PMWeb budget module manages the project budget, which generates from the approved cost estimate, and the budget planned spending projection.

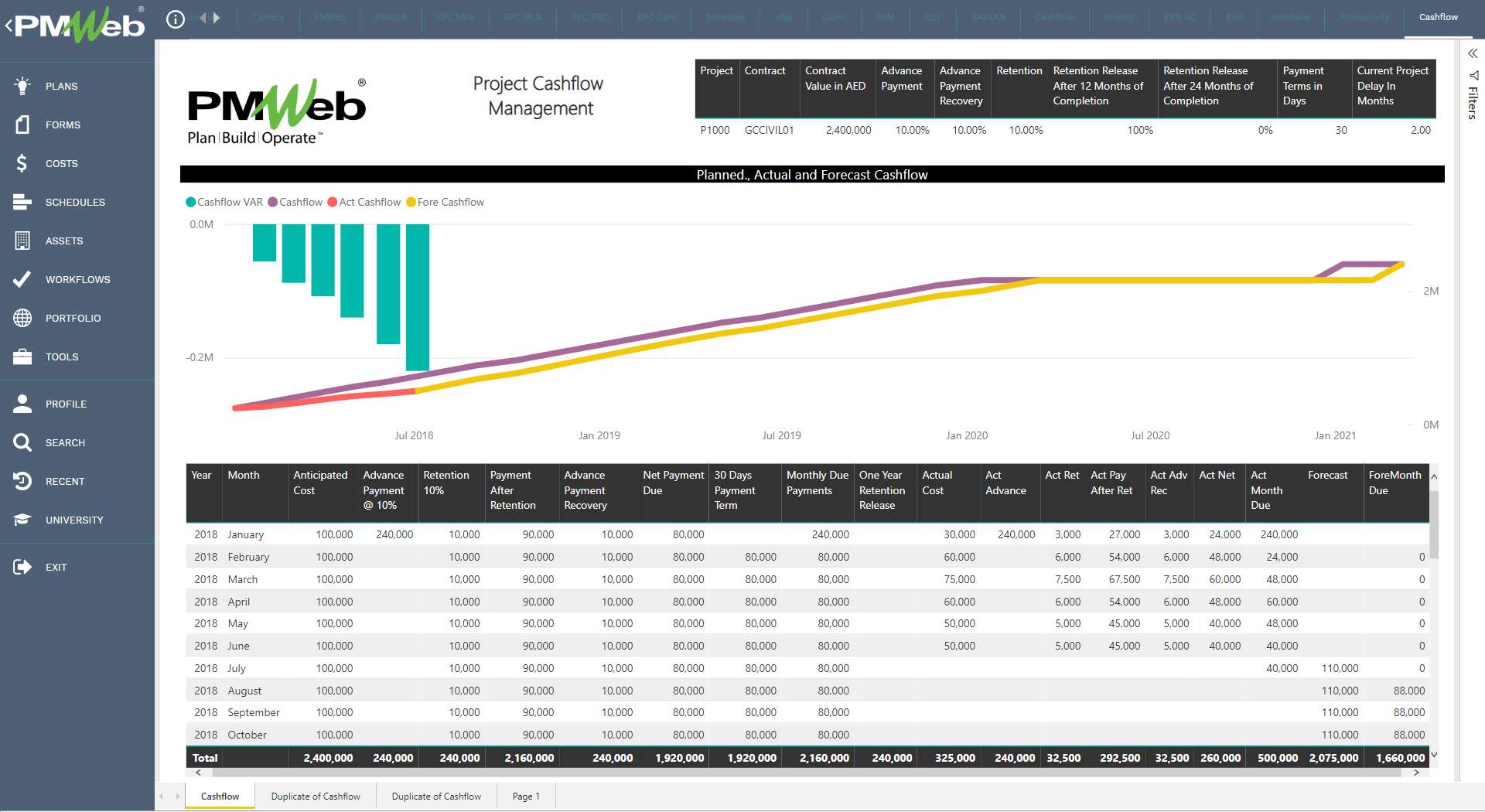

Establishing the Project Cashflow

The contractor must submit the cost-loaded schedule in most construction projects, including the performance credit earning rules. This becomes the basis for generating the cash flow detailing how the contract’s value will be achieved. The cash flow needs to be adjusted for the contract’s terms and conditions, including advance payment, recovery, retention, and 30 or 60-day payment terms. This aligns with the budget-planned spending projection to identify cashflow gaps.

Ensuring Transparency in Subcontract and Purchase Orders Award

Most contractors usually outsource part of their project’s scope of work to qualified subcontractors and suppliers that the project owner must approve. In many projects, the list of those subcontractors and suppliers is part of the contractor’s bid submission. The bank needs to ensure that competitive bids are received from those subcontractors and suppliers and that those bids are aligned with the approved cost estimate. The PMWeb online bid module captures the details of those bids and for which they become readily available for financial and technical assessment.

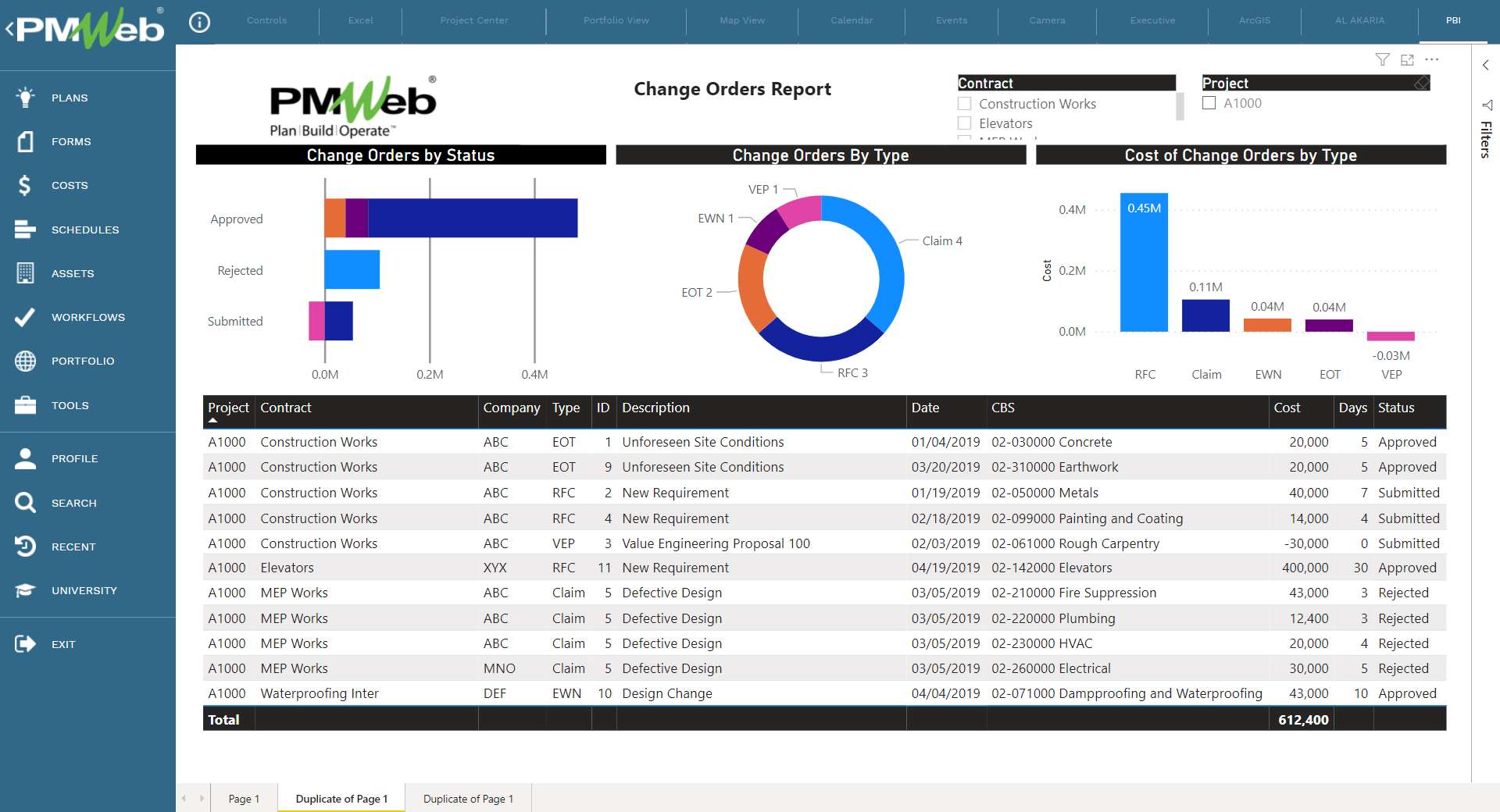

Capturing Changes of Subcontract and Purchase Orders Contracts

The bank must keep track of all potential change orders and changes orders that are related to all awarded subcontract agreements and purchase orders. This requires using two of the PMWeb modules, possible change orders and change order modules. The potential change order module captures the change order phase before it gets formally approved by the contractor. When approved, a formal change order is issued to the subcontractor or supplier using the PMWeb change order module.

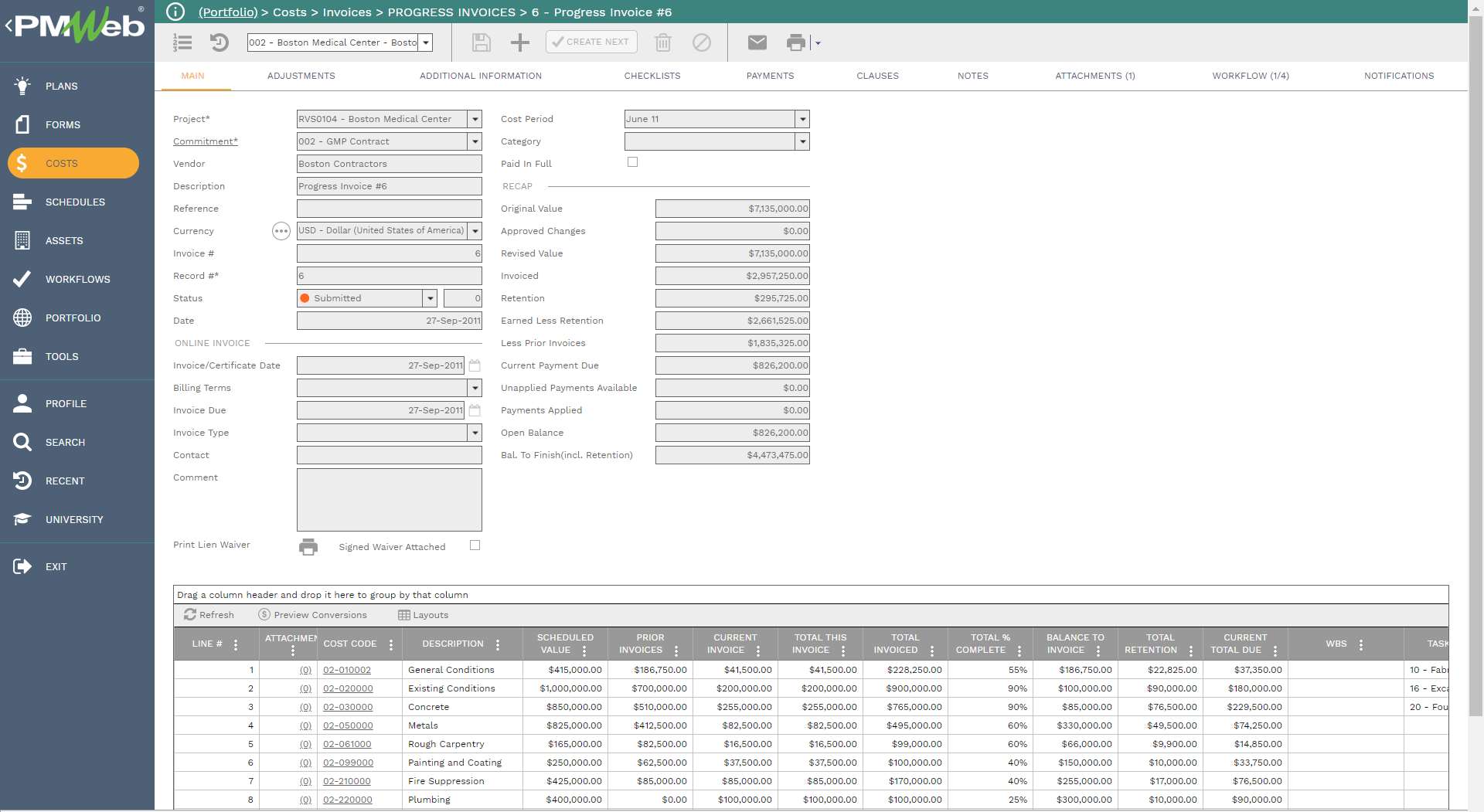

Capturing Actual Cost

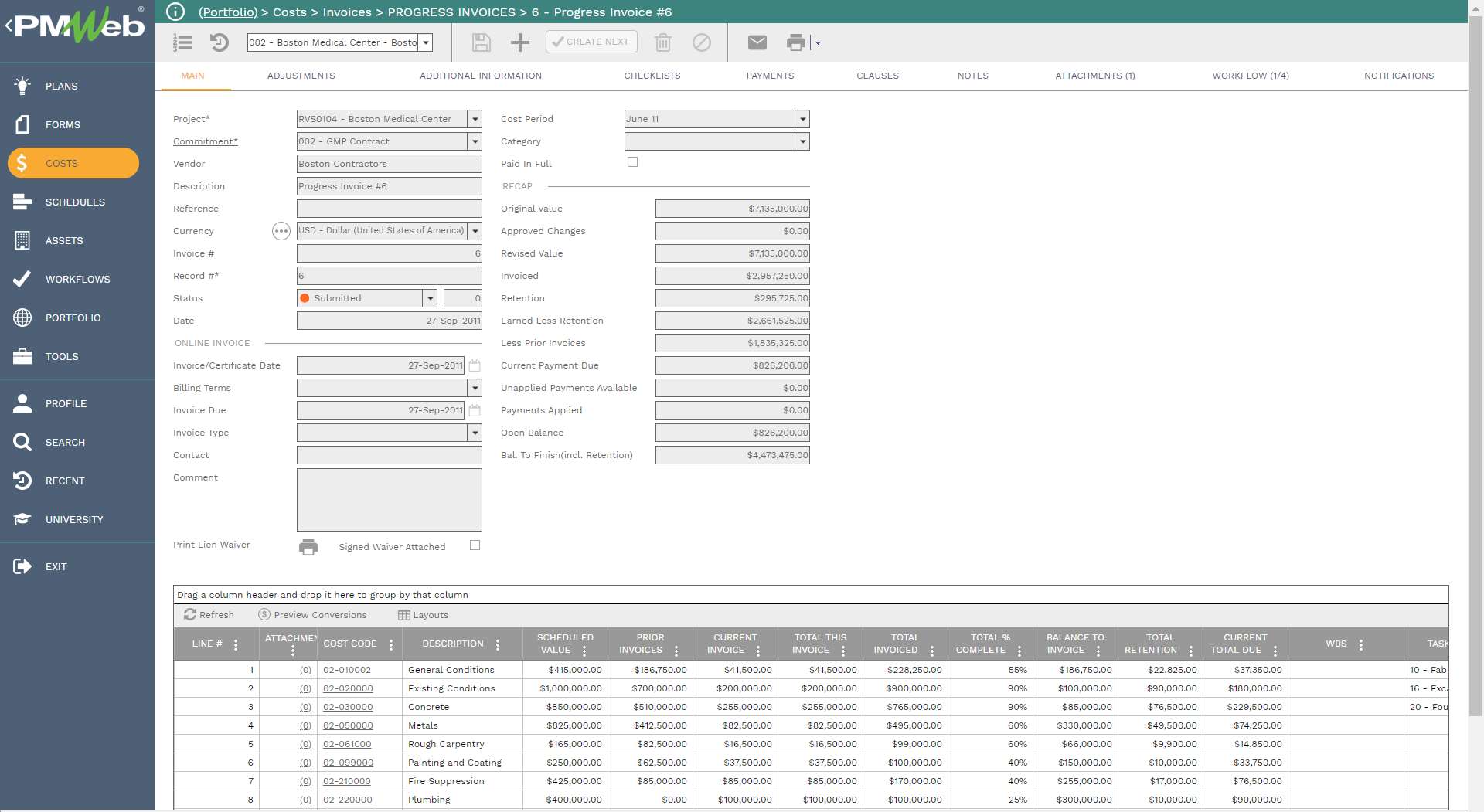

For each subcontract agreement and purchase order, progress invoices must be submitted to be reviewed and approved before payment. The PMWeb commitment progress invoice module will be used to capture those invoices. Suppose the progress invoice due for a period is linked to a project schedule activity percent (%) complete value. This activity can be connected to the invoice line item to get this value from the updated project schedule. Actual cost also includes the actual payments made against the letter of credit issued by the bank for suppliers on behalf of the contractor.

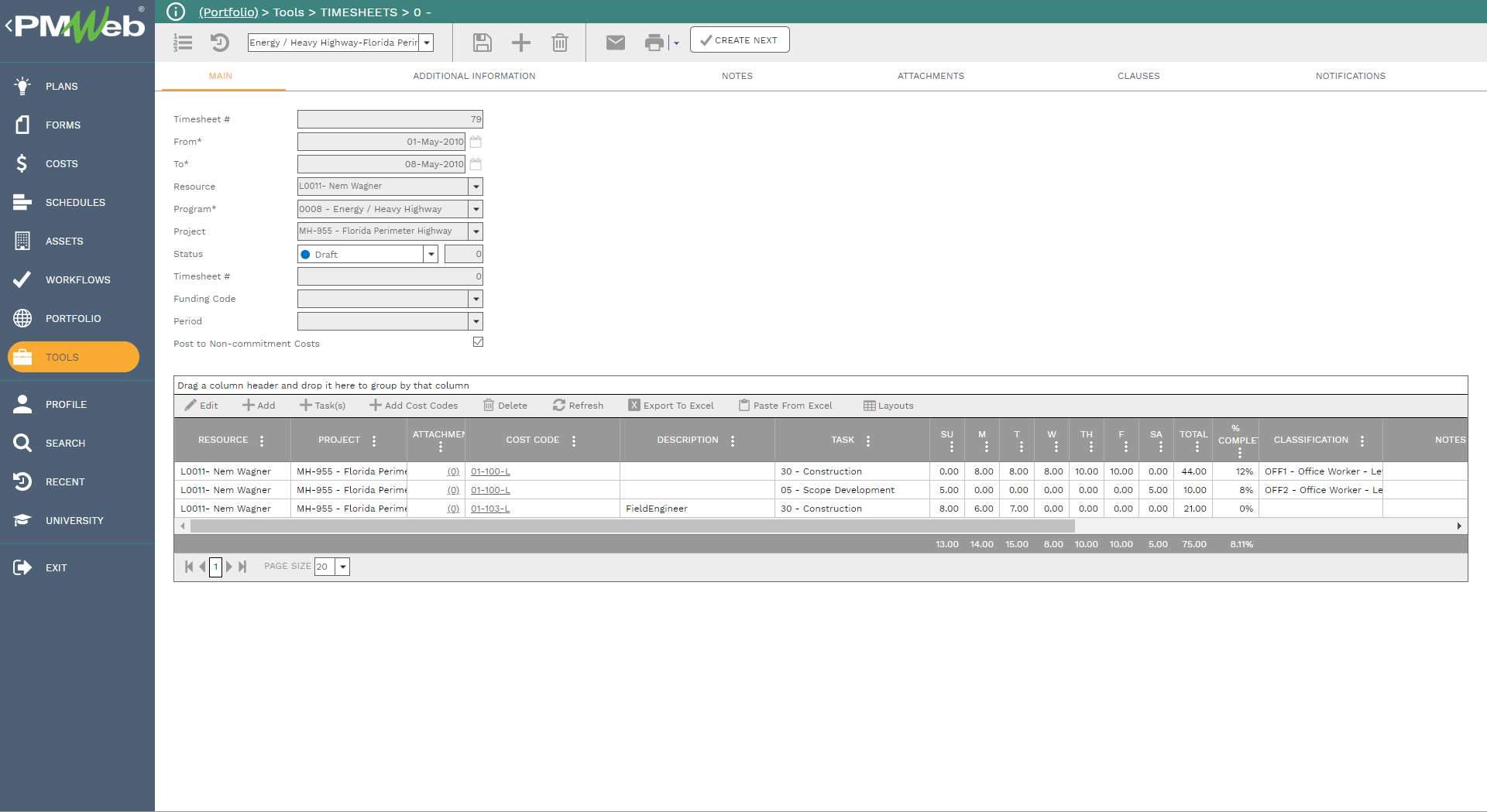

In addition, for invoices not related to subcontracting agreements or purchase orders, the PMWeb miscellaneous invoices module captures those details to be reviewed and approved before payment. For site overhead, the PMWeb timesheet module can capture the details of the construction management resources and plants assigned to the project.

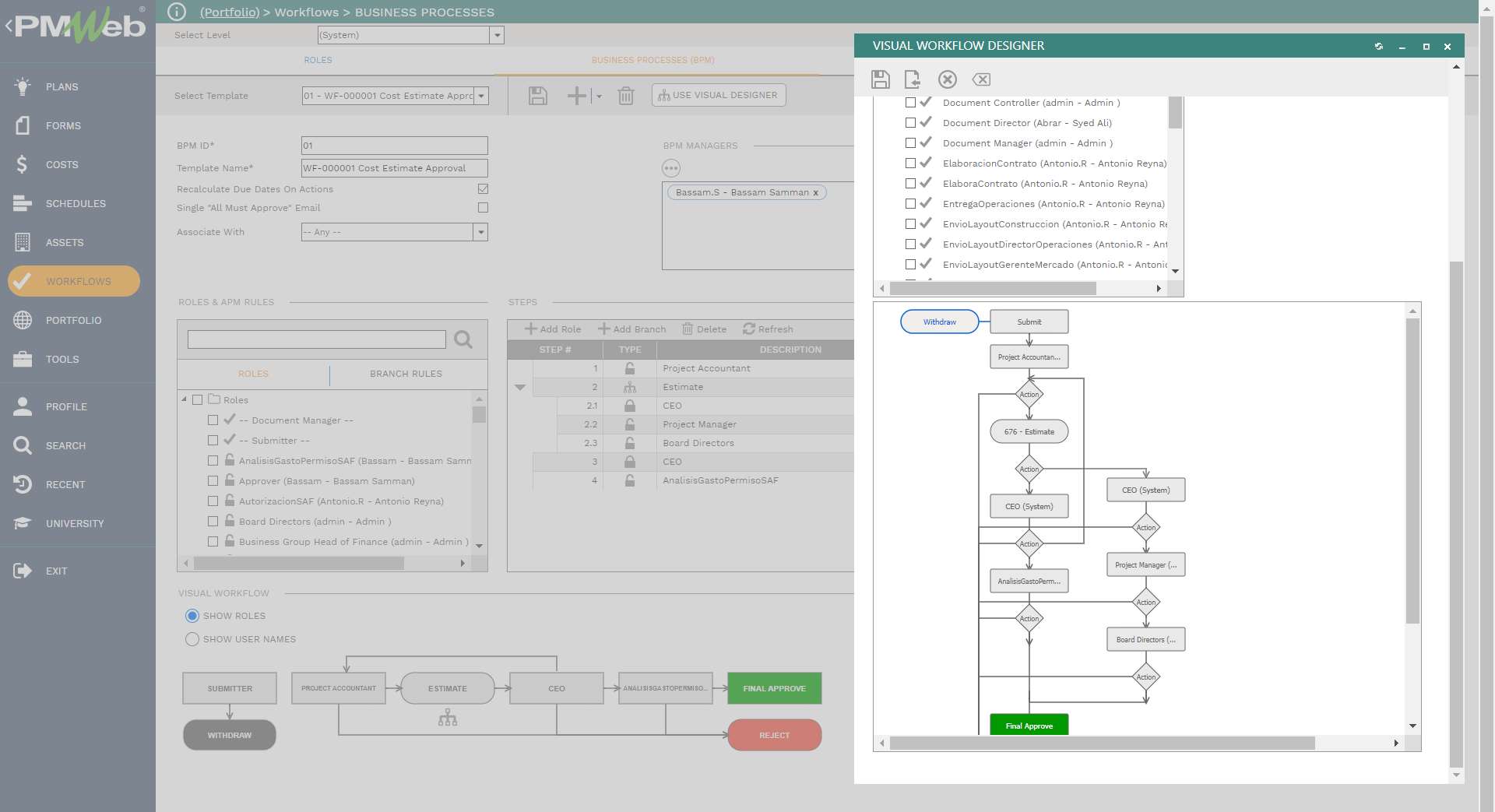

All those PMWeb records related to change orders and actual cost invoices could have a pre-determined workflow to ensure the proper review and approval before they are paid. The workflow could have conditions that could escalate the payment request if it exceeds a certain amount.

Capturing Project Schedule Status

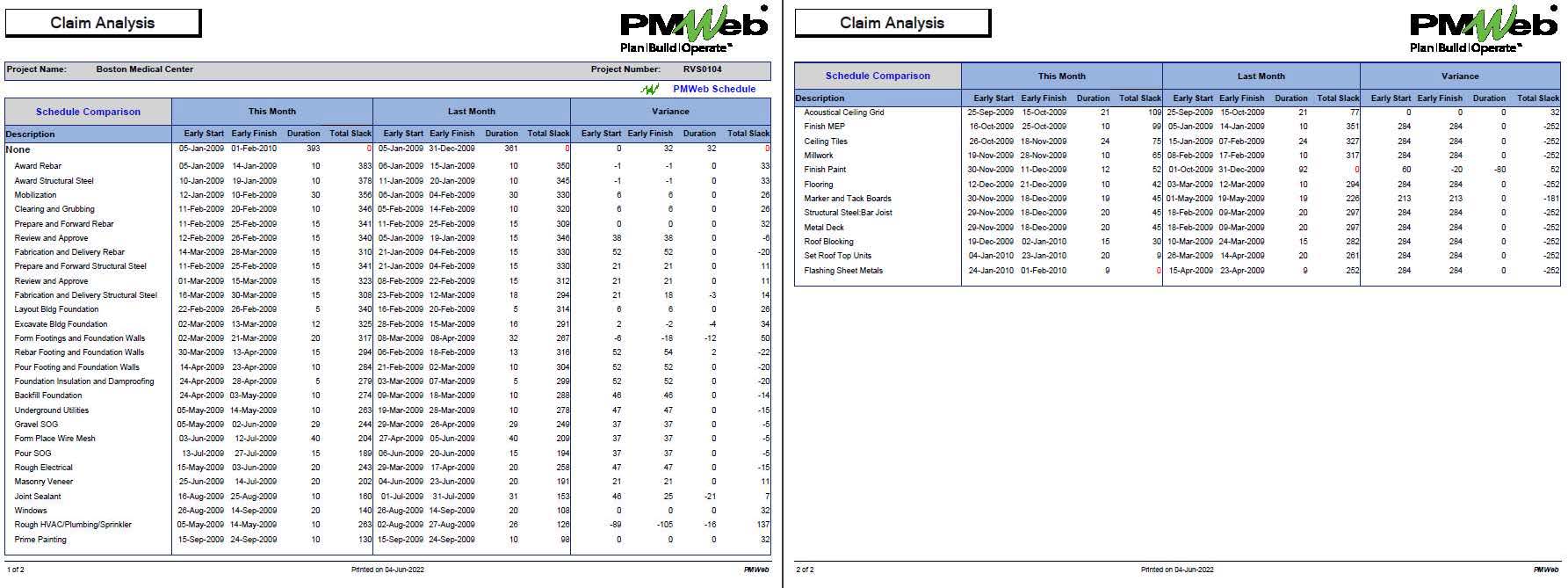

The contractor updates the project’s integrated schedule at the end of each month. The PMWeb schedule module allows importing this schedule to maintain a record of the baseline schedule, revised plans, and updated schedules. This enables the bank to have an immediate comparison between the scheduled versions to identify if there are any variances.

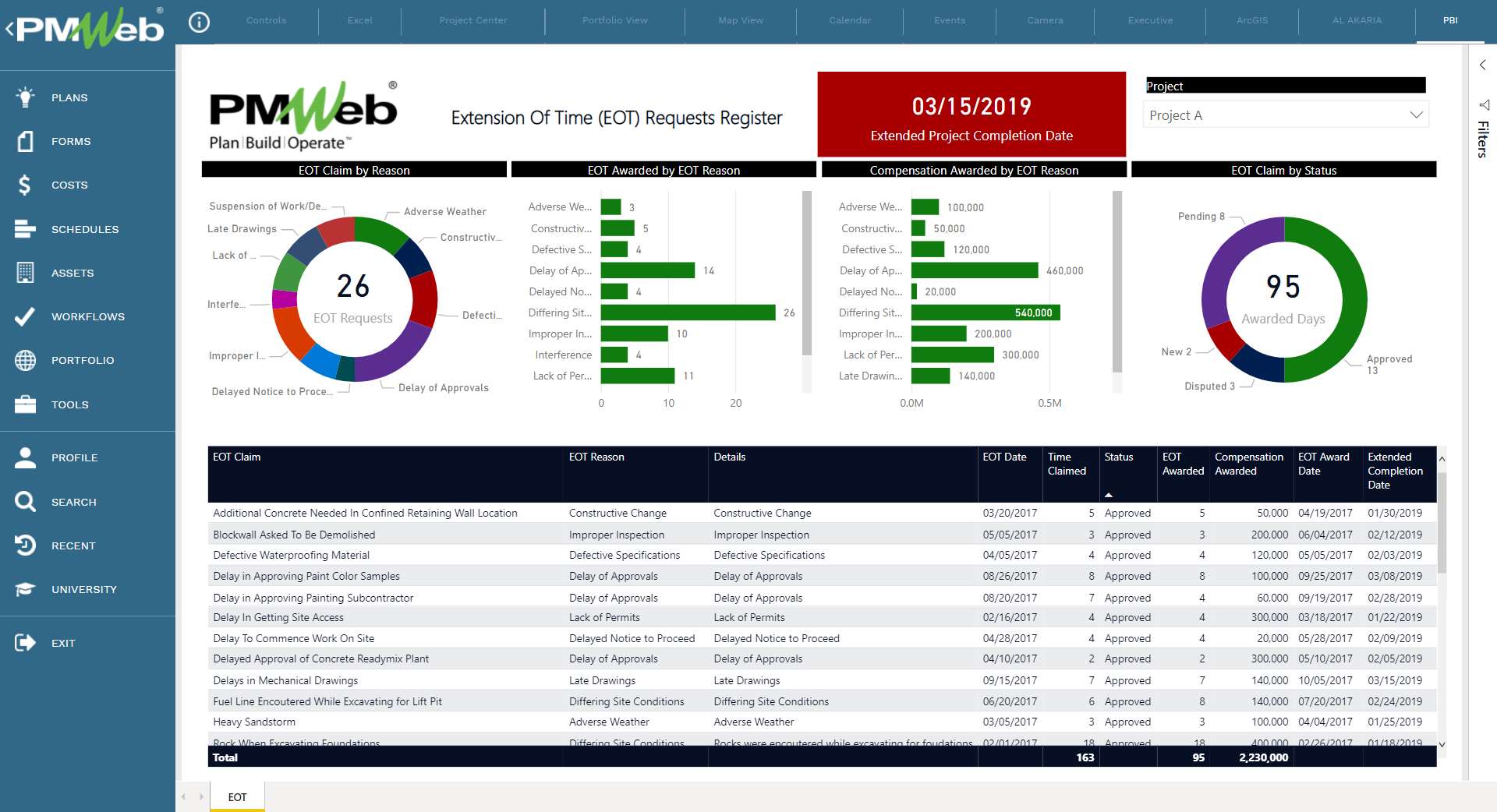

In addition, all extension of time (EOT) requests must be captured and reported. The PMWeb custom form builder captures the details and status of those requests and their impact on the project’s completion date.

Capturing Details of Progress Invoices Made by The Contractor

At the end of each month, the contractor submits the monthly progress invoice for the project owner to approve. This will be the projected revenue that the bank uses to repay the project’s loan. The percent completed for work in place could be either based on a physical assessment of completed works or linked to the project schedule to import the percent complete from the related project schedule activity.

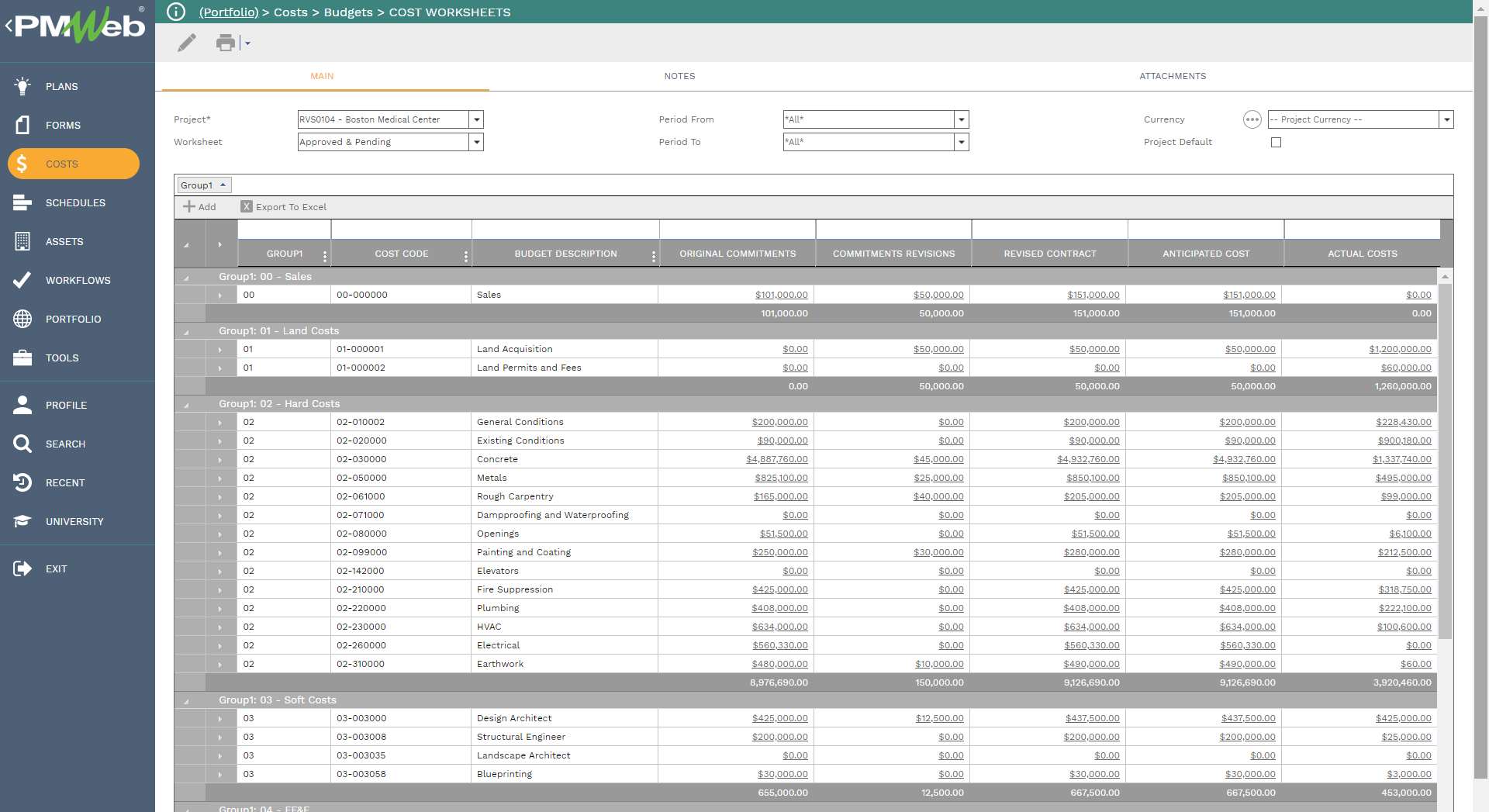

Single Version of the Truth of Project’s Financial Status

The cost data captured in the budget, budget adjustments, commitments, change orders, progress invoices, revenue contracts, change orders, requisition, payments made, and payments received need to be consolidated in a single report to provide a single version of the truth of the project’s financial status. The PMWeb cost worksheet module allows defining different spreadsheets to report the additional cost transactions captured by PMWeb modules and stored in the PMWeb cost ledger.

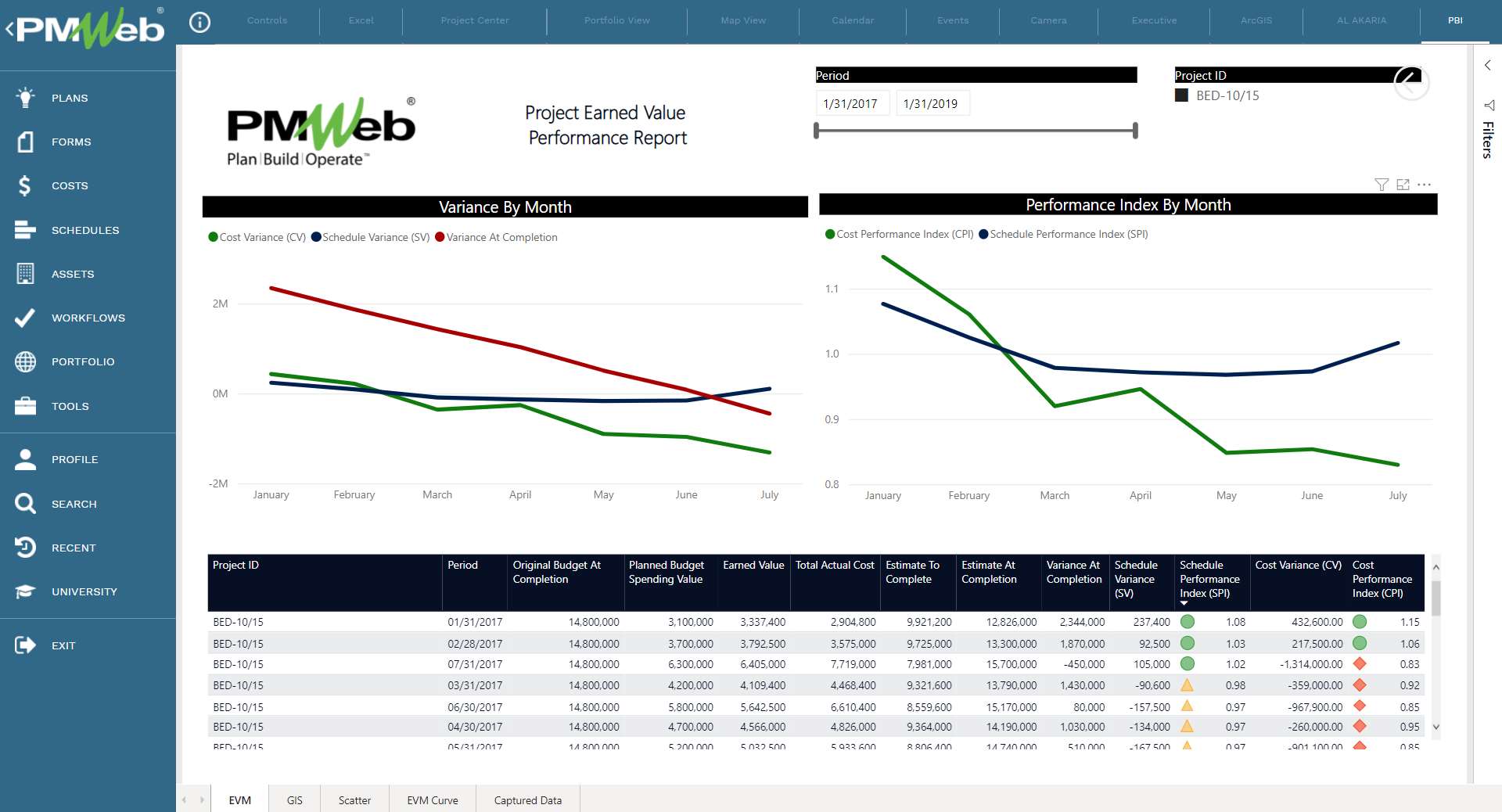

Forecasting the Estimated Cost at Completion

The planned budget spending earned value of actual progress achieved and the actual cost incurred in making this progress provides the input to assess the estimate to complete the balance of the project’s scope of work. Adding the actual cost to this estimate provides the estimated cost at completion, which identifies if there will be a variance at completion when compared to the original budget at completion. PMWeb forecast module uses the earned value to provide those calculations so they can be reported.

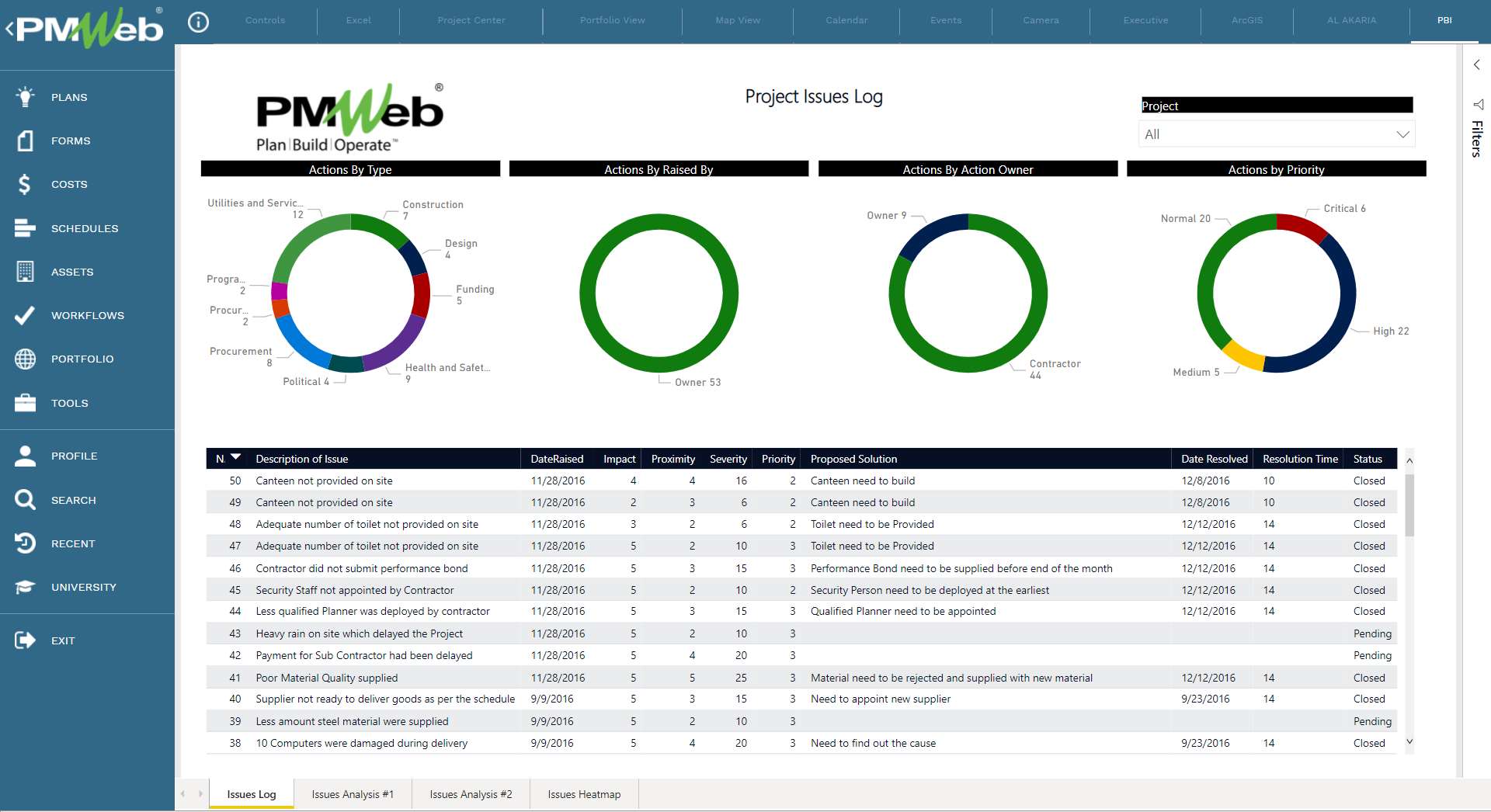

Maintaining the Project Issues Log

The bank’s authorized representative assigned to the project must maintain an updated register of all issues that could impact the project’s performance if they are not resolved within their due auction date. Those could be issues that relate to the relationship between the bank and contractor, contractor and subcontractors, and suppliers, among others. The PMWeb custom form builder allows creating the issue form so they can be tracked and resolved.

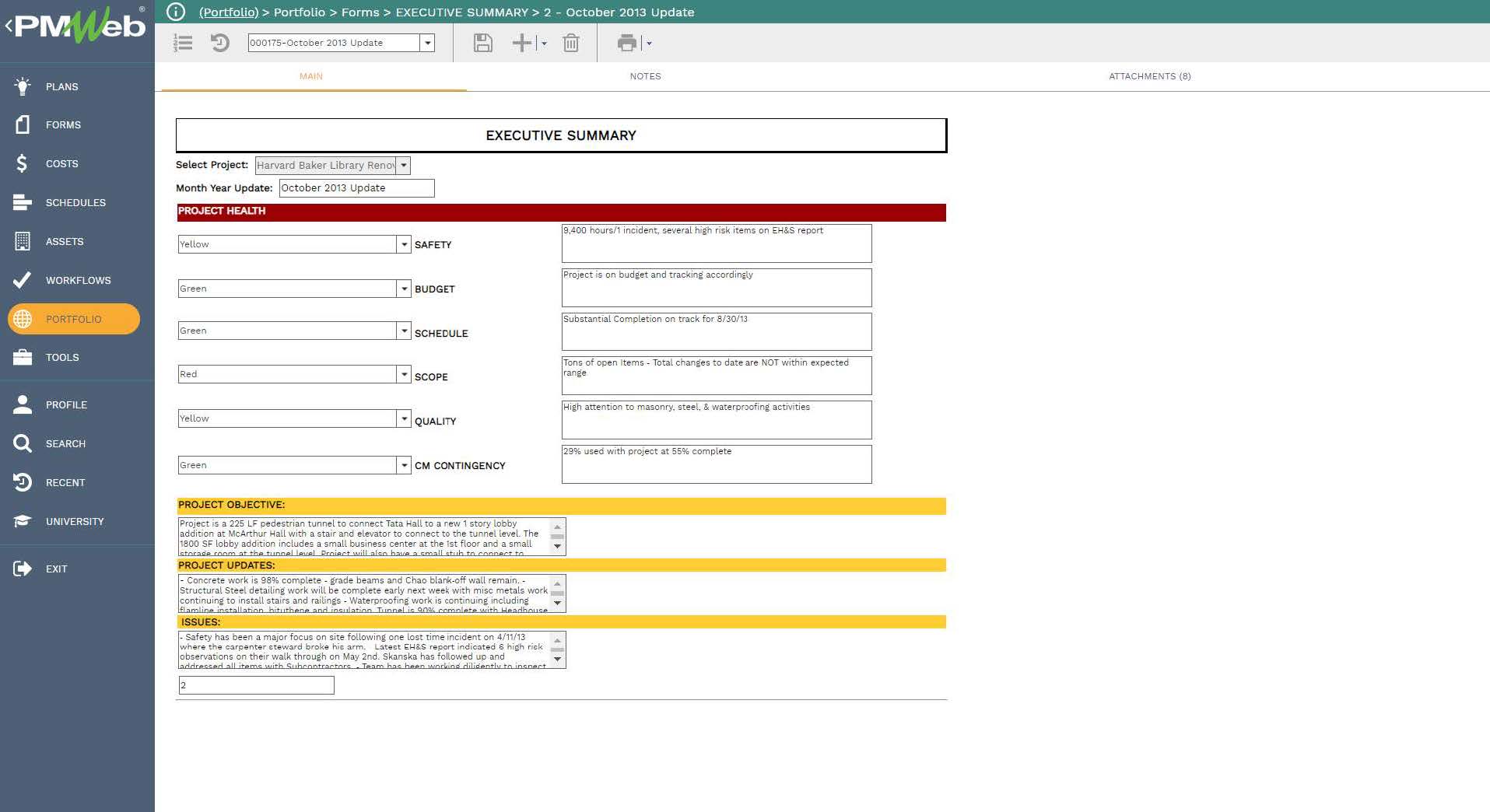

Capturing the Project Progress Narrative

It is vital for the bank’s authorized representative assigned to the project to provide their progress narrative of the current project status. The progress narrative form could include specific sections to evaluate the contractor’s quality, safety, and project management practices. The PMWeb custom form builder also allows creating this progress form, for which the captured content becomes part of the project’s monthly progress report or dashboard.

Maintain All Important Project Documents

All contract documents and revisions to those documents, critical project communications, and project documents for the different credit risk management processes, among others, must be appropriately stored and saved. The PMWeb document management repository allows uploading and storing all project documents and records and attach those documents and records to the related credit risk management process.

Lessons Learned Repository

Since exposure to credit risk continues to be the leading source of problems in banks worldwide, banks should be able to draw valuable lessons from past experiences. The bank’s authorized representative assigned to the project must capture and report on those lessons learned. The PMWeb custom form builder allows creating the lessons learned document template to enable sharing of this knowledge among the bank’s credit risk management team.

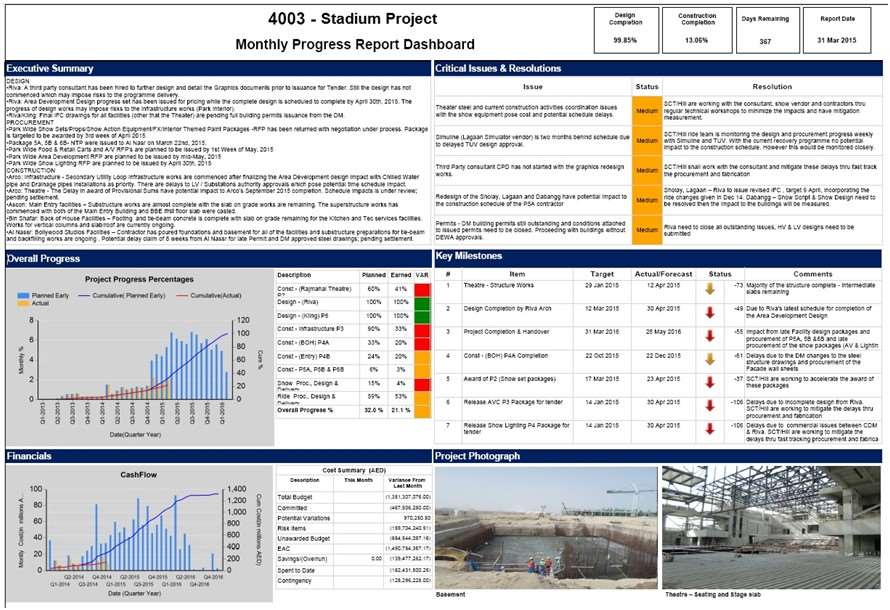

Report, Monitor, and Evaluate Project Performance

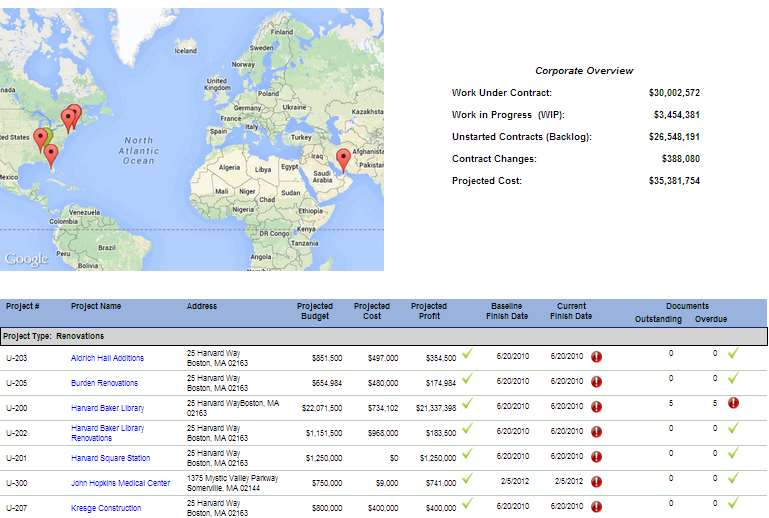

A standard dashboard should be used to report, monitor, and evaluate each project’s performance. The dashboard includes the key performance indicators extracted from the above credit risk management processes. The PMWeb reporting tool allows designing the dashboard in the form and format required by each bank.

Report, Monitor, and Evaluate Projects Portfolio Performance

Having all financed projects on a single repository enables the bank to have a single real-time version of the truth on the credit risk exposure for the complete projects’ portfolio. The PMWeb reporting tool allows designing the projects’ portfolio dashboards in the form and format required by each bank. This dashboard can be filtered to display the information specific to a particular contractor or project owner, projects in trouble, among others.