Regardless of whose perspective the project control system is managed, both the project owner and his team as well as the contractor have the requirement to have a formal process for recording, monitoring, and evaluating the forecast cost to complete the remaining project’s scope of work. The earned value management method is the most widely used technique to analyze, monitor, evaluate and report the project’s forecast to complete analysis.

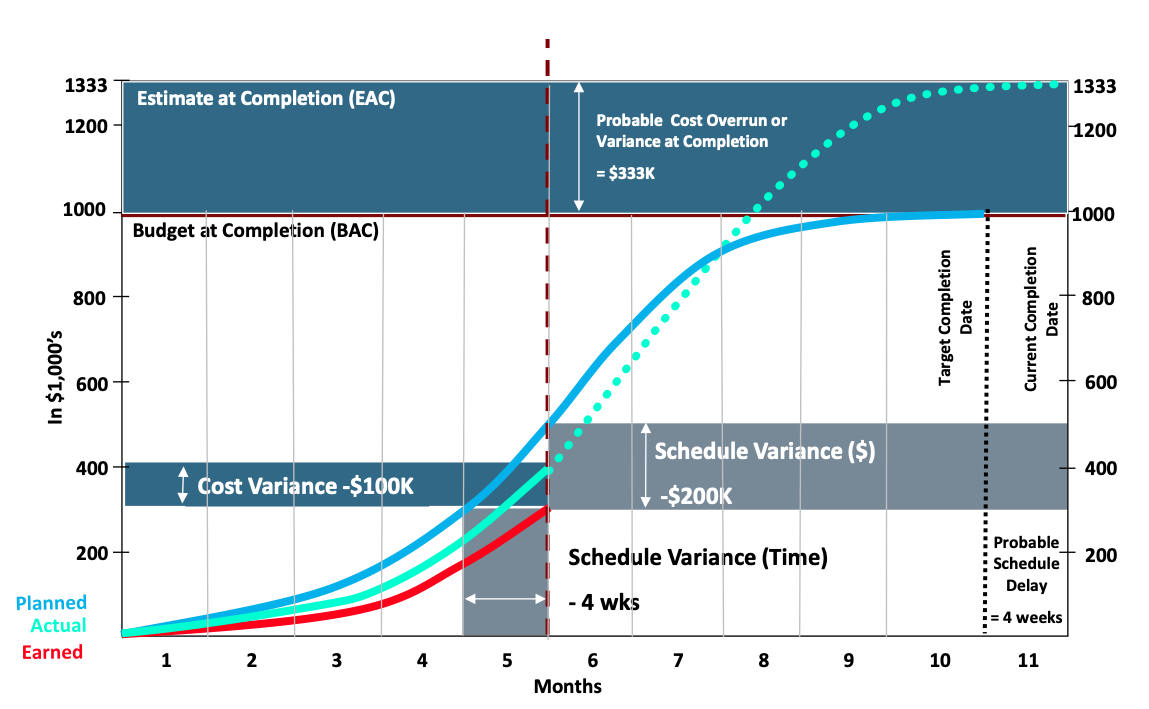

The value of each budget line item is known as the budget at completion. The planned value for the budget spending is known as the planned value or budget cost of work scheduled. The earned value (EV) or budget cost of work performed for each budget line item is calculated using the achieved progress percent complete value for that line item multiplied by the line item’s budget value or the budget at completion.

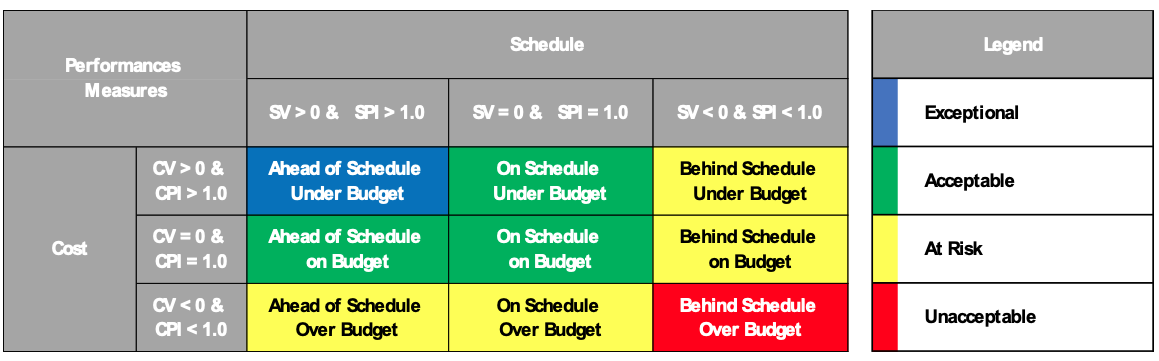

The difference between the earned value or budget cost of work performed and planned value or budget cost of work scheduled at the end of each project period is known as the schedule variance while dividing the earned value or budget cost of work performed by the planned value or budget cost of work scheduled will be the schedule performance index (SPI). A positive schedule variance (SV) or a SPI that is greater than one indicates that the project is ahead of the schedule. On the other hand, a negative SV or a SPI that is less than one indicates that the project is behind schedule.

In addition, the estimate to complete (ETC)) of each budget line item is calculated by subtracting the earned value amount from the budget at completion amount. The ETC can be adjusted depending on the anticipated performance status for the remaining scope of work.

As the project progresses, the actual cost calculates from the commitments’ interim payment certificates for work in place and other non-commitment costs that are captured from miscellaneous invoices and timesheets. The actual cost is also known as the actual cost of work performed. The difference between earned value and actual cost is the cost variance (CV) whereas the cost performance index (CPI) is calculated by dividing the earned value by the actual cost. A positive CV or a CPI that is greater than one indicates that the project is under budget. On the other hand, a negative CV or a CPI that is less than one indicates that the project is over budget.

Adding the estimate to complete amount to the actual cost amount provides the value for the estimate at completion value. The difference between the budget at completion (BAC) and estimate at completion (EAC) is the variance at completion (VAC).

For example, assume that a project’s budget was $1,000. At the end of month five, the achieved earned value was $300, while the planned value was $500, and the actual cost incurred was $400. Accordingly, the schedule variance will be -$200 and the cost variance -$100. This also means that the schedule performance index will be 0.6, cost performance index 0.75, and to complete performance index (TCPI) 1.33.

The estimate to complete of $700, which is adjusted by the TCPI, assuming that the same performance trend continues for the remaining period, becomes $933. Accordingly, the estimate at completion becomes $1,333, for which the variance at completion will be -$333.

The EVM chart also indicates that the achieved EV of $300 at the end of month five was planned to be achieved at the end of month four. This indicates that there is a probable four weeks of delay to the project’s completion date if the same performance trend continues for the remaining period. This delay is called the schedule variance for time (SVt).

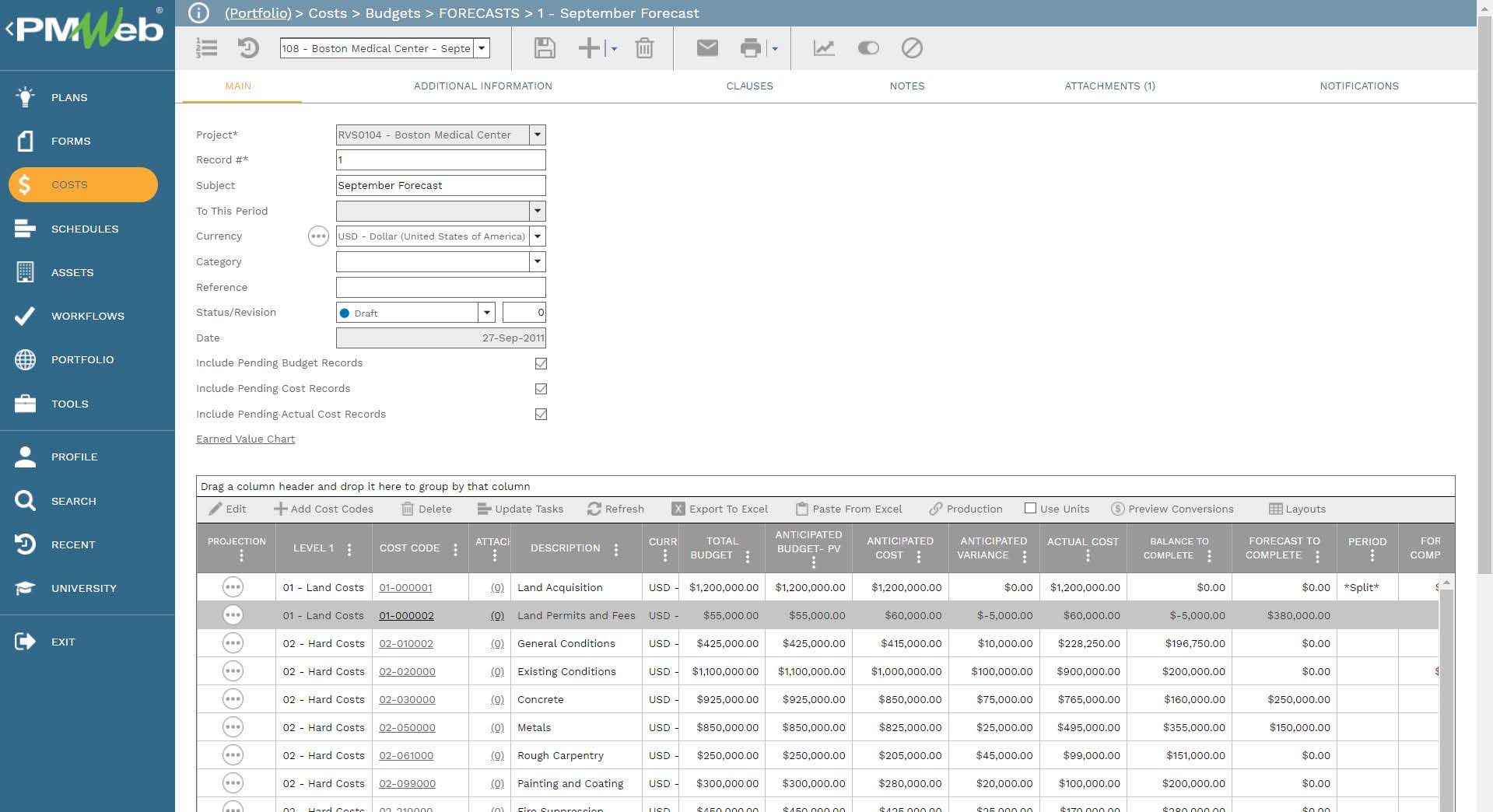

The PMWeb forecast module enables the project team to come up with a realistic adjusted estimate of completion cost for the project. For the first monthly forecast analysis, the list of the cost items that are part of the project budget are selected and dropped into the forecast template. Those cost items align with the project’s cost breakdown structure levels or cost accounts. In addition, a project schedule activity can be associated with each cost item to enable loading the updated percent complete for each activity.

For each cost line item, PMWeb automatically calculates the total budget at completion value. This equals the sum of the original budget and budget changes, planned budget value for up to the period of the forecast report, and the actual cost captured from interim payment certificates for commitments and non-commitment costs from miscellaneous invoices and timesheets. PMWeb provides the option to limit the forecast analysis to only approved cost records or also include pending budget changes and pending actual cost records.

The PMWeb forecast module automatically calculates the values for earned value by multiplying the budget at completion with the imported percent complete of the linked project schedule activity. In addition, the PMWeb forecast module also calculates the values for estimate to complete, schedule variance, cost variance, schedule performance index, and cost performance index, and estimate at completion.

Nevertheless, what is important in the PMWeb forecast module is the data field “Forecast to Complete” which has a default value of “0” but may be edited. The “Forecast to Complete” is defined as what the organization forecasts to spend to complete the scope of work associated with the cost but this does not include what has already been committed to spending as per the calculated “Estimate to Complete”. This becomes the basis for calculating the “Adjusted Estimate to Complete” and “Adjusted Estimate at Completion”.

The EV report details the EV method’s key values for each period, including the approved BAC, PV for the current period, EV for completed works, total AC to date, estimated cost to complete the balance of the works, and project EAC. Moreover, the report will display the variances in each period: the SV, CV, and estimated cost variance at completion. Furthermore, the report will show the SPI and CPI for the same periods and display the variances and performance indices trend charts.

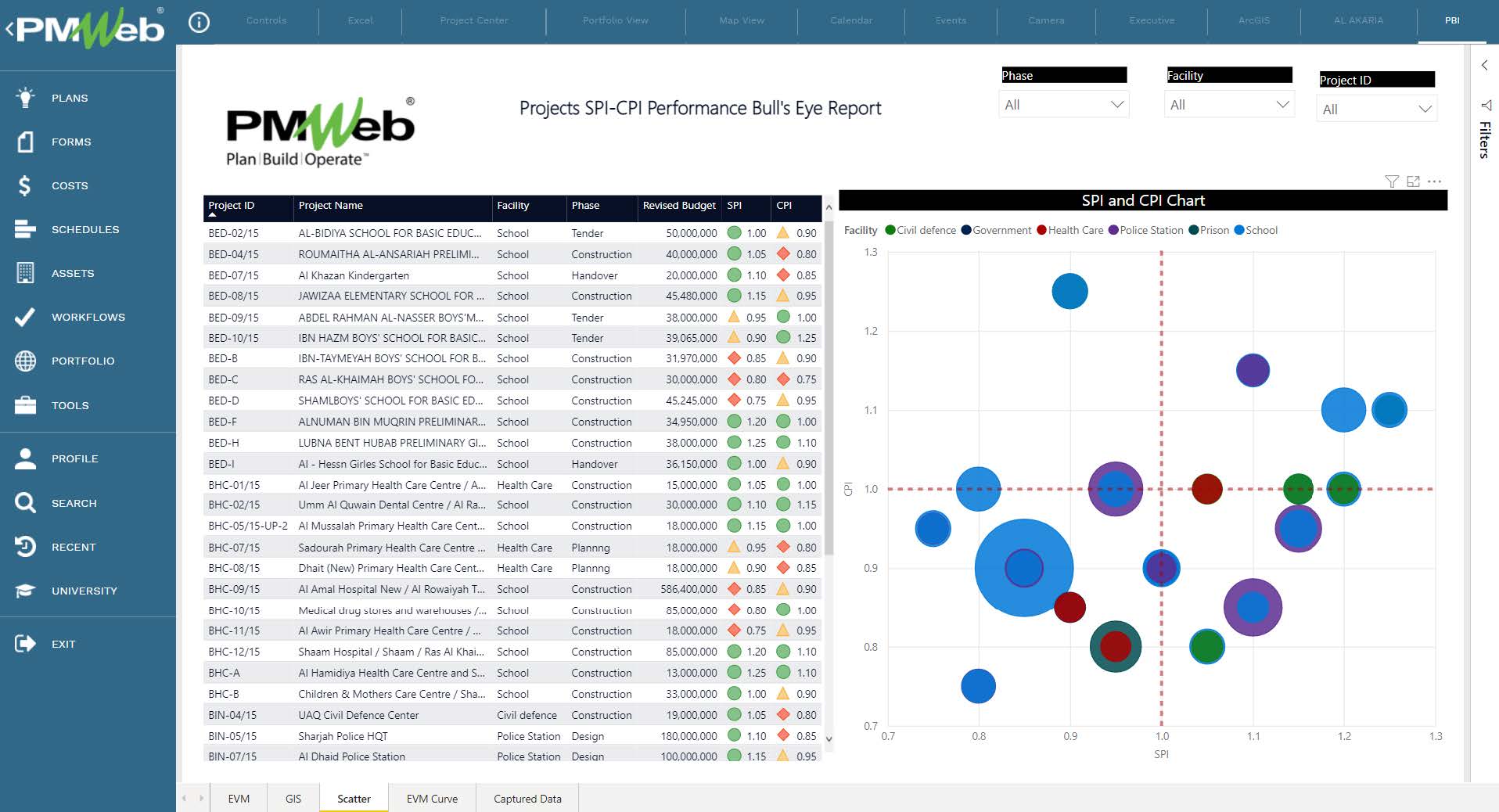

Another EVM report that is common to construction projects is the Bull’s Eye report. The report displays the performance status of a project or period by using the SPI and CPI values. The Bull’s Eye is the intersection of SPI and CPI values of 1.00, which indicates that the project is performing as planned.

The chart divides into four zones. The upper right is for projects that are ahead of schedule (SPI greater than 1.00) and under budget (CPI greater than 1.00), while the upper left will be for projects that are under budget (CPI greater than 1.00) but behind schedule (SPI is less than 1.00). On the other hand, the lower right corner is for projects ahead of schedule (SPI is greater than 1.00) but over budget (CPI is less than 1.00). The lower-left corner is for projects that are behind schedule (SPI is less than 1.00) and over budget (CPI is less than 1.00).

Reference

The content of this article was extracted from the book titled “Let’s Transform: Enabling Digital Transformation of Capital Construction Projects Using the PMWeb Project Management Information System – 2nd Edition”. The book was written by Bassam Samman.

The book provides project owners with oversight on how technology available today can support their efforts to digitally transform the management of their projects’ portfolios. For each capital project life cycle stage, PMWeb is used to detail how the relevant project management business processes can be digitalized to enforce transparency and accountability in delivering projects. In addition, MS Power BI was used to show how the real-time, trustworthy data captured in PMWeb can be aggregated, modeled, monitored, evaluated, analyzed, and reported at anytime, anywhere using any device.