Many project owners and in particular those from the public sector or publicly listed companies have the requirement to conduct an internal audit on their capital construction projects. Although the trend for most of those project owners to conduct this internal audit after project completion, nevertheless, conducting an internal audit during the project delivery could be of greater value in terms of rectifying non-compliant actions, taking advantage of identified opportunities, and maybe more importantly detecting and preventing actions that could lead to project fraud.

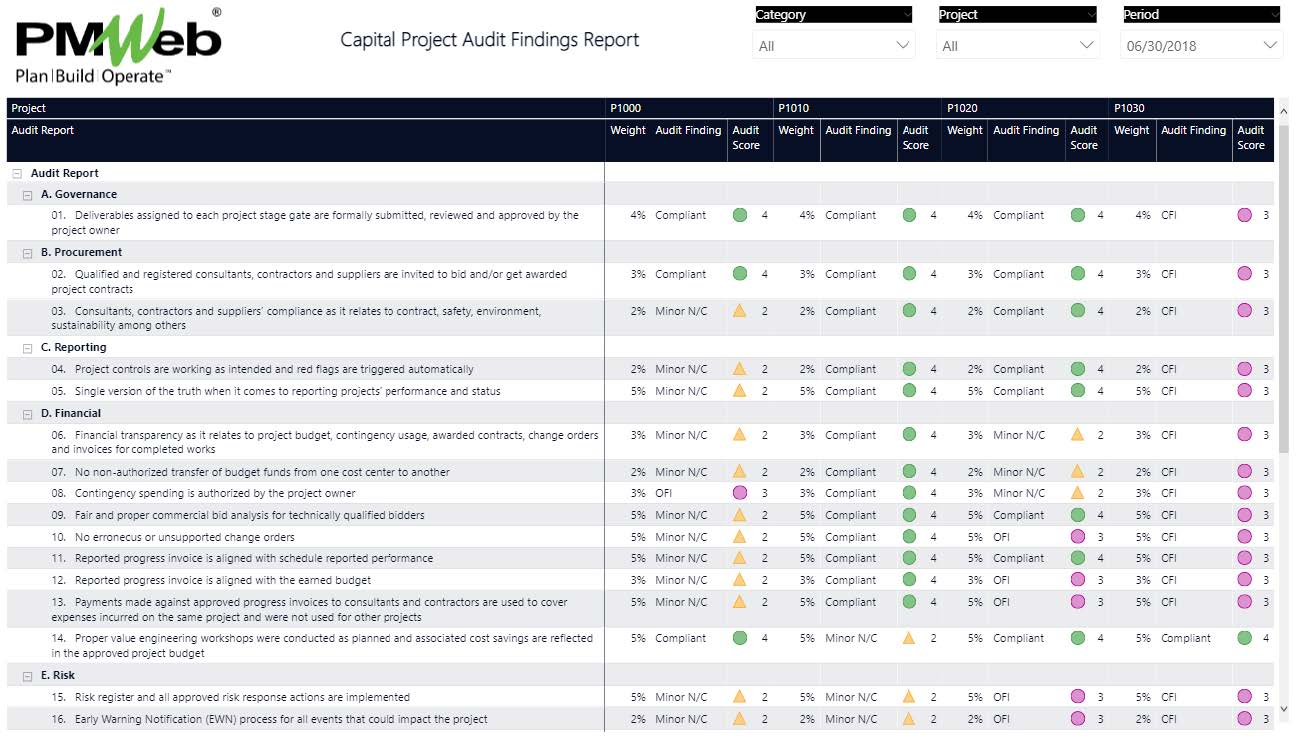

The internal audit should cover all management aspects of delivering capital construction projects. Those include governance, schedule, financial, quality, communications, stakeholders, human resources, risk, procurement, health, safety and environment, sustainable development, performance reporting, and eventually project closeout. Under each project management aspect or category, the internal audit objectives should be clearly stated and defined.

For example, under the financial category, the items that need to be audited might include financial transparency as it relates to project budget, contingency usage, awarded contracts, change orders, and invoices for completed works; No non-authorized transfer of budget funds from one cost center to another; Contingency spending is authorized by the project owner; Fair and proper commercial bid analysis for technically qualified bidders; No erroneous or unsupported change orders; Reported progress invoice is aligned with schedule reported performance; Reported progress invoice is aligned with the earned budget; Payments made against approved progress invoices to consultants and contractors are used to cover expenses incurred on the same project and were not used for other projects, and proper value engineering workshops were conducted as planned and associated cost savings are reflected in the approved project budget. Each one of those audit objectives has a weighted value so the total of all audit objectives is 100%.For each audit item, the internal auditor needs to report the audit findings which could be compliant, opportunities for improvement (OFI), minor non-compliances, and major non-compliances. Those findings are scored on a scale of 4 where being compliant has a score of 4 points (Green) while major non-compliances scores 1 point (Red). The score for opportunities for improvement (OFI) is 3 points (Purple), and minor non-compliances scores 2 points (Yellow).

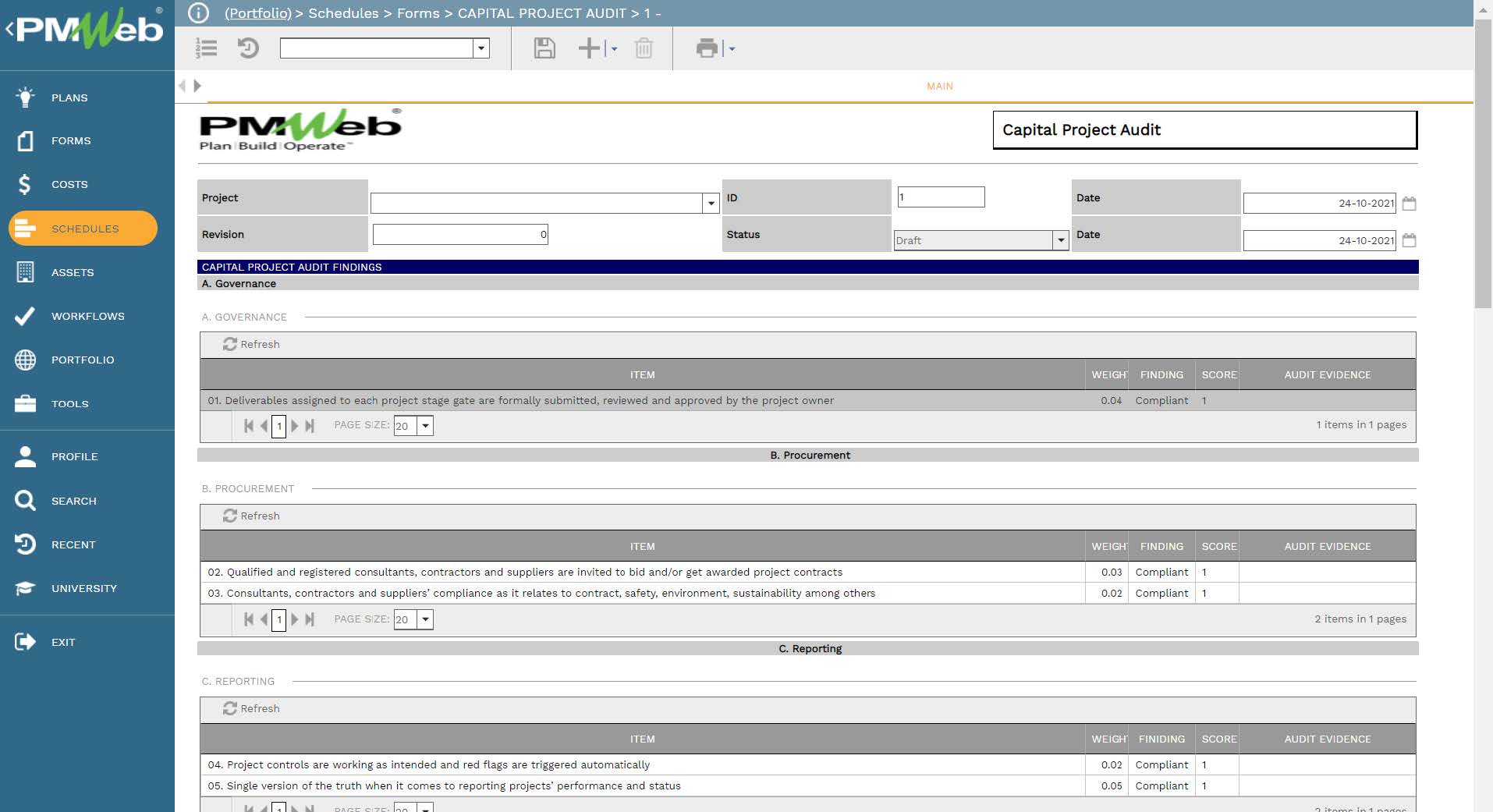

Using a Project Management Information System (PMIS) solution like PMWeb, all project management business processes are digitalized so you can monitor, evaluate, and report on them. In addition, PMWeb custom form builder helps to create a template to capture the findings by the internal audit team so they can be reported on. The Capital Project Audit template includes tables to capture the audit findings for each project audit category. Each table lists the audit objectives, assigned weight for each objective, scoring, and evidence of finding. The template can be modified to include details of the Internal Auditor name, although this is captured in the workflow assigned to the Capital Project Audit template.

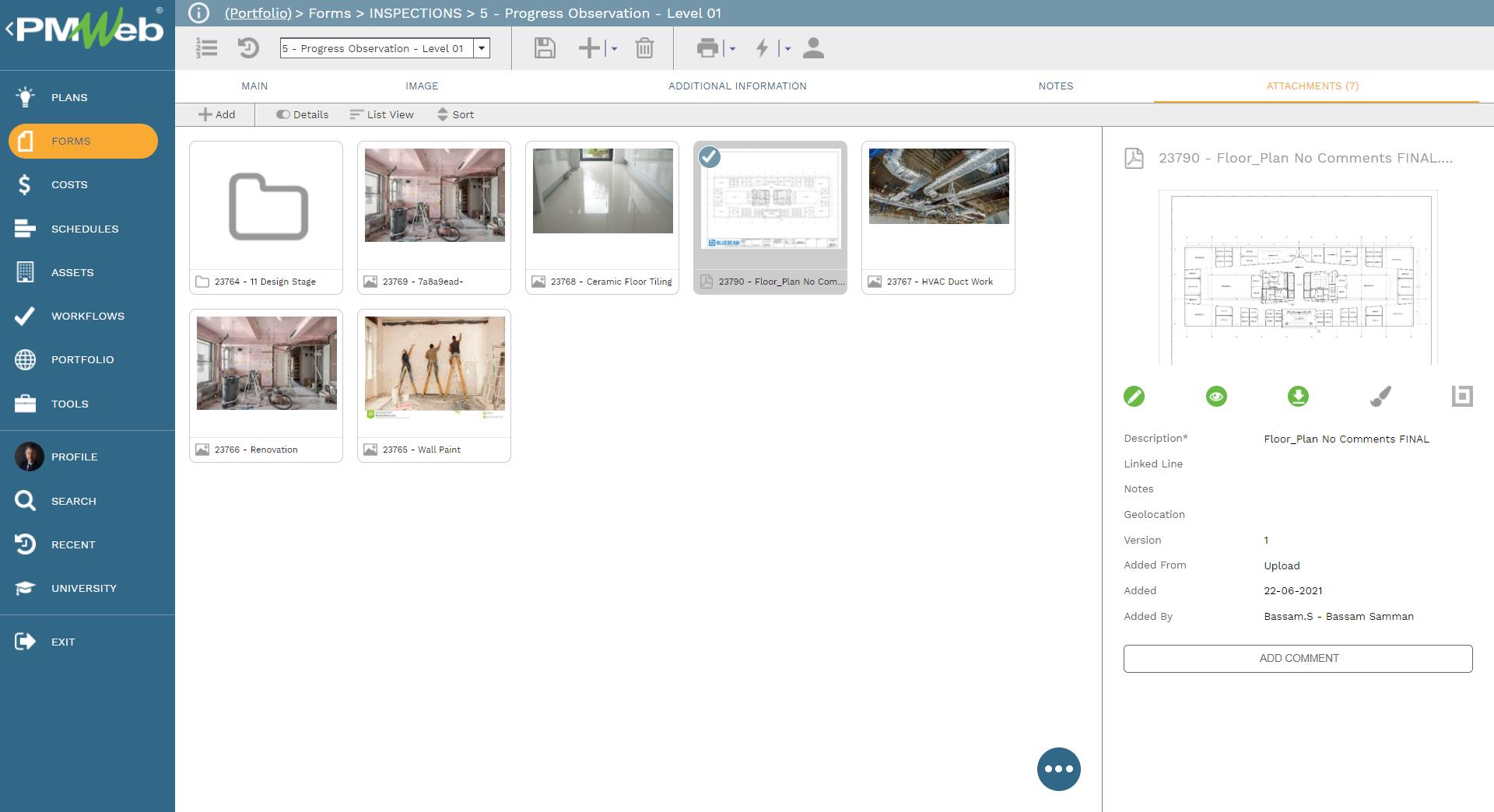

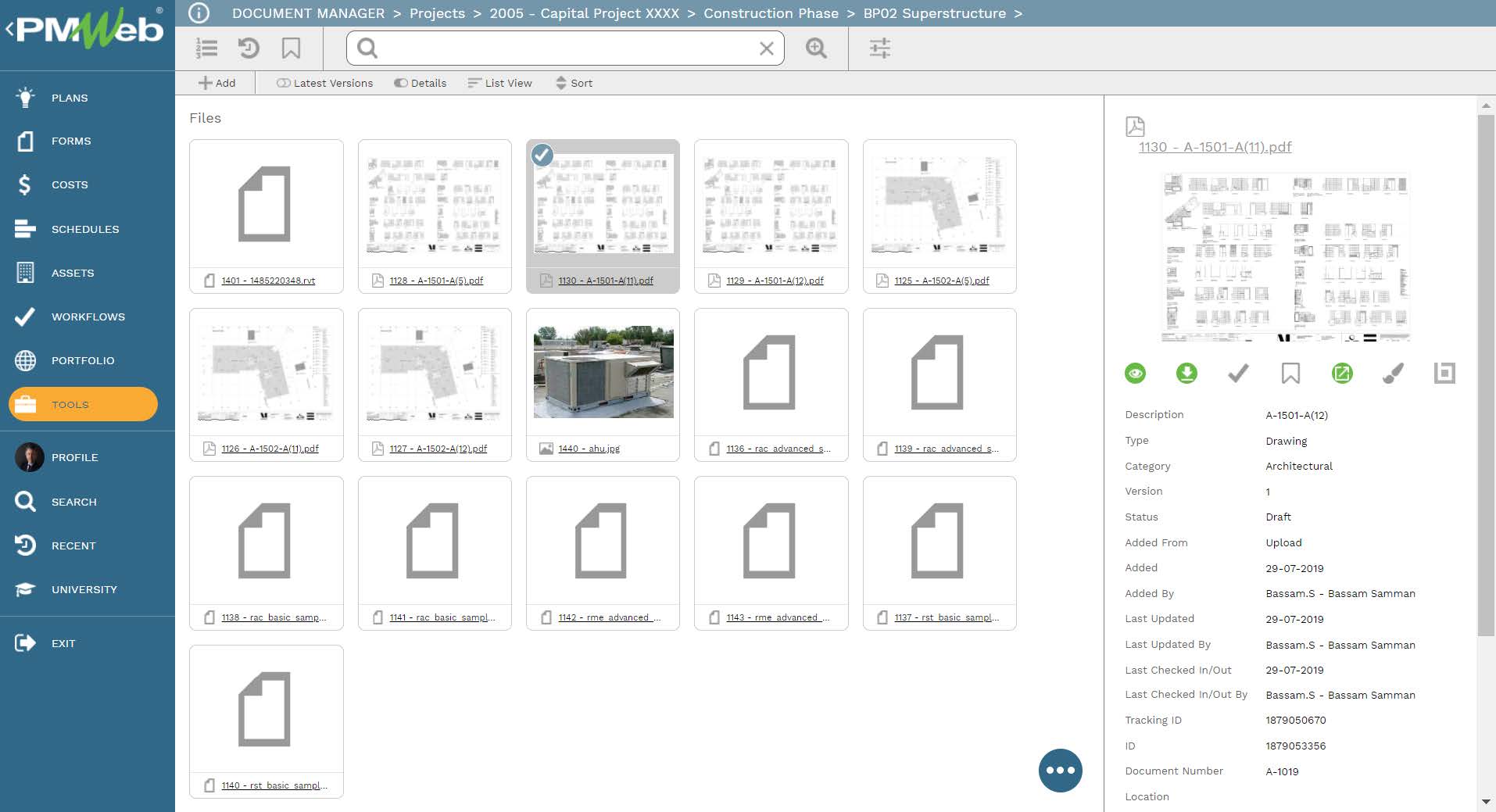

PMWeb allows attaching all supportive documents to each transaction of each business process template. It is highly recommended to add details to each attached document to better explain to the reader what is being attached and viewed. In addition, links to other relevant transactions or records of other business processes managed in PMWeb can also be added.

It is highly recommended that all those supportive documents, regardless of their type or source, get uploaded and stored on the PMWeb document management repository. PMWeb allows creating folders and subfolders to match the physical filing structure used to store hard copies of those documents. Permission rights can be set to those folders to restrict access to only those users who have access to do so. In addition, PMWeb users can subscribe to each folder so they can be notified when new documents are uploaded or downloaded.

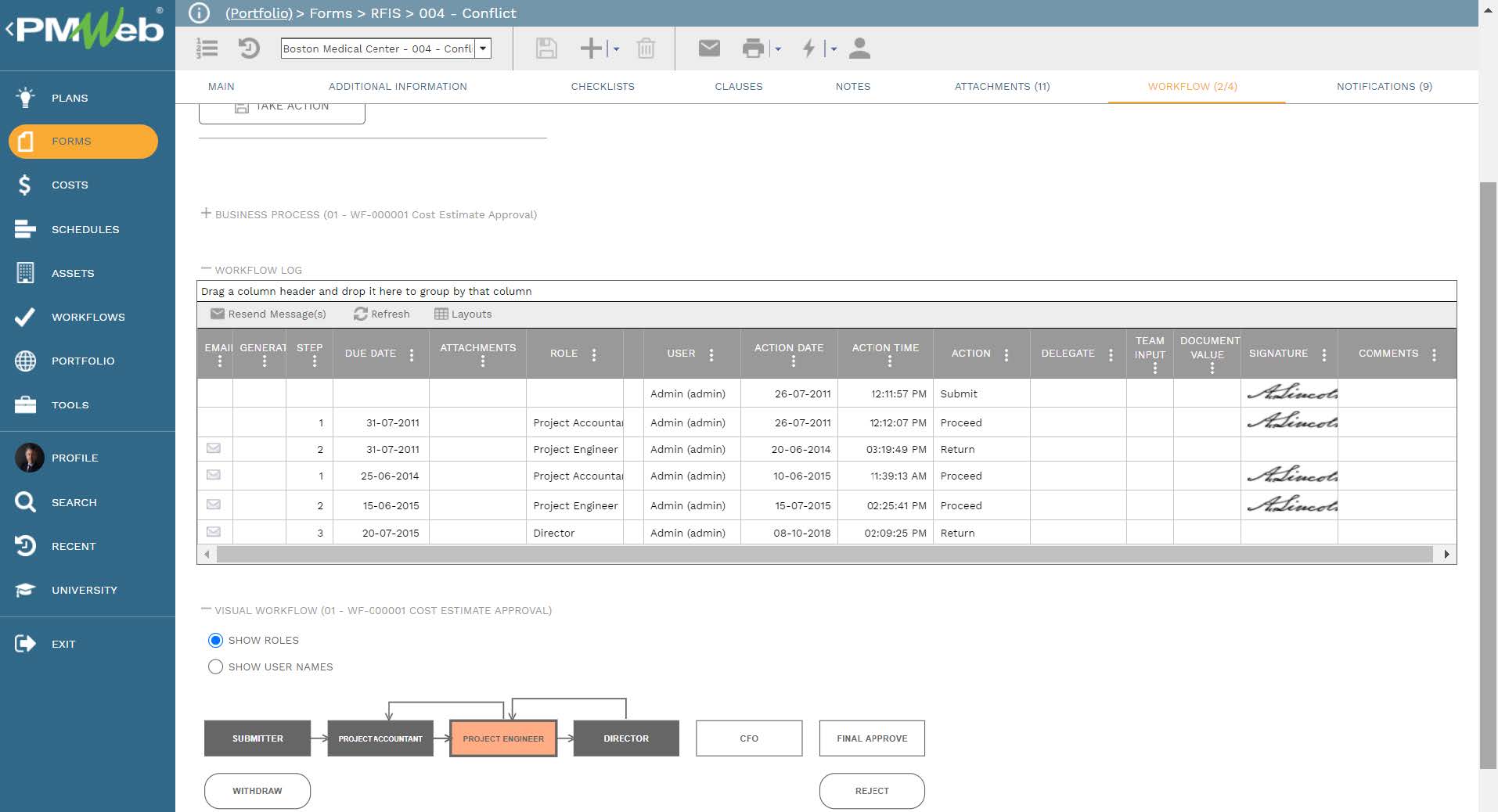

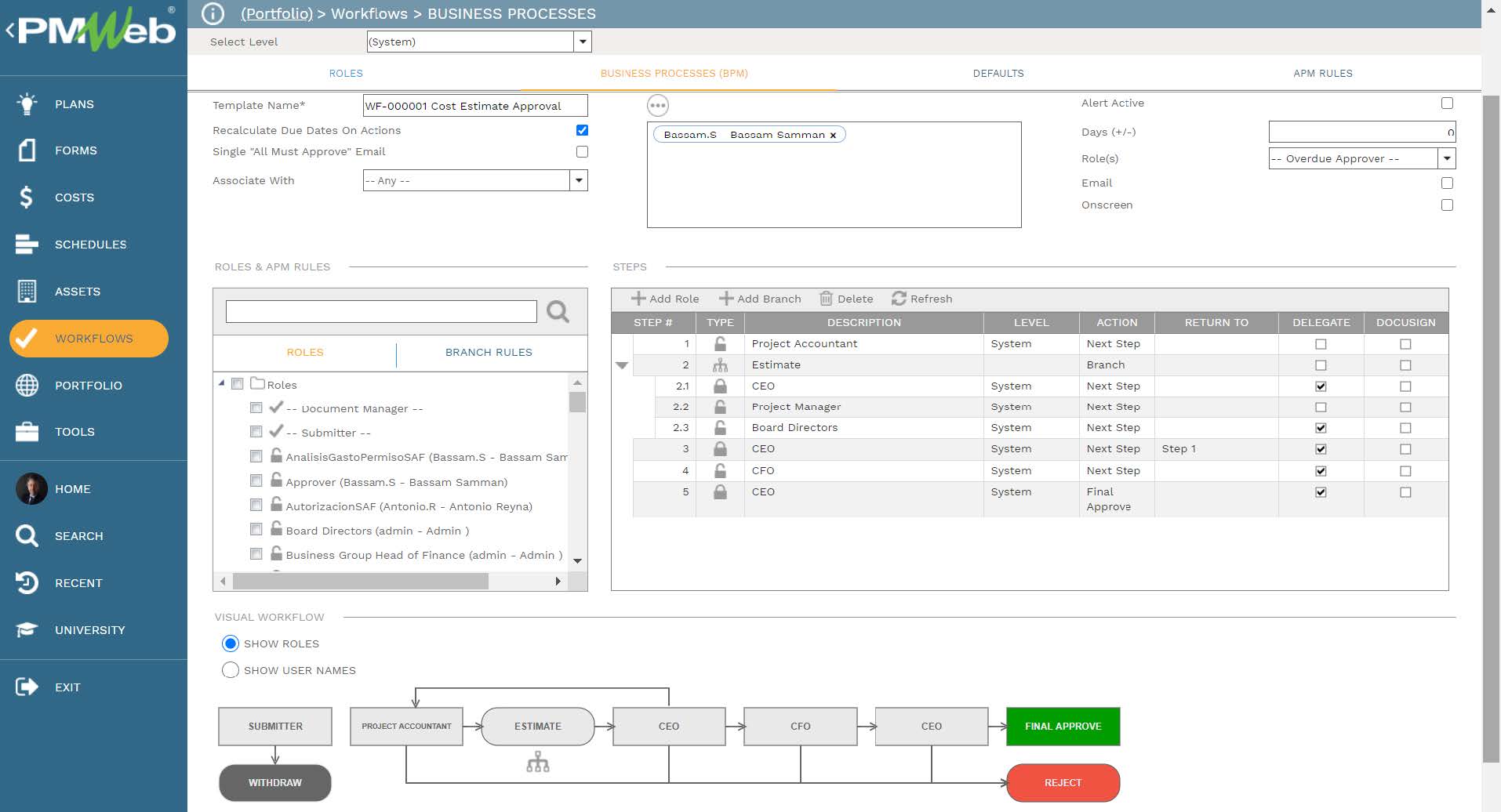

To enforce transparency and accountability in reporting the findings of the internal audit, a workflow needs to be added to the Capital Project Audit template to map the submit, review and approve tasks, role or roles assigned to each task, task duration, task type, and actions available for the task.

When the Internal Audit for a project is completed and is submitted for review and approval, the workflow tab available on the relevant template captures the planned review and approve workflow tasks for each transaction as well as the actual history of those review and approval tasks. The captured workflow data includes the actual action data and time, done by who, action taken, comments made, and whether team input was requested.