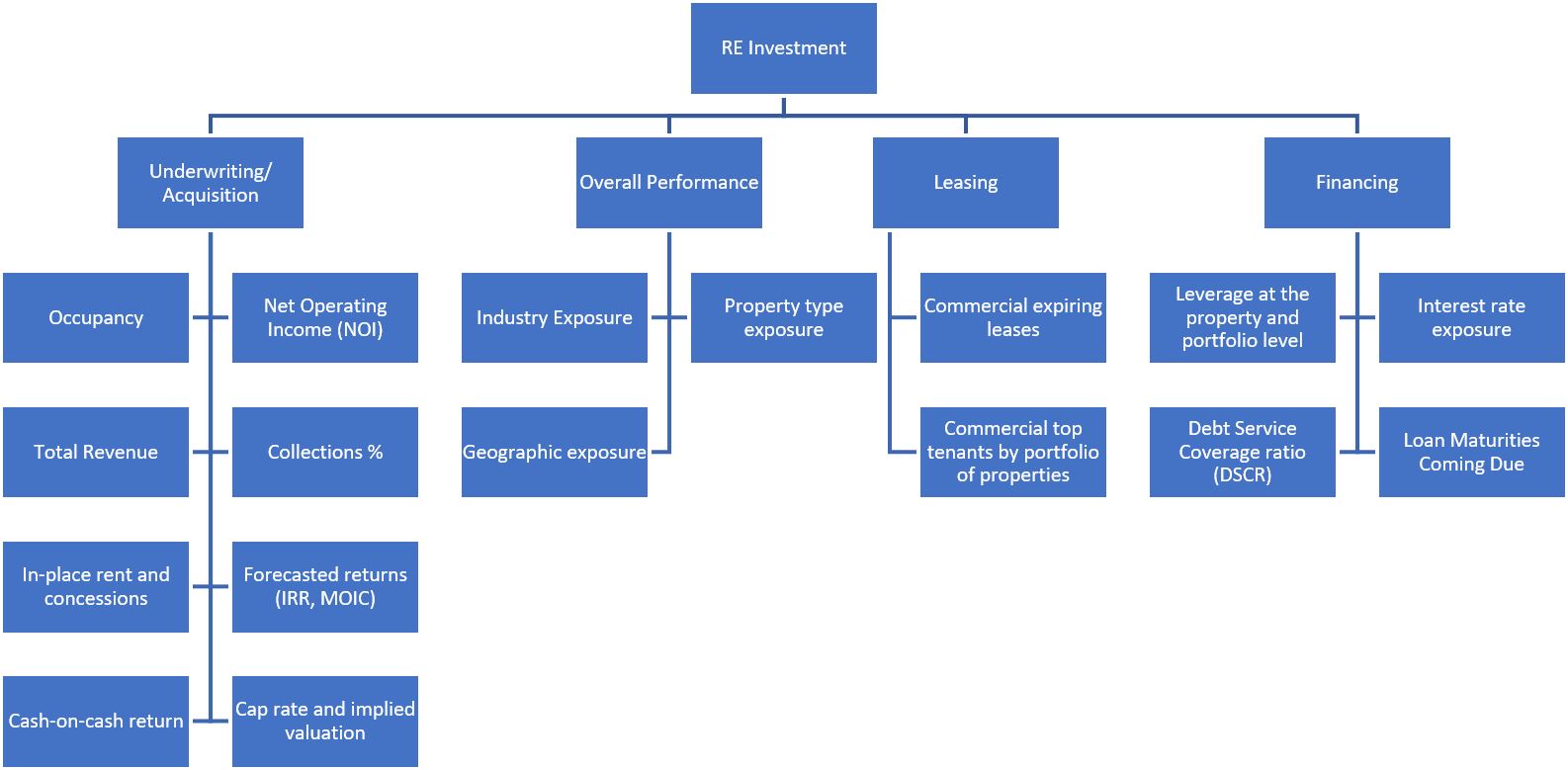

For real estate developers and investors, the performance of their real estate investments is not limited to the stages of planning, design, tendering, construction, and handing over the completed facilities but also extends to the operations and maintenance stage of those facilities. This is the stage where the real estate developer or investor realizes the benefits of their investments when operating those facilities. Accordingly, monitoring, evaluating, and reporting the performance of a real estate investment during the operation and maintenance stage is as critical as monitoring, evaluating, and reporting the performance of capital construction project stages.The article written by Wayne Gretzky titled “Top 17 Real Estate KPIs for Investor Reporting” provides a good example of what performance measures real estate investors usually look for to monitor, evaluate and report on. Those 17 KPIs were grouped under four categories: Underwriting/Acquisition to Current Period, Overall Performance, Leasing, and Financing.

A careful review of those key performance indicators shows that to be able to have a real-time single version of the truth monitoring, evaluating, and reporting of the performance of those KPIs across the real estate portfolio that an investor has, there is a need to capture a number of data values to calculate those measures. Those include the real estate current valuation, a total number of available spaces to be occupied and those actually occupied, details of lease agreements including rent due dates, the amount due and collected amounts, rent type whether in-place or concessions, expenses associated with operating and maintaining the real estate assets, total real-estate investment cost and details of loans associated with the real estate investments. In addition, general information is associated with the real estate assets such as location and type as well as tenant types.

Although there are a number of applications that are specific for managing real estate investments, nevertheless using a Project Management Information System (PMIS) solution that has asset management as one of its modules like PMWeb can be of great value. Not only can PMWeb asset management module capture all of the needed information listed above, but when PMWeb is used to manage the capital construction project of the real estate investment, then the investor has an unmatched 360-degree insight into the complete real estate investment life cycle stages.

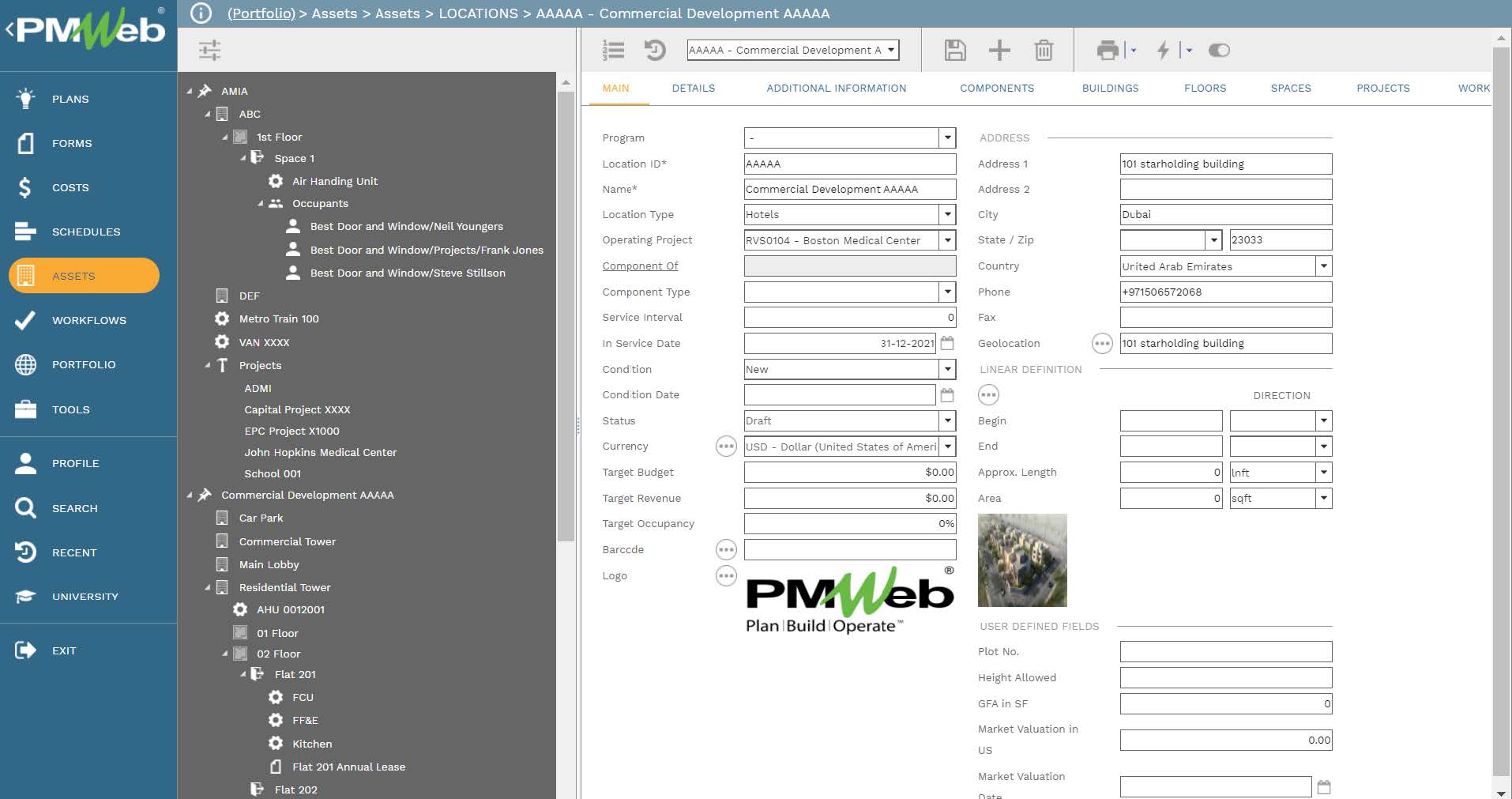

The budget and the actual cost of the capital construction project that produced the real estate asset, the actual cost of recapitalization and refurbishment projects as well as the actual cost of work orders to maintain the operation of those assets are all captured in PMWeb. By having the revenue or net income from those facilities along with all direct and indirect costs incurred on the same facilities then the Internal Rate of Return (IRR) and the Multiple on Invested Capital (MOIC) can be accurately calculated and verified. Unlike IRR, MOIC focuses on how much rather than when, meaning that MOIC does not take into account the time it takes to achieve the needed level of returns but just how much the returns are.PMWeb asset management module helps create the complete register of all real estate facilities, capital construction projects, and recapitalization and refurbishment projects. PMWeb assets explorer allows defining all locations that an investor either has or plans to have real estate investments at. For each location, all types of capital construction projects associated with the location are tagged. In addition, each location is broken down into the buildings or zones that exist at the location. For example, those could be Residential Tower A, Commercial Tower B, Podium, etc. For each project or building, there is no limit to the data that can be added. For example, those could type, category, geospatial location, boundaries polygon, built-up area, current valuation, etc.

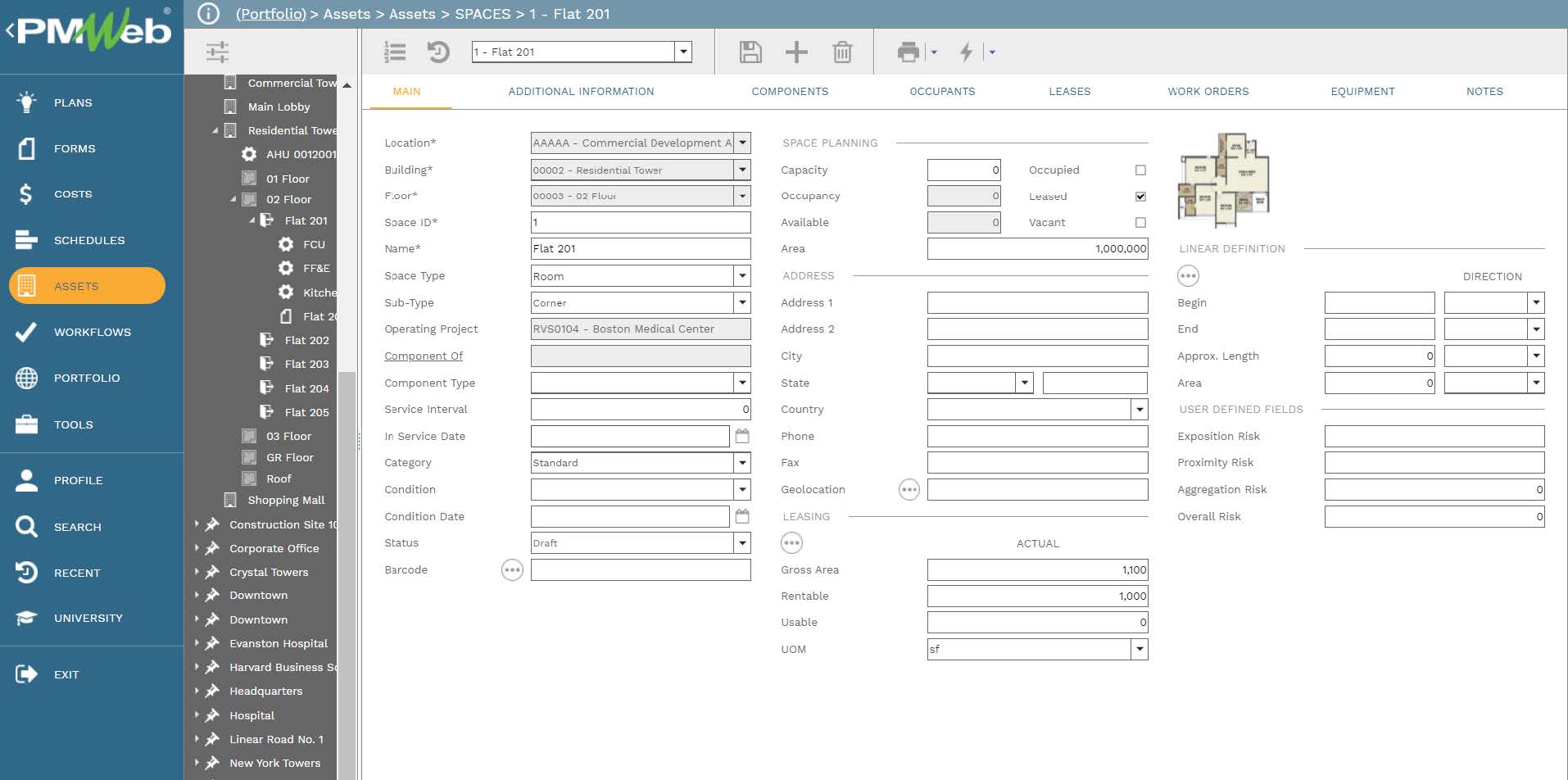

Each building within a location can be further broken down into its floor levels like a basement, ground floor, first floor, etc. In addition, each floor can be further broken down into the spaces that exist within a floor. For example, those could be the residential flats, office suites, retail spaces, entrance and elevator lobbies, restaurants, mechanical and electrical rooms, etc.

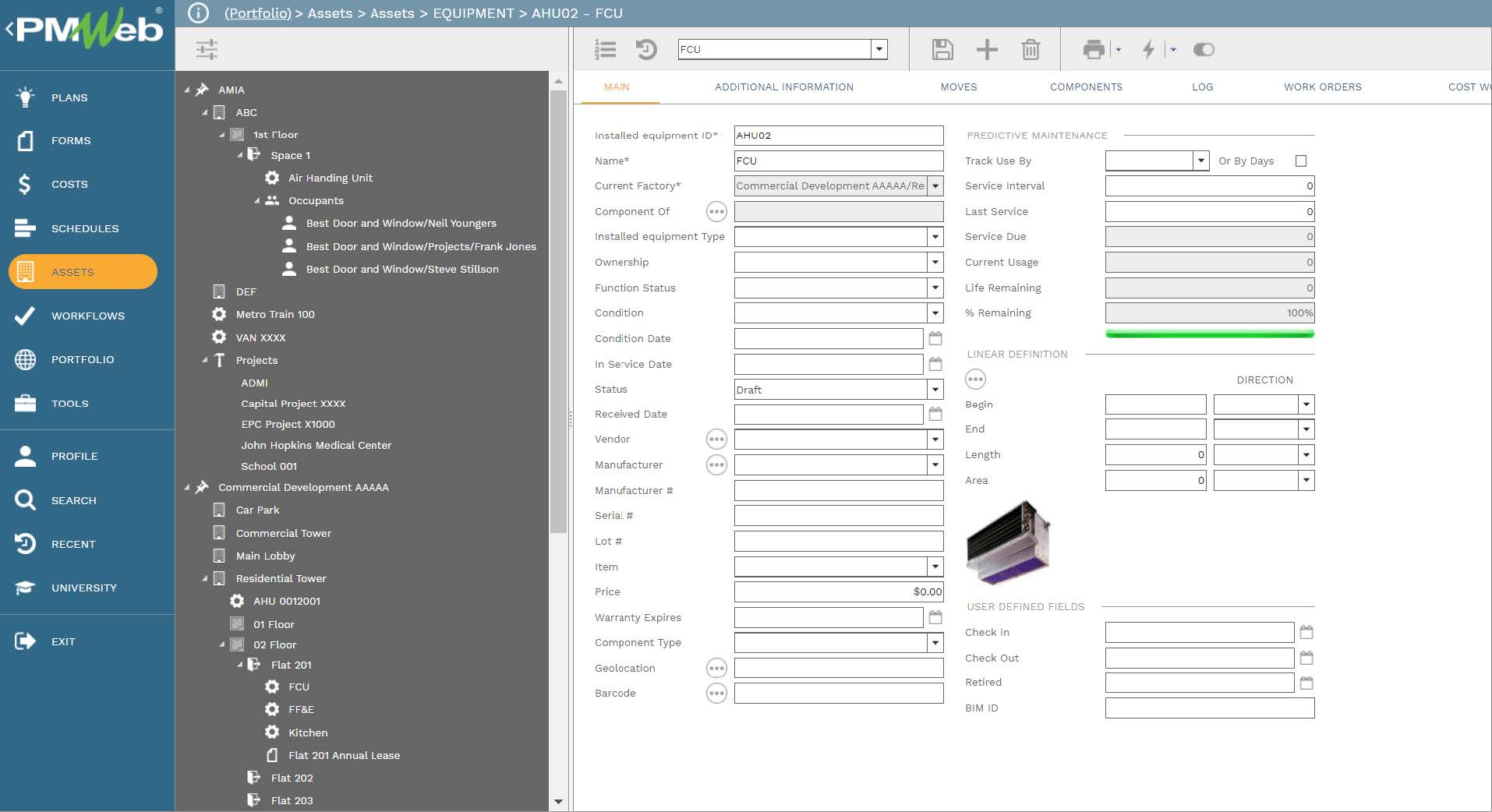

For each space, PMWeb allows defining all the assets that need to be maintained by the real estate investor. Those can include HVAC, mechanical, electrical, conveying, communication, fire alarm, and another type of equipment assets. Work requests and work orders will be issued and captured against the maintenance activities for the equipment. Similarly, work requests and work orders will be also issued and captured against the facility spaces like paintworks, damaged tiles, broken windows, etc.

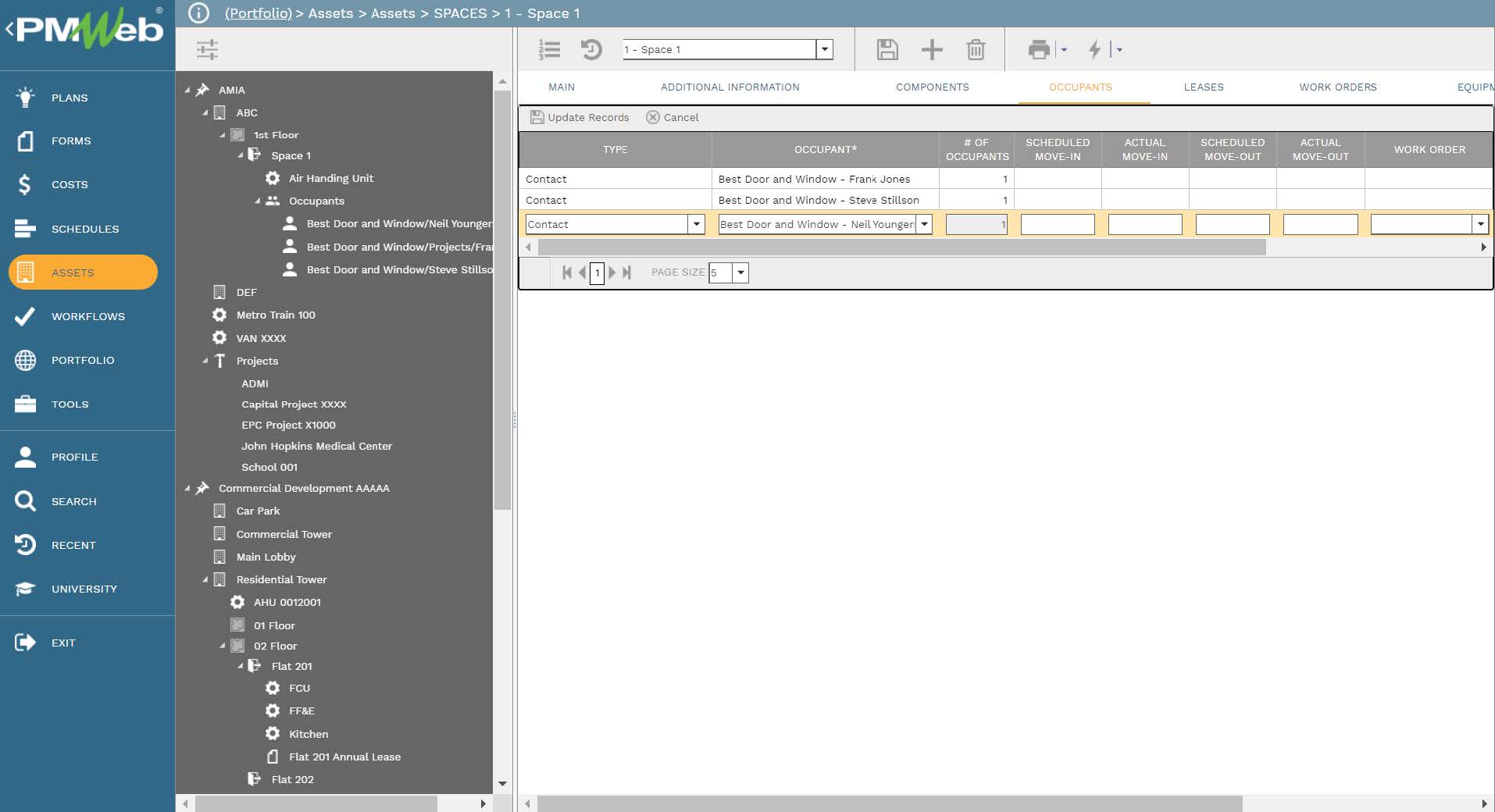

In addition, PMWeb allows capturing the details of occupants of each space. Those can be companies or individuals for which they need to be first defined in PMWeb companies’ module to ensure standardization and accuracy of this important information. For each occupant, PMWeb allows capturing the number of occupants or individuals at each space, scheduled move-in and move-out dates, actual move-in, and move-out dates, work order associated with the move-in or move-out, and notes.

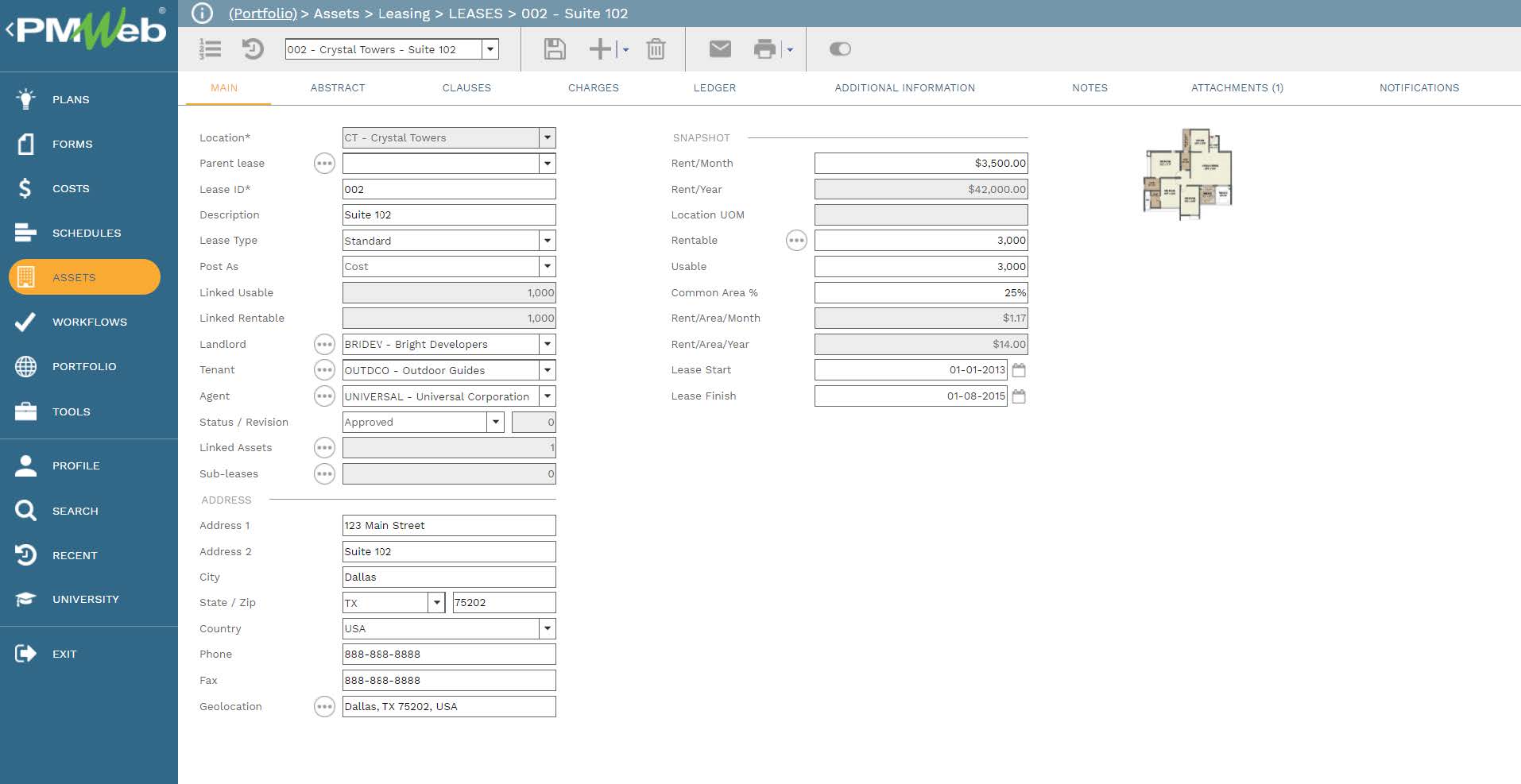

Further, lease agreements as well as a suite of lease agreements can be created for the spaces. The invoices amount due, payments collected, and pending payments for all those lease agreements is also captured in PMWeb. Similar to all other business process templates in PMWeb, there is no limit to the number of user-defined data fields that can be created and added to the lease templates. For example, for lease agreements, a data file helps identify if the lease needs to be considered as an in-place or concession lease agreement. For concession lease agreements, the values could include the options of Free Month’s Rent, Moving Assistance, Rent Reduction, Security Deposit Reduction, and Free or Discounted Amenities.

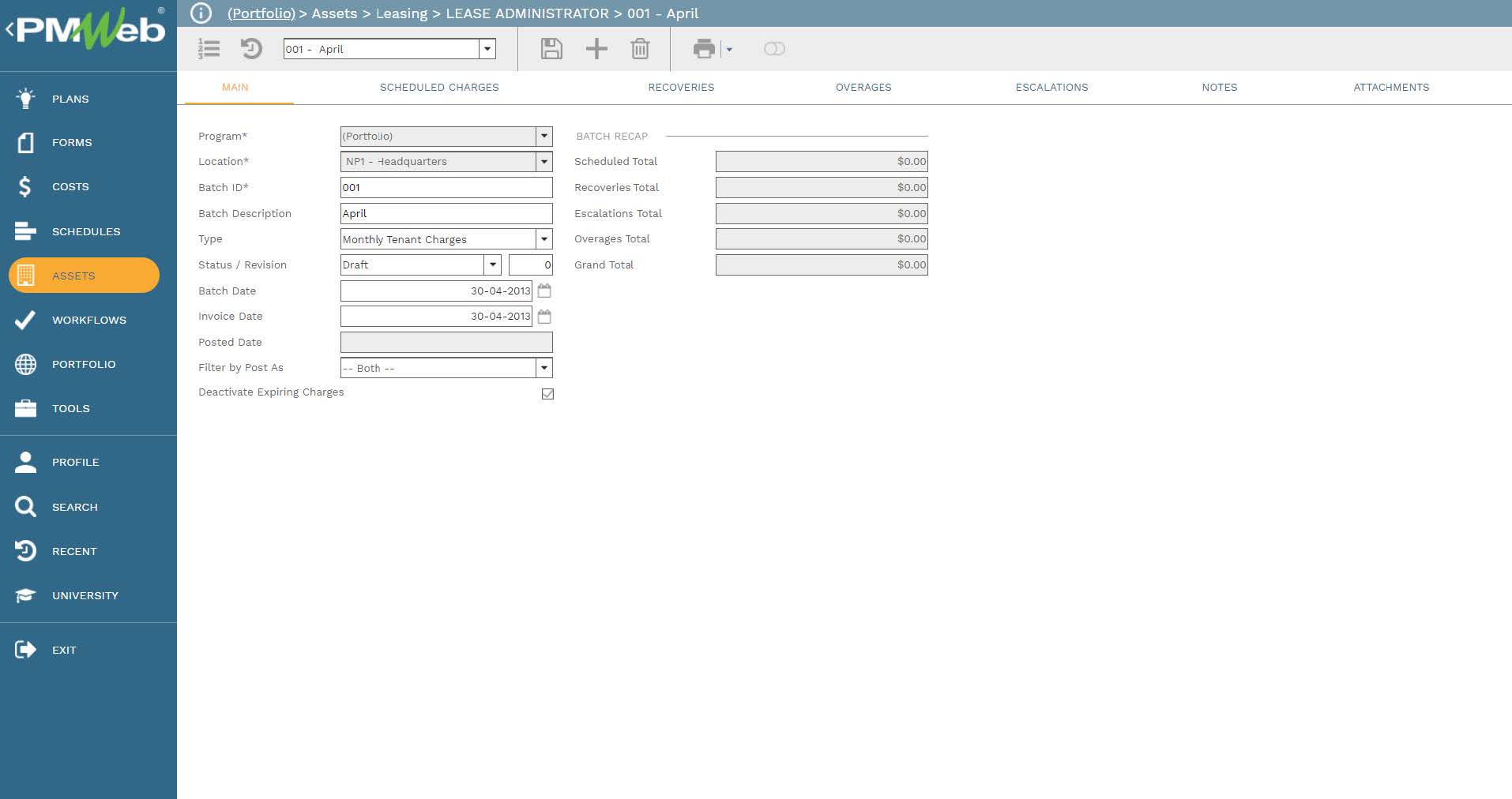

In addition, PMWeb allows capturing the expenses that could be associated with operating those facilities such as utility fees and other tenant charges. PMWeb allows capturing scheduled charges, recoveries, escalating charges, and overcharges to have the grand total of those charges. Of course, PMWeb offers other modules that could be found to be better used to capture all expenses associated with the real estate investments to provide the accurate expenses amount to calculate the net income from the total revenue. Those project-related modules include commitments and purchase orders, miscellaneous invoices, and timesheets.

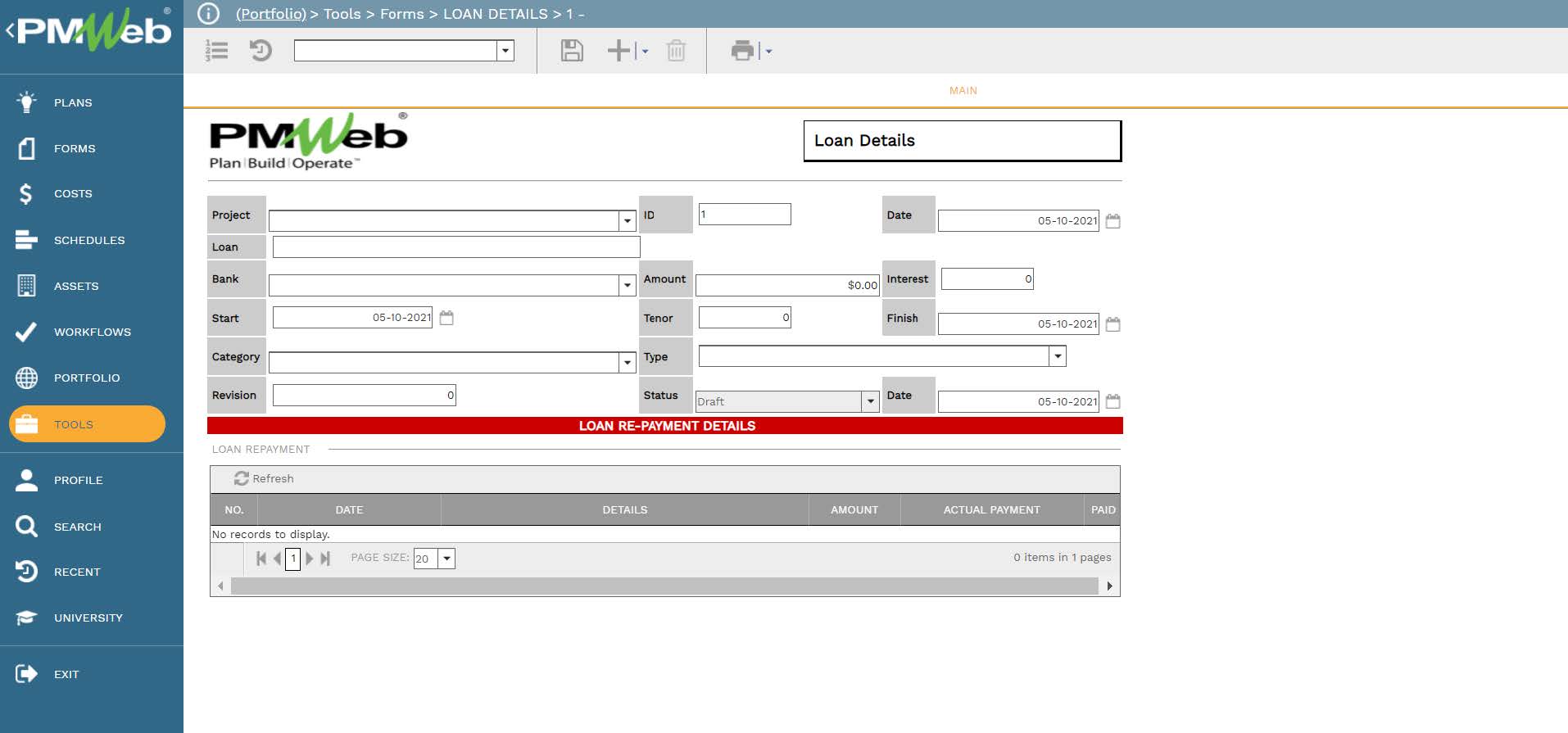

To capture the detail of all loan agreements that the real estate investor has used to finance the real estate investment, the PMWeb custom form module helps capture the details of each loan. The template includes the financial institution providing the loan, loan amount, interest rate, payment terms, loan tenor duration, loan start, and end date, etc. In addition, the template will include a table that will show the due loan repayments amounts and dates, and actual repayments are done. Of course, the template can be designed in any desired format to capture all needed details by the real estate investor.

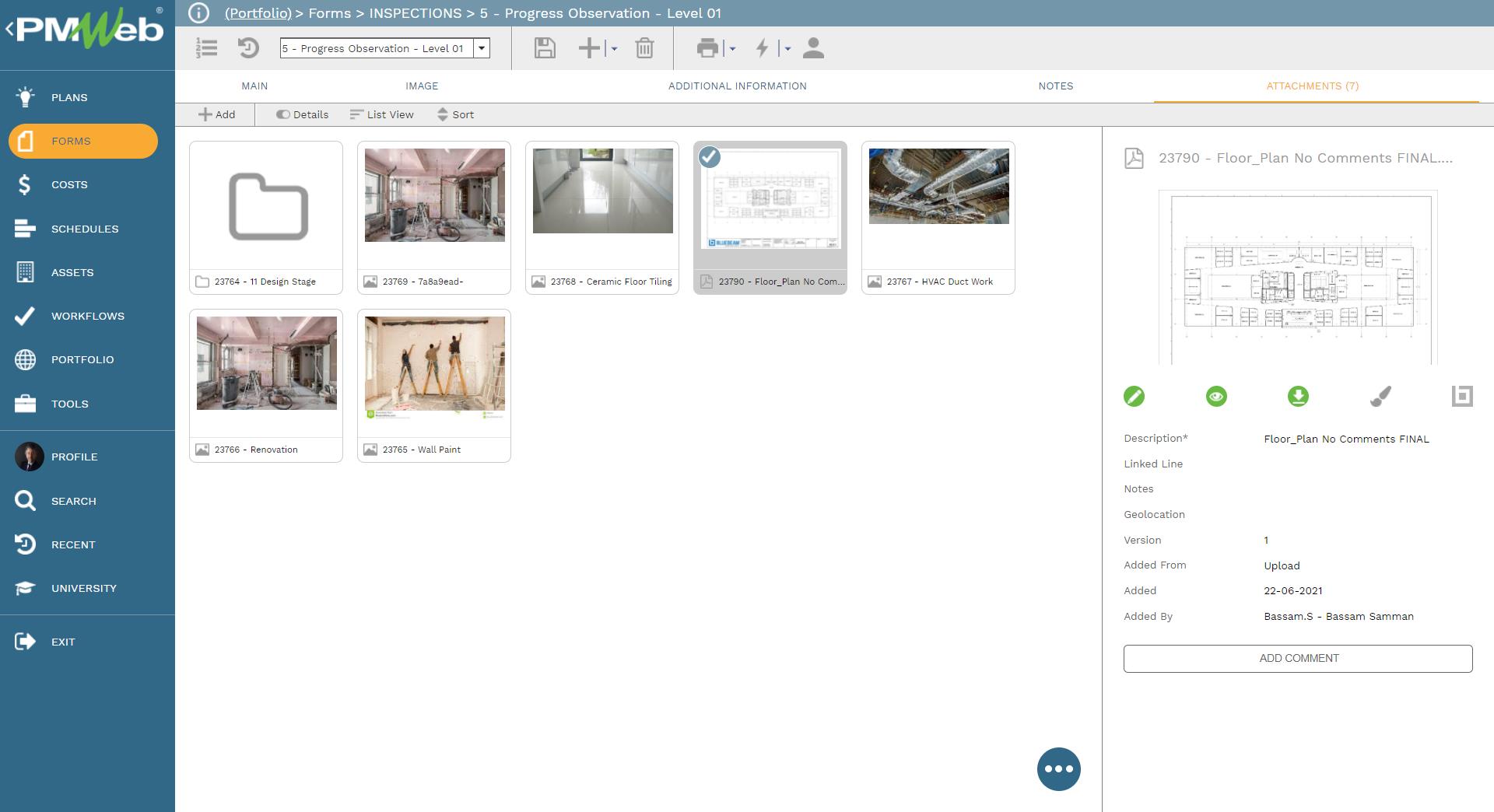

For all those templates that were detailed above, PMWeb allows attaching all supportive documents and pictures to be attached to each transaction associated with those templates. It is highly recommended to add details to each attached document to better explain to the reader what is being attached and viewed. In addition, links to other relevant records of other business processes managed in PMWeb can be also linked to the records of those change orders-related business processes.

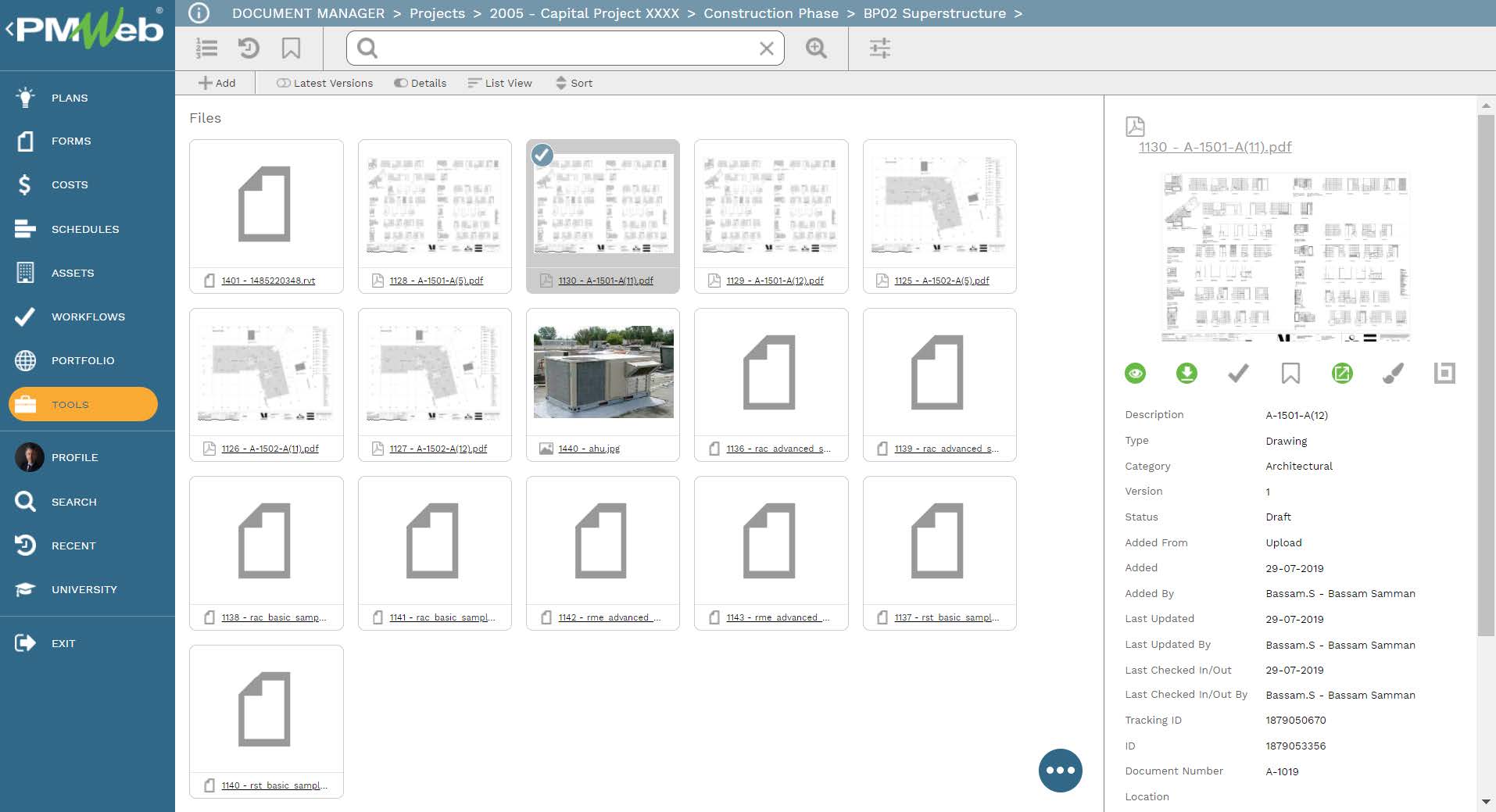

It is also highly recommended that all those supportive documents, regardless of their type or source, get uploaded and stored on the PMWeb document management repository. PMWeb allows creating folders and subfolders to match the physical filing structure used to store hard copies of those documents. Permission rights can be set to those folders to restrict access to only those users who have access to do so. In addition, PMWeb users can subscribe to each folder so they can be notified when new documents are uploaded or downloaded.

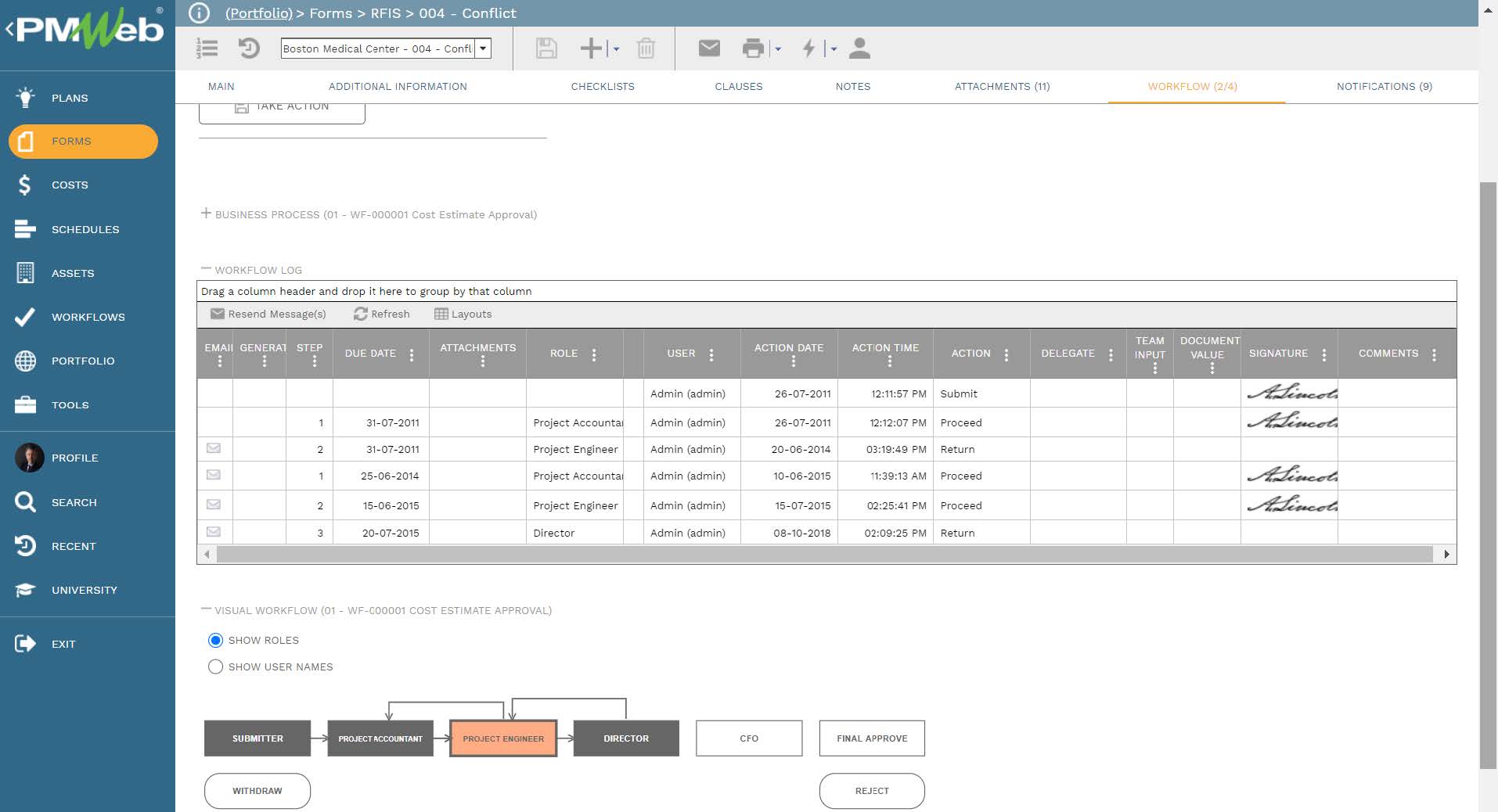

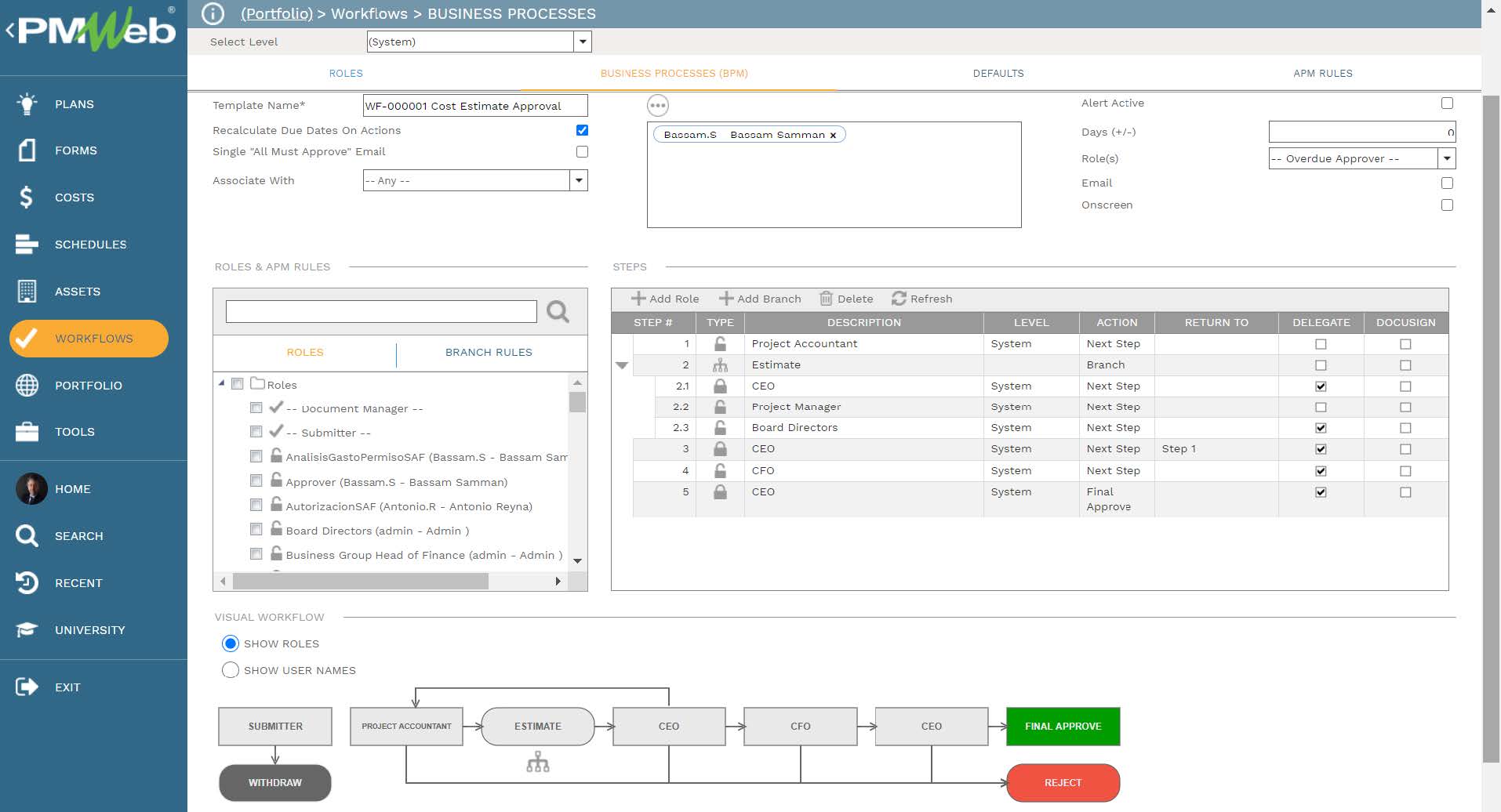

To ensure that the submit, review, and approve dates of each real estate investment business processes’ transaction submission are captured, assign a workflow to each one of those business processes. The assigned workflow maps the submit, review, and approve tasks, roles or roles assigned to each task, task duration, task type, and actions available for the task. In addition, the workflow could be designed to include conditions to enforce the approval authority levels as defined in the Delegation of Authority (DoA) matrix.

When any of those business processes’ transactions are initiated, the workflow tab available on the relevant template will capture the planned review and approve workflow tasks for each transaction as well as the actual history of those review and approval tasks. The captured workflow data includes the actual action data and time, done by who, action taken, comments made, and whether team input was requested.