A bankable project is a project that has sufficient collateral, future cash flow, and a high probability of success, to be acceptable to lenders for financing. In simple phrases, a capital project is considered bankable if lenders are willing to finance it. The bankability of capital projects requires identifying potential legal, technical, and economic risks throughout the entire project life cycle from project design to operation and decommissioning. Those identified risks need to be quantitatively and qualitatively assessed, managed, and controlled.

Capital project owners and lenders need to establish a common practice for a professional risk assessment process to reduce the risks associated with investments in capital projects. Those risk assessment and mitigation guidelines need to be developed based on market data from historical due diligence, operation and maintenance records, and damage and claim reports.

The Solar Bankability Project is an example of how to establish a common practice to assess potential technical risks in this type of capital project. The report has developed checklists to assess technical risks which are usually specific to each type of capital project. Of course, the same approach also needs to be done for legal and economic risks which tend to be identical to most types of capital projects.

The Solar Bankability Project

Solar Bankability is a project funded by the European Commission’s Horizon 2020 program. It aimed to contribute to the reduction of the risks associated with investments in sustainable energy projects. The Technical Bankability Guidelines present the best practice guidelines to provide recommendations for investors, banks, insurance, and regulatory bodies to enhance the technical quality of their PV investments.

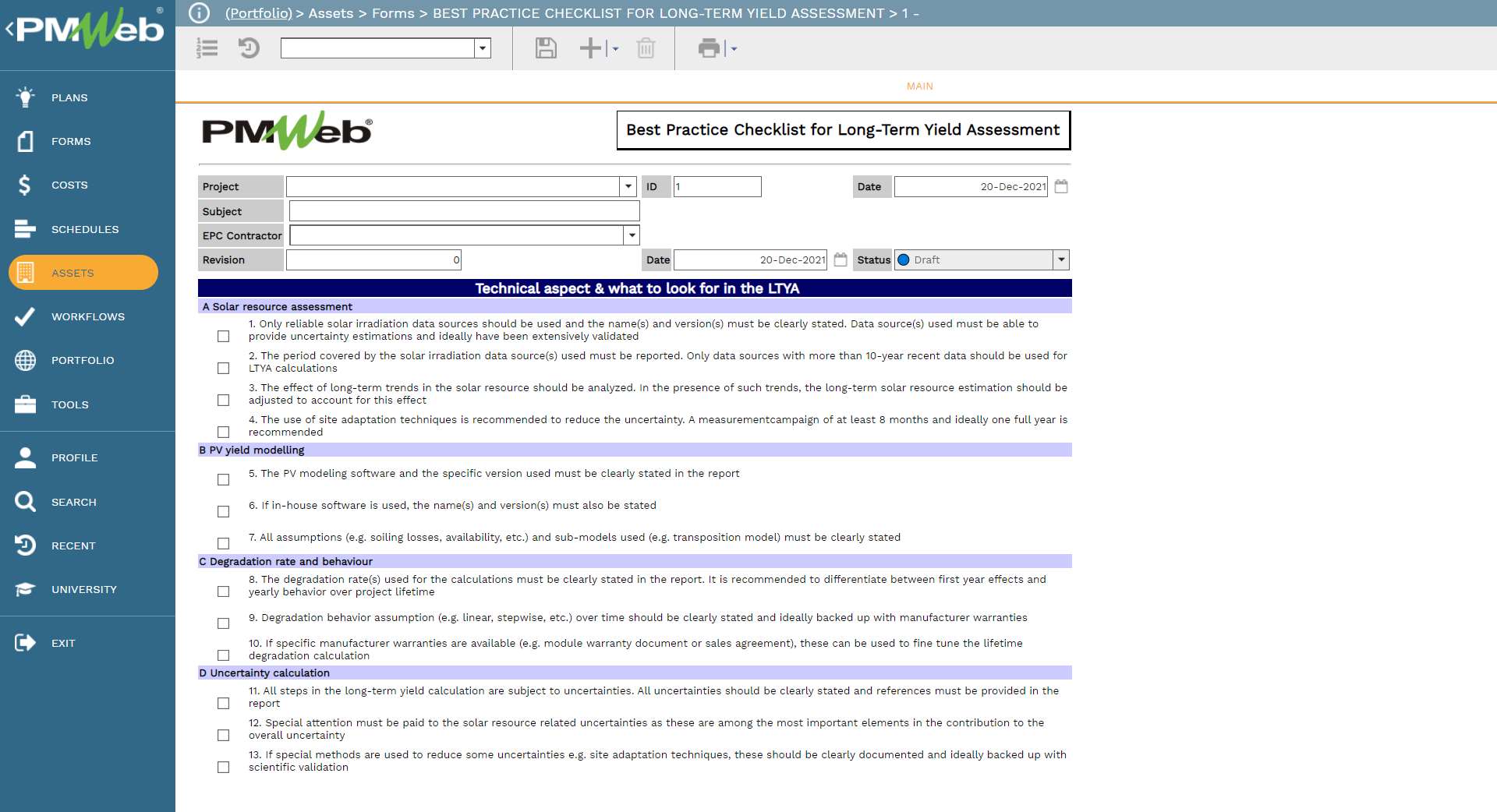

The Solar Bankability project has created three main best practice checklists to identify risks in solar projects covering the entire project life cycle from project design and engineering, component procurement, installation, commissioning, operation, and decommissioning. The three best-practice checklists are EPC Technical Aspects. O&M Technical Aspects and Long-Term Yield Assessment. For each checklist, an extensive list of “what to look for” has been detailed.

How Can Project Management Information Systems (PMIS) Support Project Bankability?

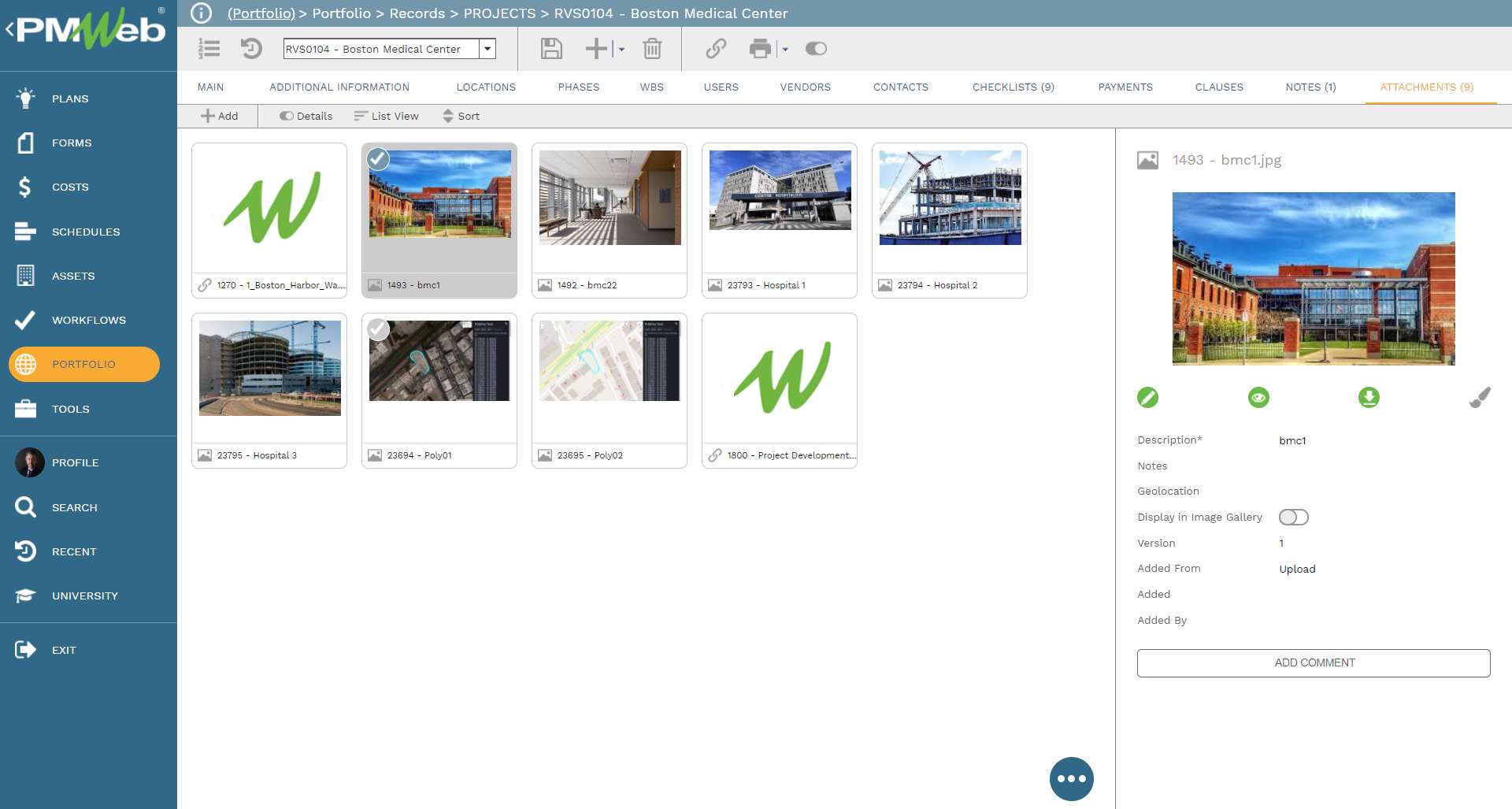

Project Management Information Systems (PMIS) like PMWeb help stakeholders who are part of a capital project delivery to implement the many project management processes needed to manage the complete project life cycle phases. Those include the processes needed for the bankability assessment of a project. PMWeb custom form builder allows creating the needed risk identification checklists that can be used by those evaluating the project’s bankability to identify, analyze, assess, respond, and control the technical, legal, and economical risks that could encounter delivery and operation of a capital project. The content of those checklists, and in particular technical checklists, will be specific to the capital project type.

The Best Practice Checklist for EPC Technical Aspects created using PMWeb custom form builder covers the categories of definitions, interpretation, contractual commitments, scope of work – engineering, scope of work – procurement, scope of work – construction, scope of work – administrative and others, manufacturer warranties, EPC warranty, and defect liability period (DLP), key performance indicators (KPIs) and guarantees and commissioning and acceptance. In total, the checklist will have 58 items to look for when it comes to assessing the EPC technical risks aspects. For each item, the reviewer team needs to tick the box next to each item to confirm if this step was completed. The checklist design can be modified to include the date this action was completed, the name of who did the review, and remarks made by the reviewer including details of relevant documents that are attached to the checklist.

The checklist for Best Practice Checklist for O&M Technical Aspects cover the categories of definitions, interpretation, purpose, and responsibilities, scope of works – environmental, health, and safety, scope of works – operations, scope of works – maintenance, scope of works – data and monitoring, scope of works – spare parts management, scope of works – plant security, key performance indicators (KPIs) and contractual commitments. In total, the checklist has 44 items to look for when it comes to assessing the O&M technical risks aspects. For each item, the reviewer team needs to tick the box next to each item to confirm if this step was completed.

The last checklist is the Best Practice Checklist for Long-Term Yield Assessment (LTYA) covers the categories for solar resource assessment, PV yield modeling, degradation rate and behavior, and uncertainty calculation. In total, the checklist has 15 items to look for when it comes to assessing the LTYA risks aspects. For each item, the reviewer team needs to tick the box next to each item to confirm if this step was completed.

For each checklist form, the attachment tab allows attaching all supportive documents that are relevant to the items included in each checklist. In addition, links to PMWeb records as well as imported MS Outlook emails can be added to the form. The attached documents are usually uploaded and stored in the PMWeb document management repository. Each document could have attributes and other details to provide complete information for the reader when it is reviewed. For documents that could have different versions, PMWeb allows maintaining all these versions and displaying either the latest one or all of them.

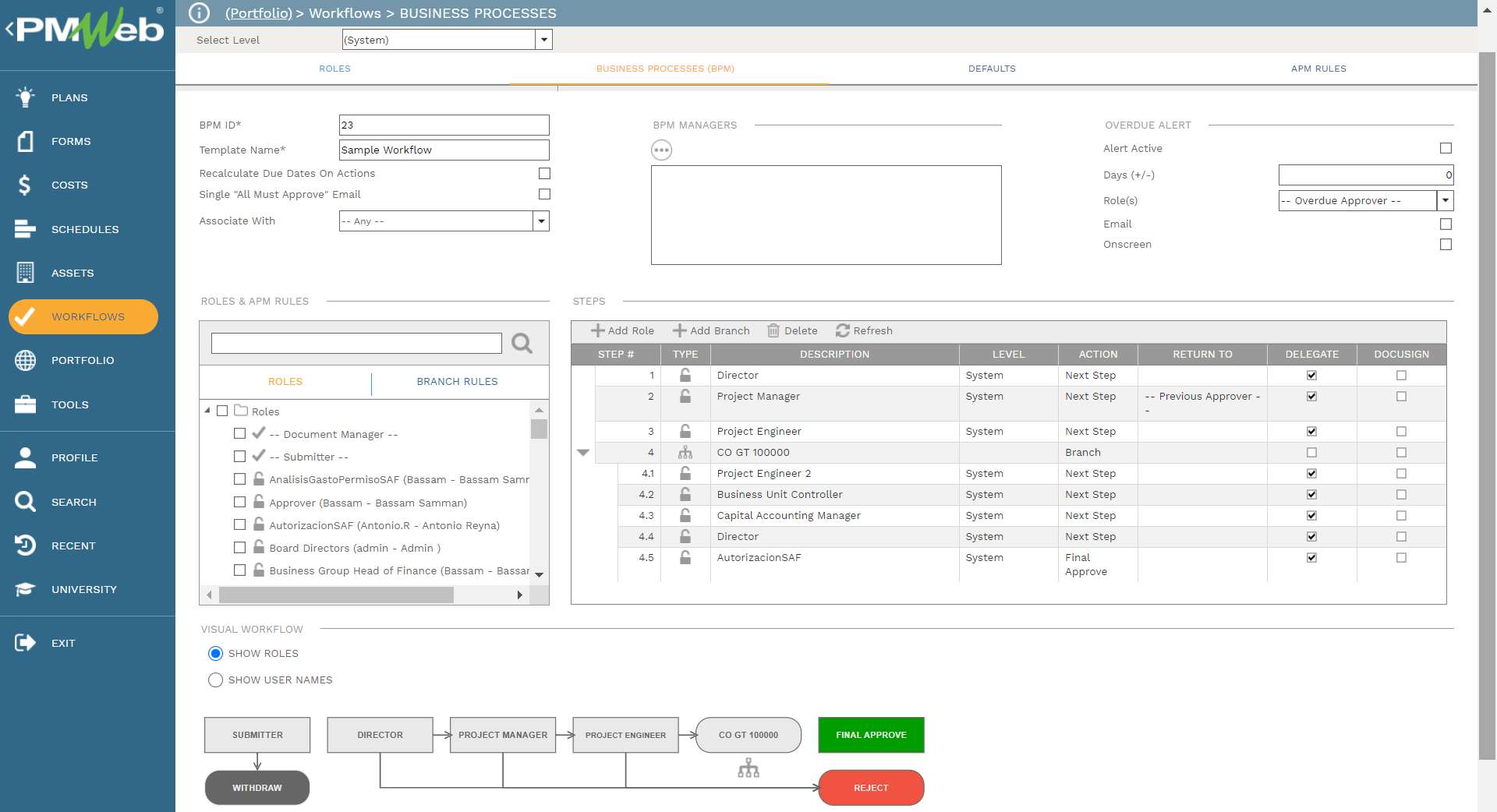

Assigning a workflow to each checklist form that includes all the review and approval tasks ensures that each best practice checklist is completed by the right project team members. The workflow can align with the access rights assigned to each project team member when it to comes to responding to the checklist items to ensure accountability when it comes to completing the assessment review and approval process. PMWeb workflow allows capturing notes and remarks made by the reviewers as well as the exact time when the review step was completed.

For those stakeholders who are either not part of the predefined workflow steps or do not have access to the PMWeb platform, the project team member can share the Best Practice Checklist with those stakeholders using the PMWeb notification option. PMWeb automatically records details of those issued notifications on the Best Practice Checklist record.