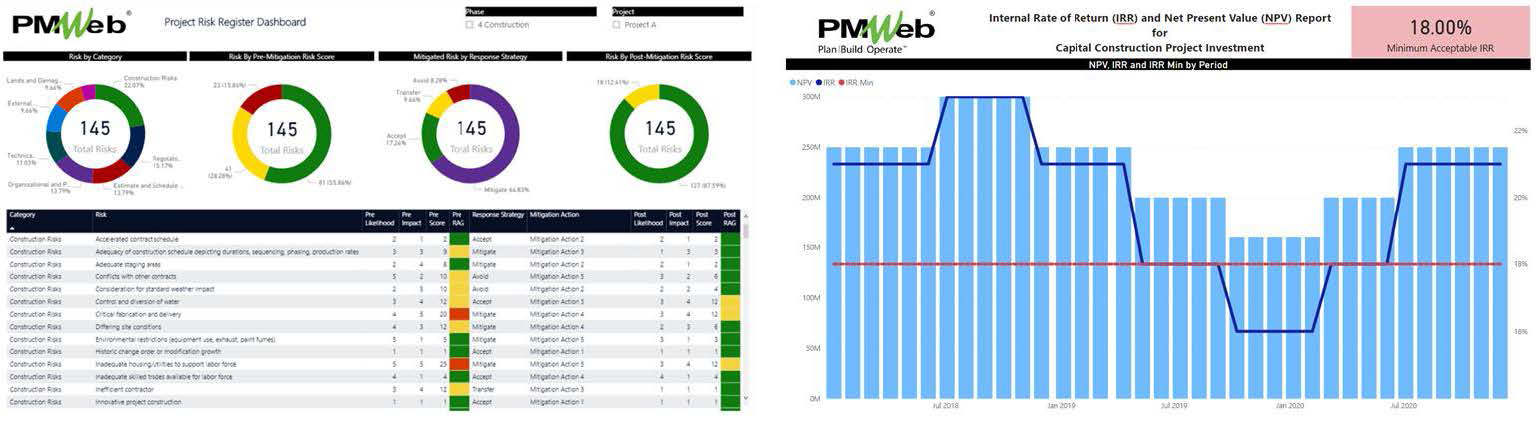

Although many of those involved in investing in capital construction projects have different criteria to decide if the project opportunity is worthwhile investing in or not, nevertheless, two of the most important measures that will always appear on this list are Risk Attractiveness and Internal Rate of Return (IRR). Those interrelated measures identify the organization’s appetite when it comes to investing in capital projects as common sense always says the higher the risk is, the higher the return should be.

Assessing the risk attractiveness of a project requires the organization to implement a formal management process to identify, analyze, respond, monitor, and control project risks. A Project Management Information System (PMIS) like PMWeb not only enables the organization to implement their project management business processes across their complete projects’ portfolio but also enables monitoring, evaluating, and reporting on how the risk attractiveness of a project could change over time. The risks captured during the project life cycle stages for the complete projects’ portfolio provide the organization with a risk knowledge database that no organization can afford not to have. The real-time risk register will be used by the organization to monitor and evaluate their risk exposure and trigger needed actions to keep it in line with the organization’s risk policy.On the other hand, assessing the project’s Internal Rate of Return (IRR) requires having a comprehensive and consolidated cash flow of all project costs or expenses as well as revenues or income. The project cost will include all construction direct and indirect costs for building the capital construction project, professional services, price of land, statutory fees, operation cost, funding and financing cost, pre-sales commission, marketing, and promotion fee, contingency, and management reserve allowance among others. On the other hand, project revenue could be from building assets sale, short and long -term lease, operation revenue like school fees, hotel room and restaurant revenue, healthcare revenue, interest received among others.

To ensure that the project’s IRR value is accurate and can be trusted, all business processes associated with managing the project’s direct and indirect costs as well as revenue should be managed, monitored, evaluated, and reported on. PMWeb provides a single 100% web-enabled platform to manage all those business processes across the complete projects’ portfolio that the organization has. This will not only enable monitoring, evaluating, and reporting on the Net Present Value (NPV) and Internal Rate of Return (IRR) for a capital construction project but also compare and benchmark the IRR performance across the complete projects’ portfolio.

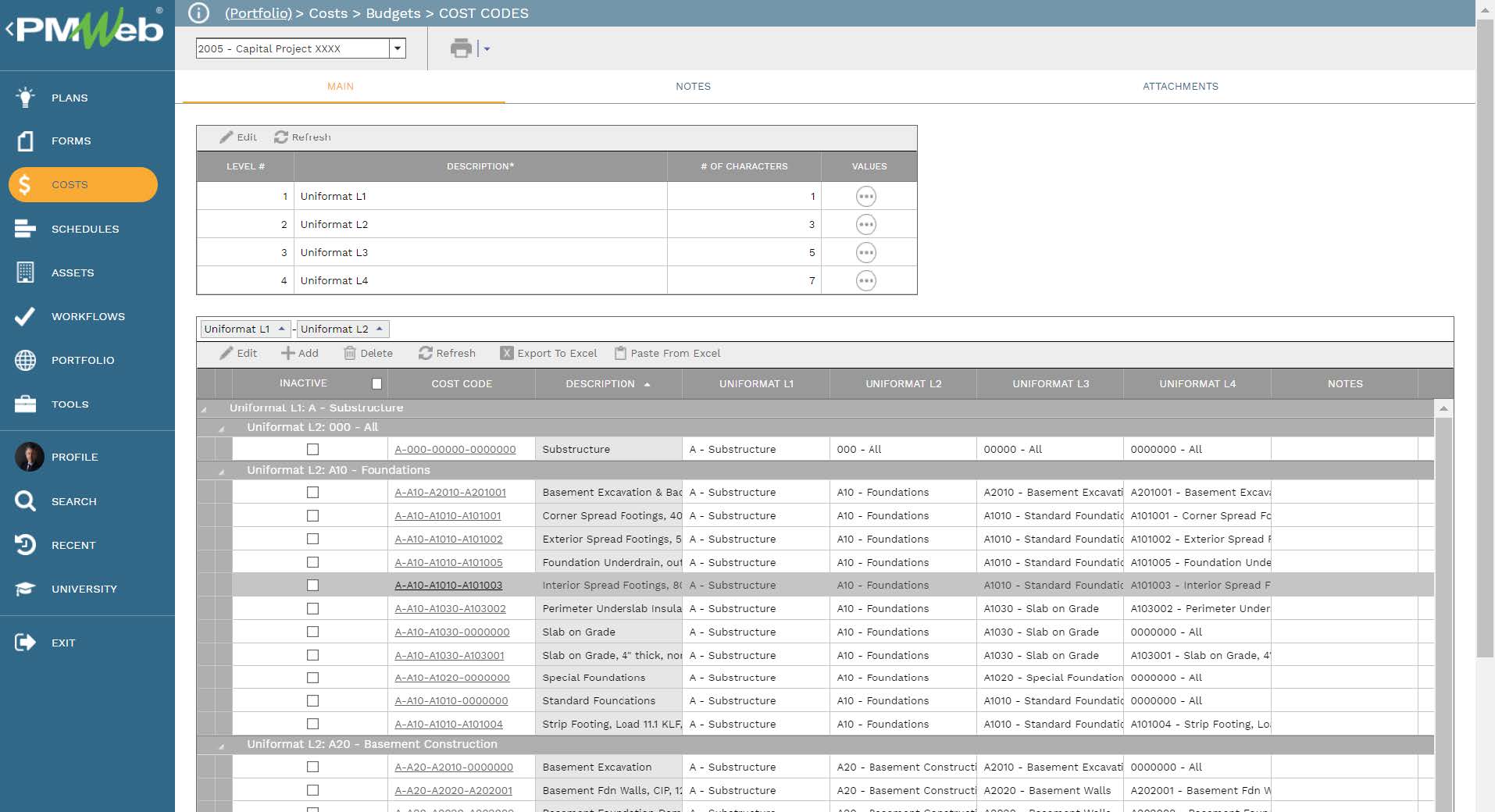

To estimate the project cost as well as revenue, the organization needs first to define the cost breakdown structure (CBS) which will be used to capture all those expenses and income at the desired control level. The cost breakdown structure (CBS) will be common to all cost-related business processes including those for a cost estimate, budget, budget adjustments, commitments, changes, actual cost, revenue contracts, revenue adjustments, actual revenue collected, and project funding.

PMWeb cost breakdown structure (CBS) allows the organization to define up to 16 cost breakdown levels to enable controlling cost and revenue to the required level of detail. Each level could be 10 digits level. The cost breakdown structure can be a hybrid structure by taking into account the organization’s financial control requirements that will be coupled with the Work Breakdown Structure (WBS) of one of the internationally recognized facility breakdown standards like the UniFormat™ developed by the Construction Specification Institute (CSI).

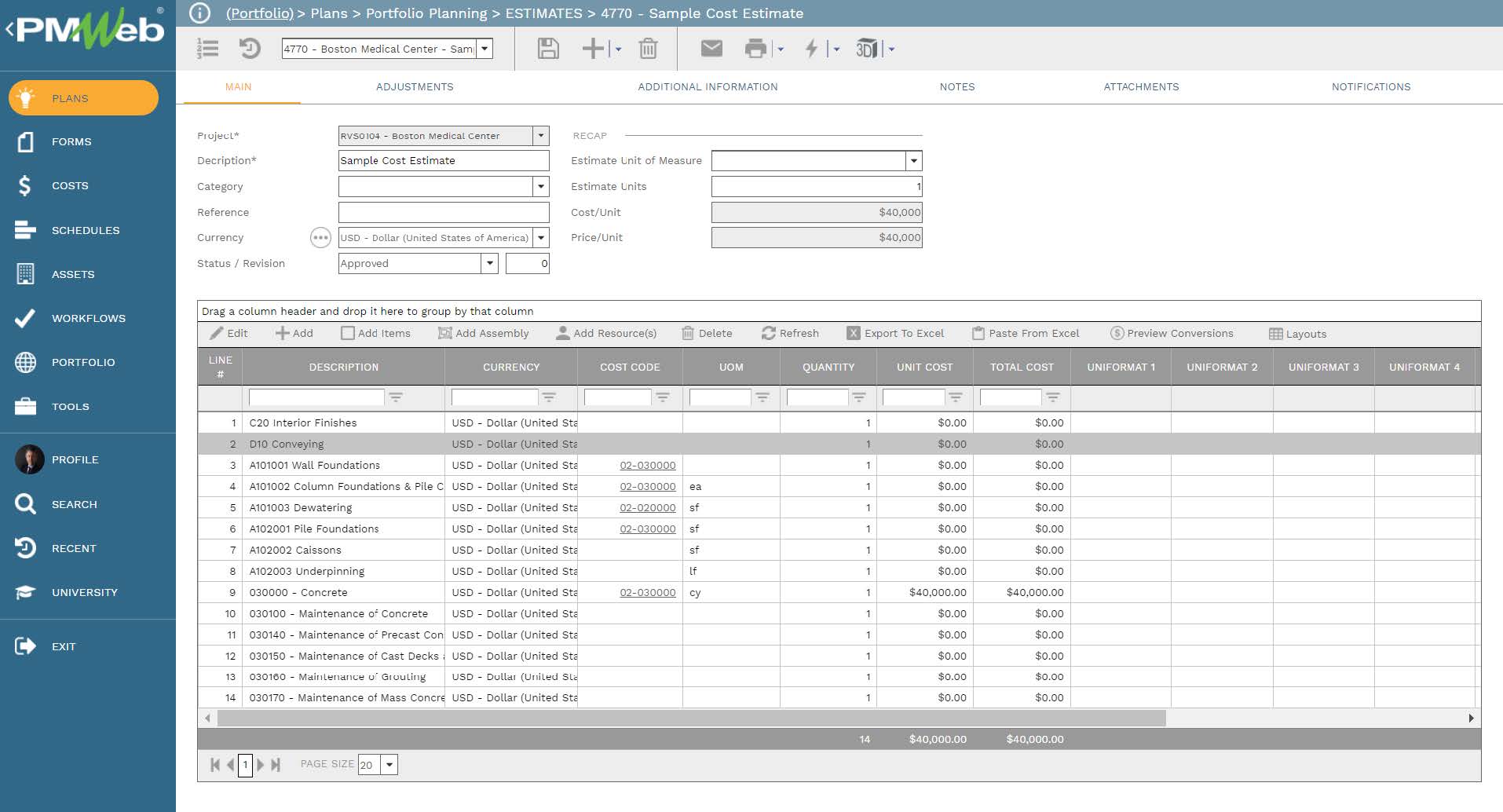

The starting point for reliable cost and revenue values is to have an accurate estimate for all required items. For each defined cost breakdown structure (CBS) level, the quantity of the work needs to be calculated in accordance with internationally recognized quantity take-off standards including quantities that are automatically calculated from the Building Information Model (BIM) if it is in use. Of course, the level of accuracy depends on the BIM Model level of detail (LOD) which will improve as the project design moves from concept to detailed design development. Of course, the same will also apply when capturing the estimate to all sources of revenue.PMWeb cost estimate module will be used to capture the project’s cost and revenue estimates. This information can be added directly to the estimate spreadsheet, use the cost database created in PMWeb, use pre-defined building assemblies, or just import the cost estimate from MS Excel if it was done using a third-party cost estimate tool. The line items in those cost estimates can be in any currency defined in PMWeb. In addition, the cost estimate line items can be associated with their relevant project schedule activity which will be eventually needed for the cash flow.

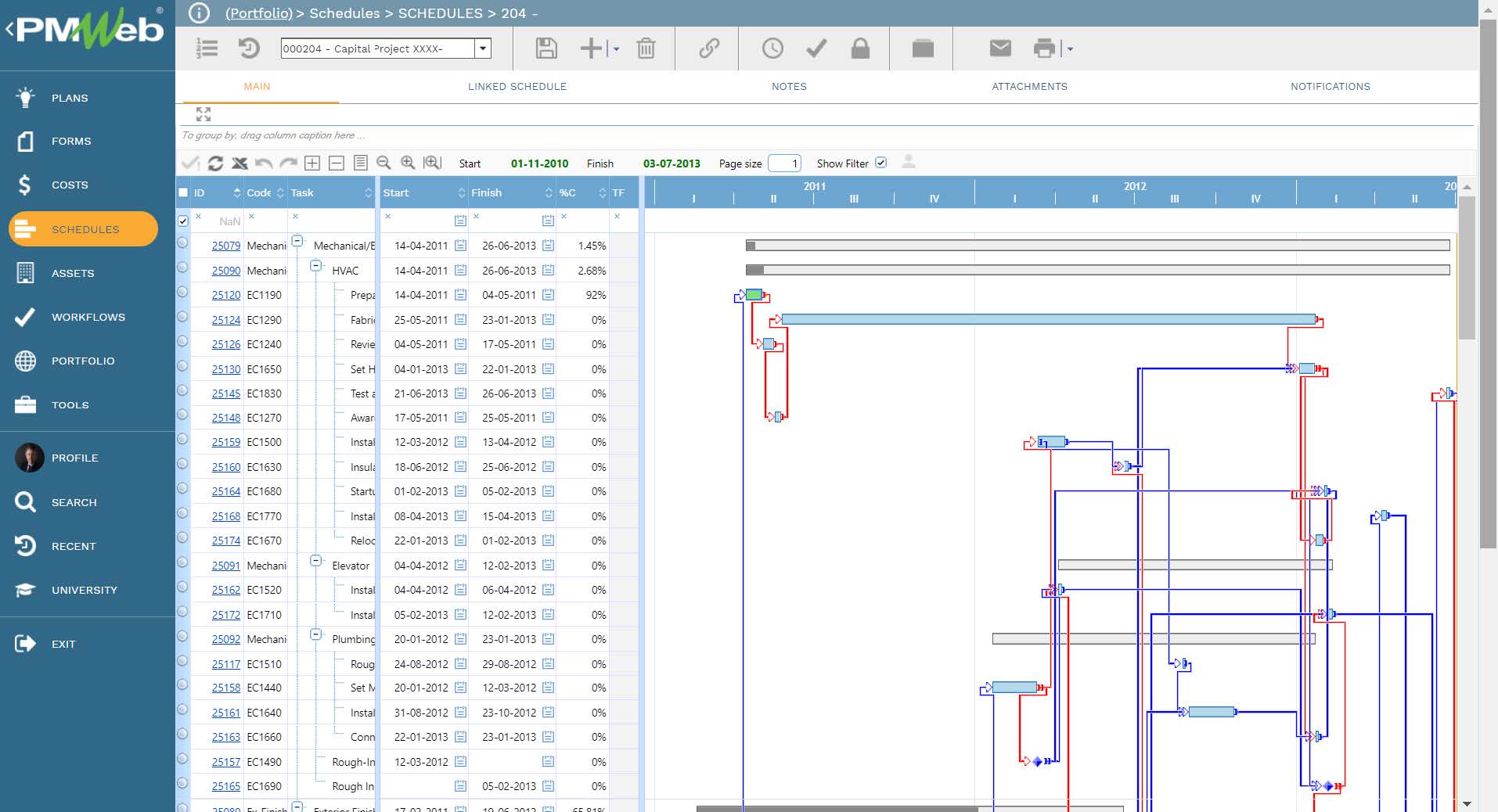

There also is a need to create a project schedule to detail the activities required to deliver the capital construction project. It is recommended that the project schedule be aligned with the CBS levels as the main purpose of having the schedule is to generate the cost and revenue cash flow projections that are needed to calculate the NPV and IRR measures. The project’s delivery schedule created in the PMWeb schedule module will take into consideration design, authorities’ approvals, contracts, and material procurement, construction, commissioning, handing over, and another scope of work needed for delivering the project asset. In addition, the schedule should include all revenue generation, maintenance, and operation activities during the complete asset life cycle stages.

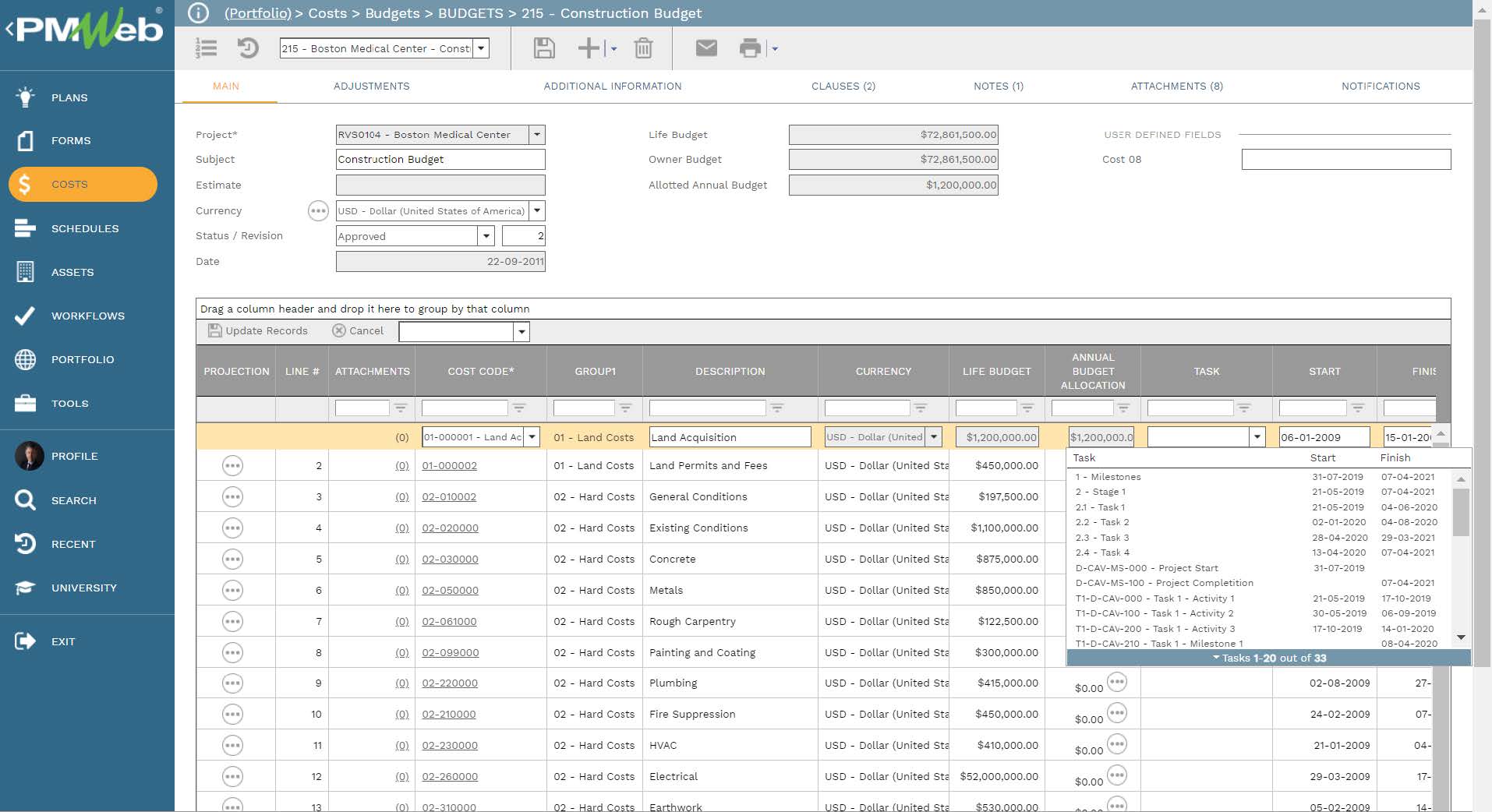

The approved cost estimate will become the basis for generating the project’s cost and revenue budget using the PMWeb budget module. Of course, different budget versions can be created and maintained depending on the cost estimate revisions although only one version can be approved and others need to be withdrawn. Each budget line will be linked to the relevant project schedule activity.

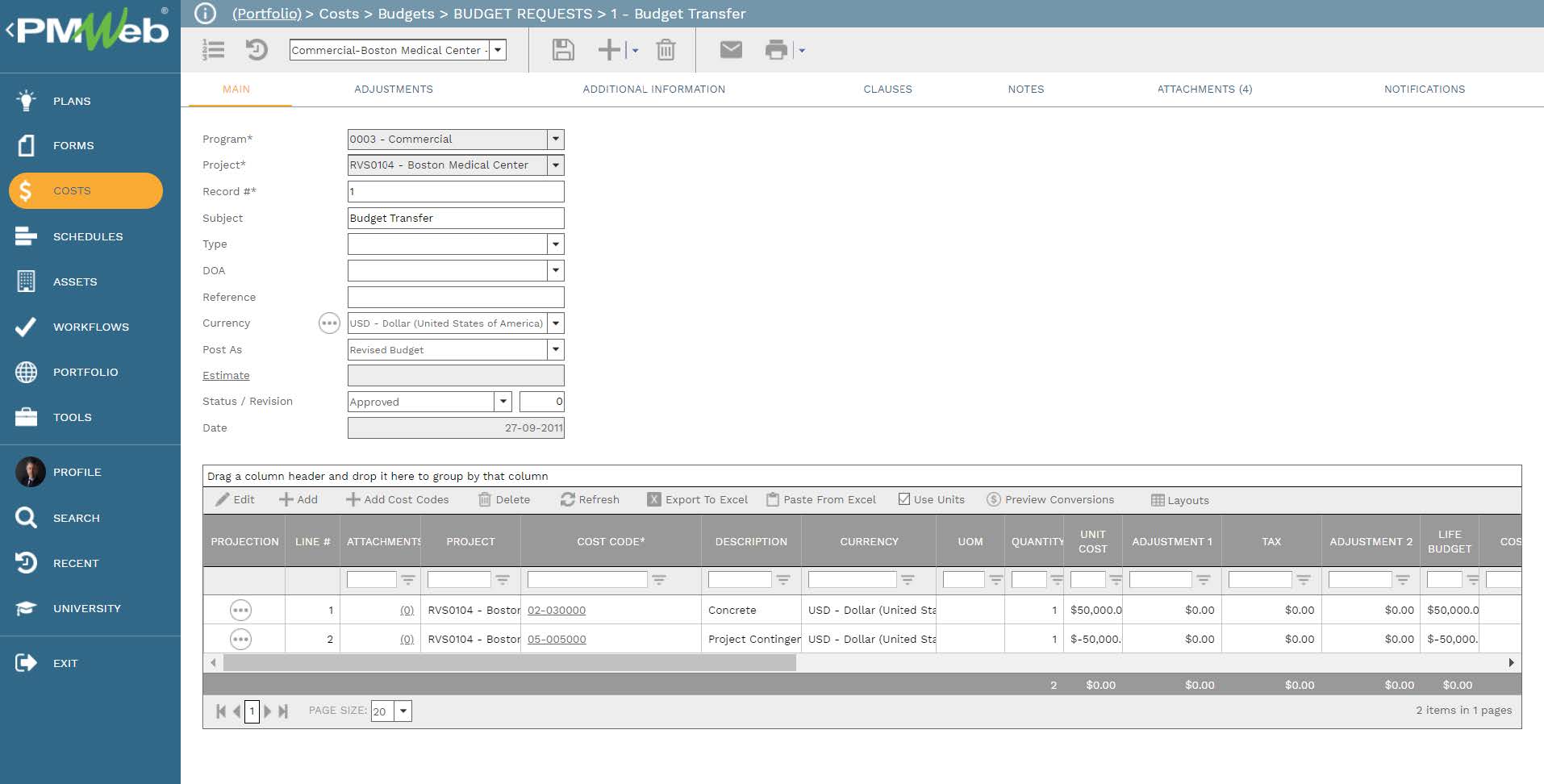

All adjustments to the approved budget will be captured using the PMWeb budget request module. Those adjustments could be to reflect the budget increase or decrease due to some changes, transferring the approved budget amount from one CBS level to another. One of the most common budget transfers is the one associated with project contingency and management reserve for which the organization needs to keep track of the contingency fund drawdown during the project life cycle. Each budget adjustment needs to be posted to the financial period that it had occurred.

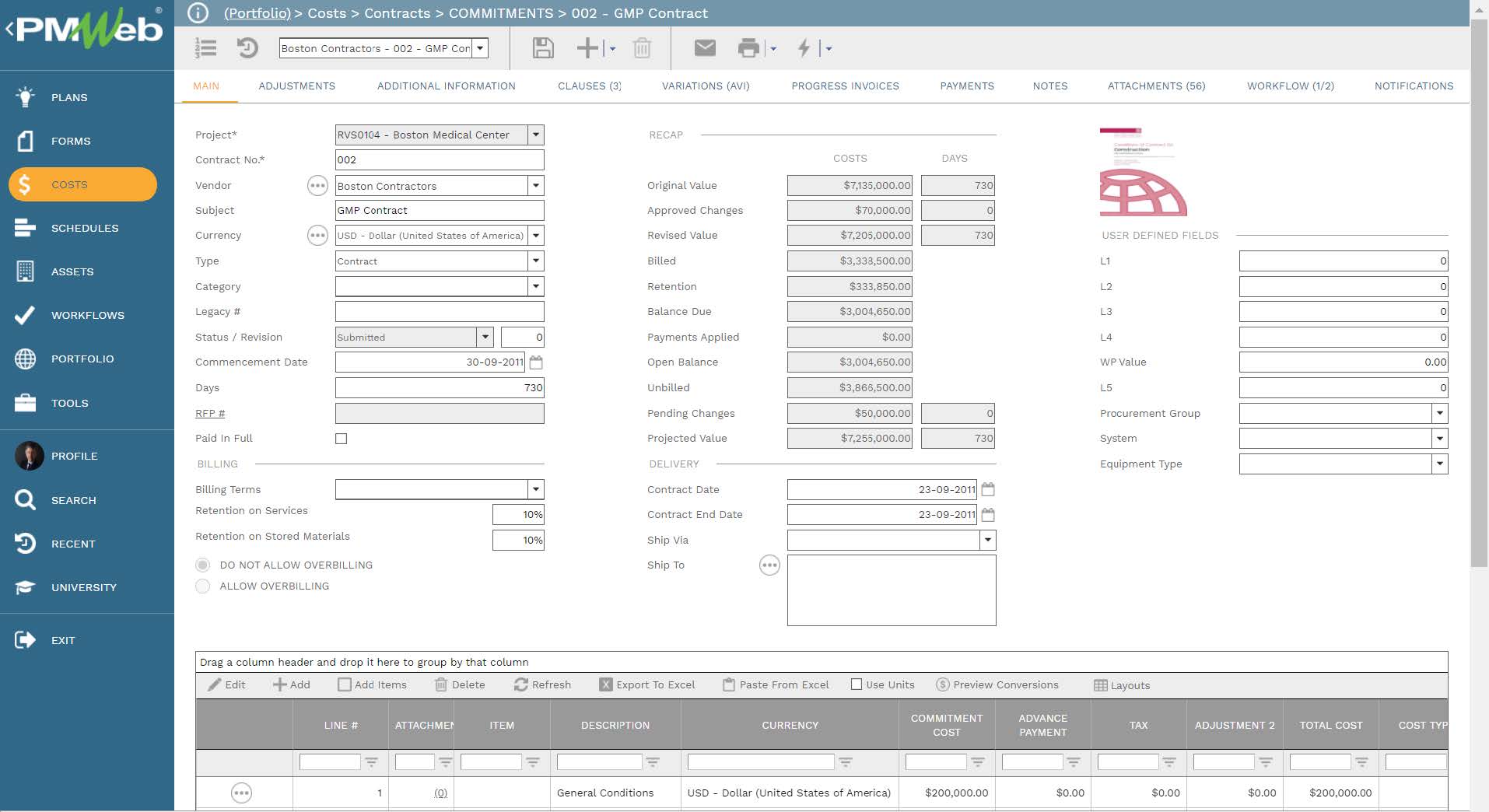

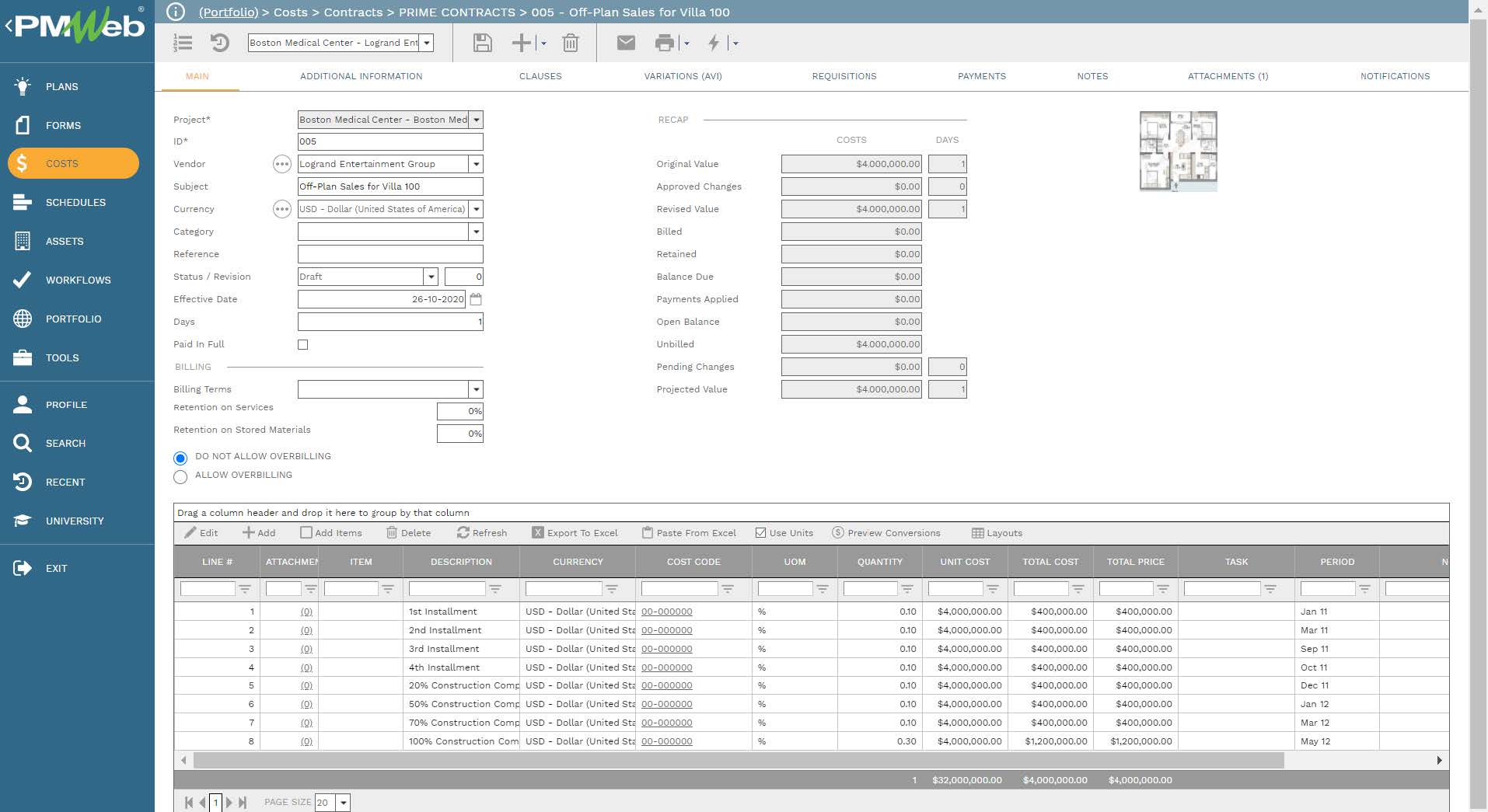

To enable capturing actual direct and indirect costs or expenses incurred on the project as well as earned income or revenue, contract agreements need to be created using PMWeb commitment contract and revenue contract modules. Although PMWeb allows capturing the procurement process of all awarded commitment contracts using the prequalification, procurement, and online bidding modules, nevertheless, it will be assumed that those commitment contracts and purchase orders will be just made available. PMWeb commitment module will be used to capture the details of all those commitment contracts for which each line item will be assigned the relevant cost breakdown structure (CBS) level.

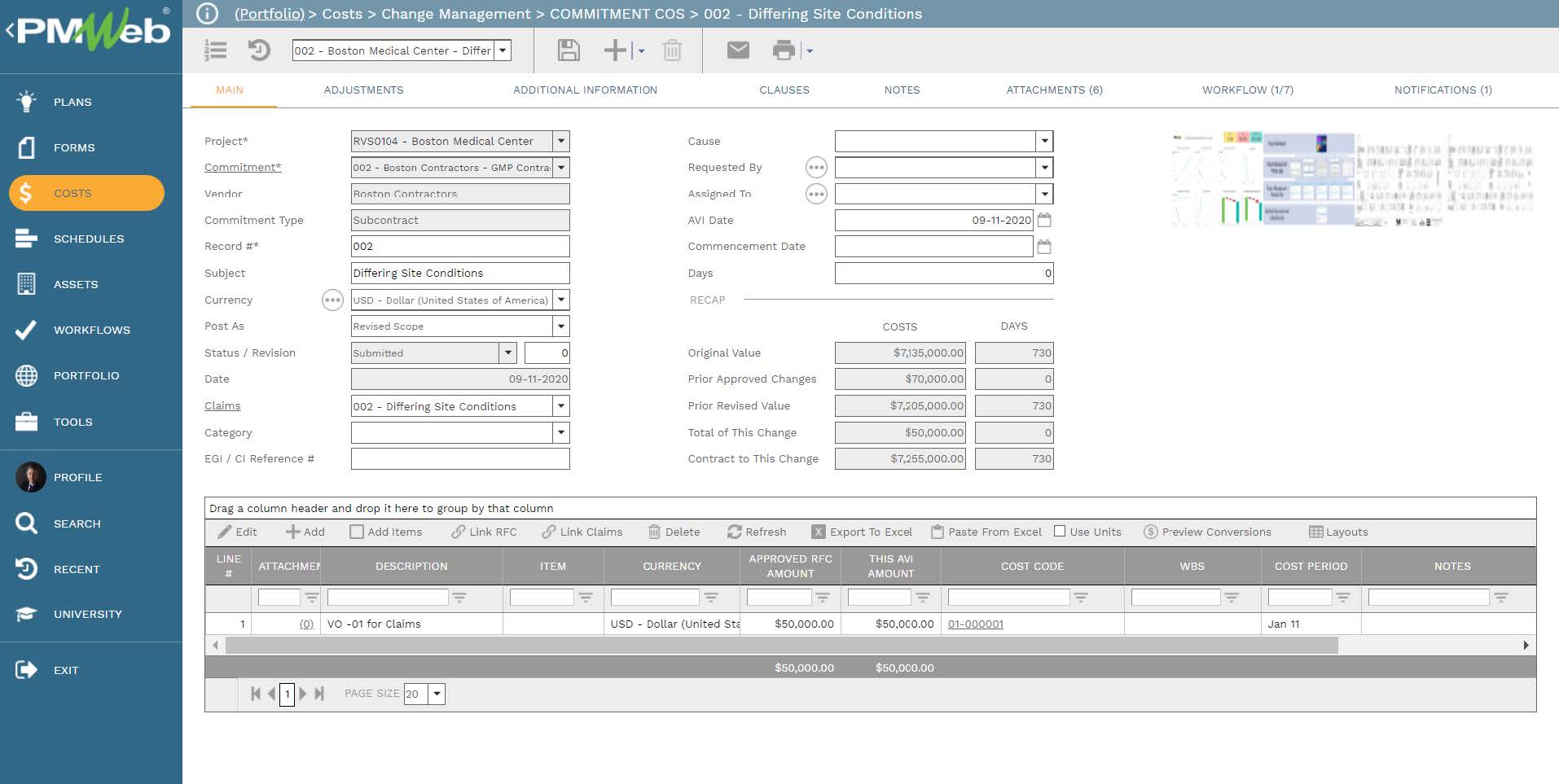

For each commitment contract, PMWeb allows capturing potential change orders (PCO) also known as claims or early warning notifications (EWN), and change orders whether they were approved, pending approval, rejected, or disputed. Those changes will be the basis for calculating the project’s revised commitment and projected commitment values.

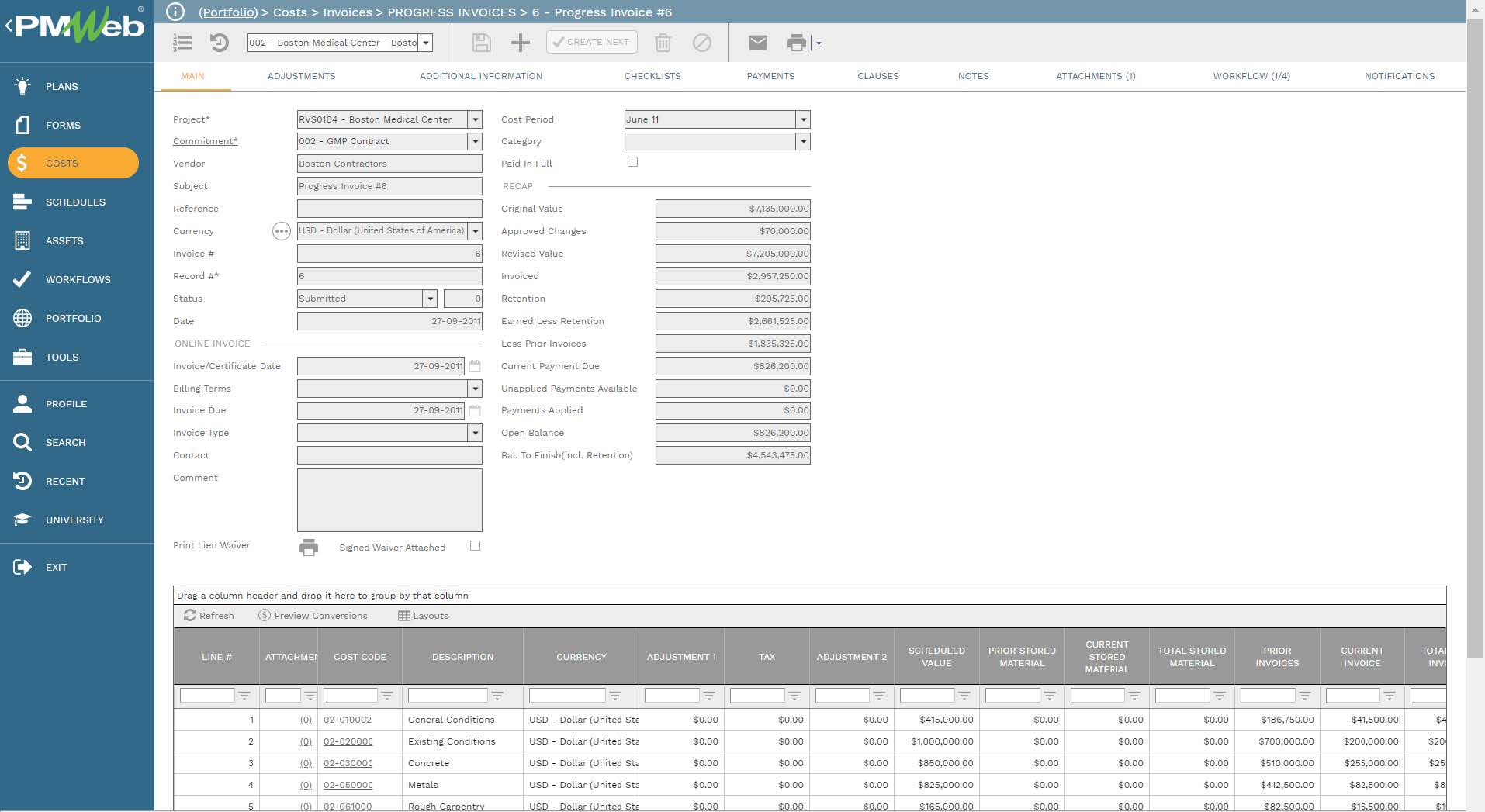

The actual cost for approved work in place for each awarded commitment contract will be captured using the monthly progress invoice for which the project schedule activity percent (%) complete for each control account will be imported. This will be repeated for each period.

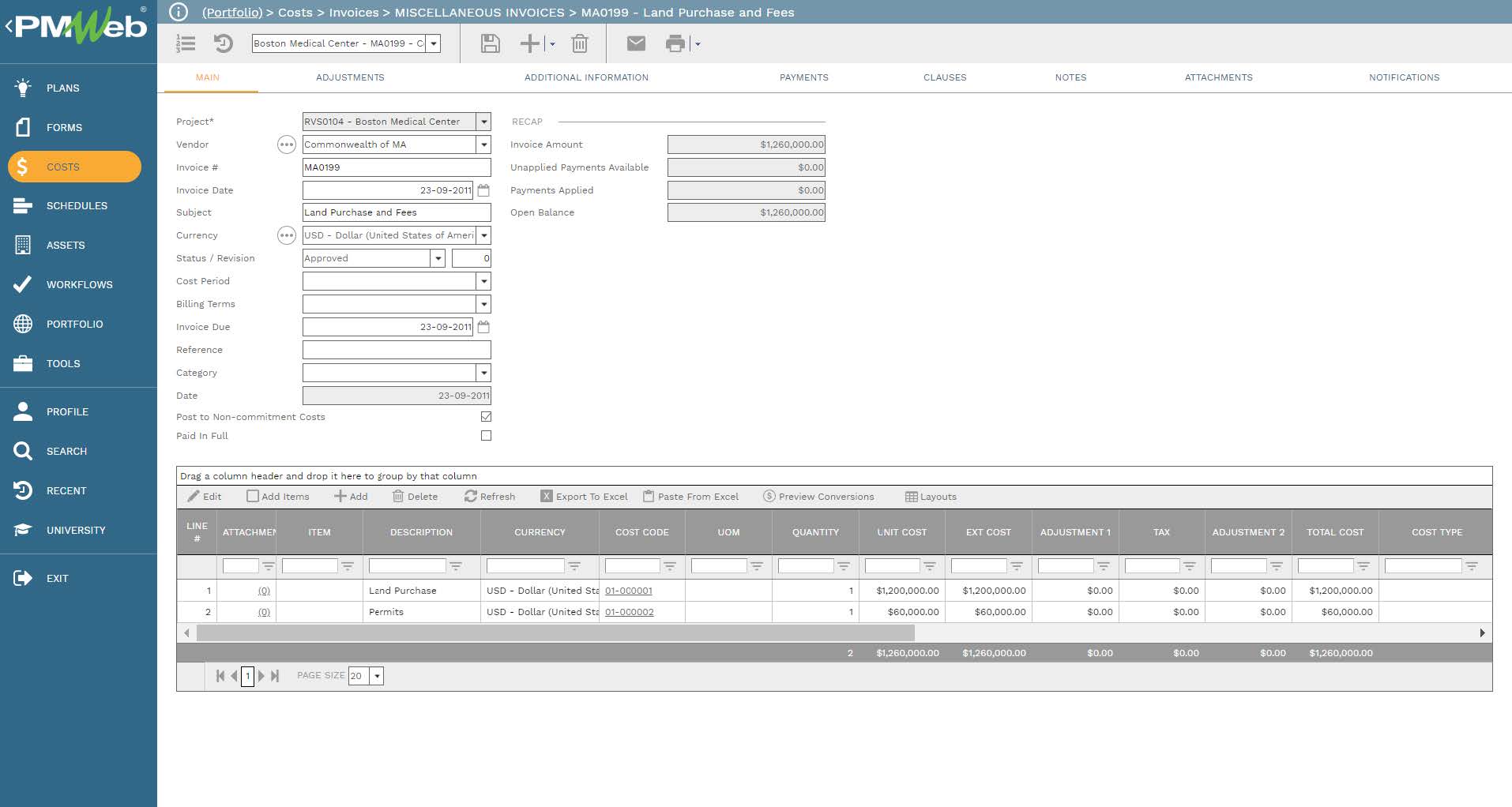

In addition, the actual cost for all miscellaneous invoices, which might include indirect costs, incurred at each period will also be captured in PMWeb using the miscellaneous invoices module. Further, the indirect cost can also be captured from the PMWeb timesheet module if this was used to capture the cost associated with the real estate developer’s own resources that are not part of any commitment or direct cost contract.

The revenue contracts module in PMWeb will be used to capture all planned and actual income sources for the project. This would usually include building assets sale, short and long -term lease, operation revenue like school fees, hotel room and restaurant revenue, healthcare revenue, interest received among others. Similar to the budget, each revenue source will be linked to the relevant control account and the project schedule activity. This will ensure that the revenue projection is captured in the consolidated project cash flow.

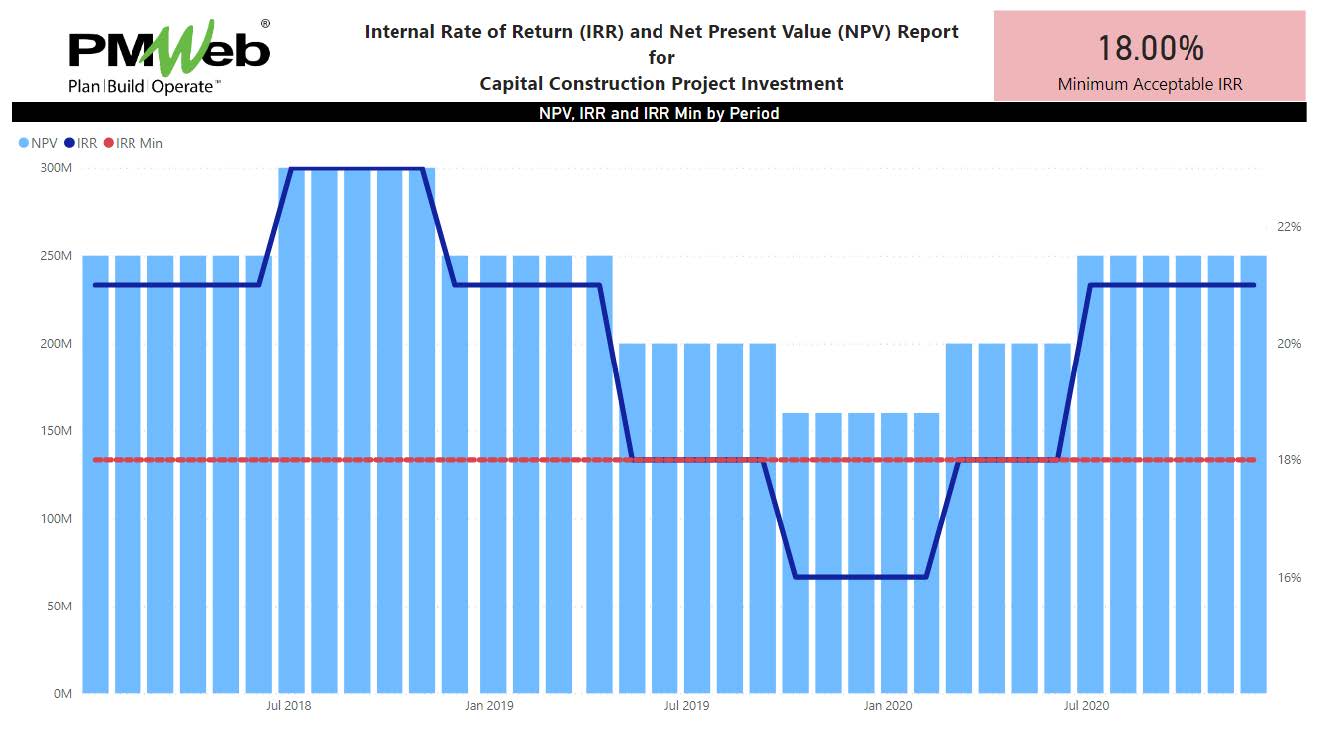

With both, the planned budget spending and revenue, the planned consolidated cash flow projection for the project will be generated. This will also enable the organization to make any adjustments for those captured values due to approved budget requests and change orders. In addition, the actual cost and actual revenue cash flows will also be added as those will have an impact on the actual Net Present Value (NPV) and Internal Rate of Return (IRR). The Internal Rate of Return (IRR) and Net Present Value (NPV) will be calculated assuming a minimum attractive internal rate of return of 18%.

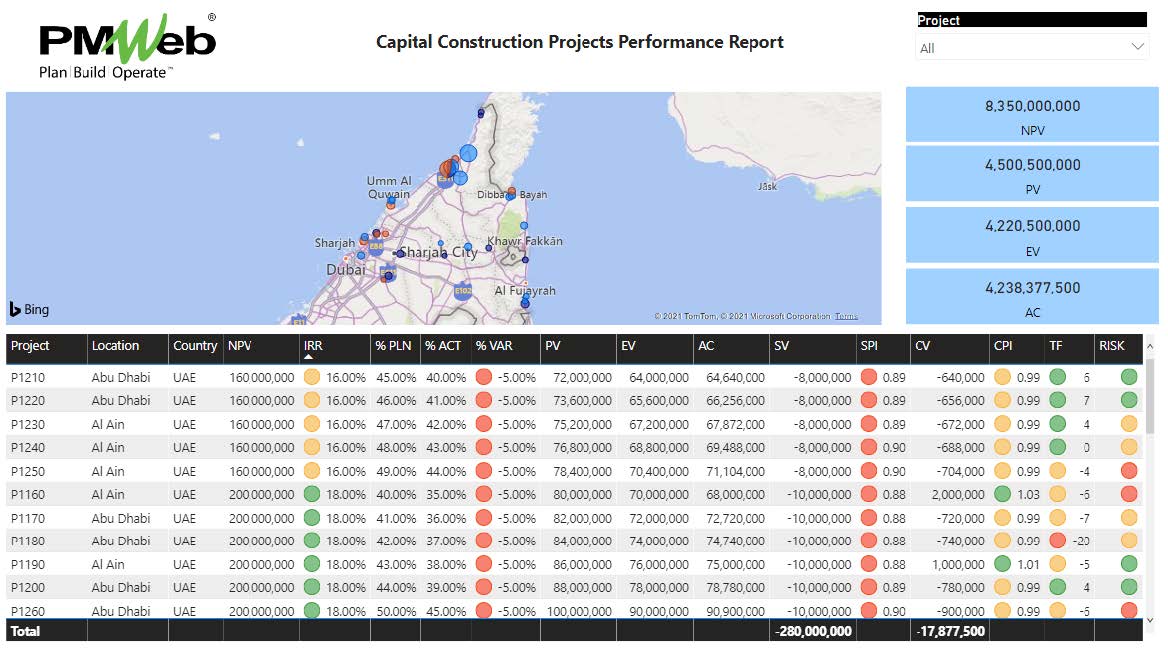

This will enable the organization to monitor, evaluate and report the IRR, NPV and other project’s key performance indicators (KPIs) measures on a single project or multiple projects portfolios. Those measures could include for example the Earned Value Management (EVM) measures of Schedule Variance (SV), Cost Variance (CV), Schedule Performance Index (SPI), and Cost Performance Index (CPI). In addition, measures for project delays by using the Total Float (TF), progress percent complete variance, and Risk Exposure as Low, Moderate, and High will be part of the overall projects’ portfolio performance report. For organizations that have projects at different locations either within the same country or other countries, a map visual will be part of the report. The visual will use the risk exposure value to color the locations of those projects and the current value of the IRR to determine the size of the project location.